Crypto Today: Bitcoin, Ethereum and XRP consolidate as SUI continues impressive run

- Bitcoin is consolidating around the $63,600 level following mild profit-taking from holders.

- Ethereum bounced off the $2,595 support, and XRP is moving horizontally around $0.589.

- SUI has given investors a monthly gain of 65% after seeing key updates within its ecosystem.

Bitcoin, Ethereum and XRP updates

Bitcoin traded around $63,600 on Tuesday, as prices appear to be consolidating within the $62,000 and $64,700 key levels. On-chain data shows that the consolidation may be due to profit-taking by holders and mild Bitcoin ETF net inflows of $4.5 million, per Farside Investors data.

Ethereum is trading within key rectangle channels and tested the $2,595 support before bouncing toward the $2,630 level. If the support level continues to hold, ETH could rally to test the resistance at $2,817. Additionally, Ethereum ETFs posted heavy net outflows of $79.3 million on Monday — their highest since July 30.

XRP is consolidating around the $0.589 level at press time, following a similar weak performance across the crypto market. XRP could see increased bullish momentum if it reclaims the $0.600 psychological level.

Market movers

Bitcoin and the general crypto market remained fairly muted following People's Bank of China (PBoC) Governor Pan Gongsheng's announcement that China will reduce its reserve requirements ratio (RRR) by 50 basis points (bps). RRR is a portion of deposits that a commercial bank must hold in its reserve instead of lending or investing all its assets. A reduction in the RRR is used to stimulate the economy, meaning investors have access to more loans, and banks could make more investments.

While Chinese stocks rallied after the announcement, the price of Bitcoin and altcoins showed no response, unlike the crypto market rally that followed the US Federal Reserve's (Fed) decision to cut interest rates by 50 bps. The reaction underscores Bitcoin and crypto's rising correlation to Fed rates and US stocks.

However, with central banks worldwide gradually easing economic policies and a historically positive Q4 for crypto, the market may continue its impressive rise in the coming weeks.

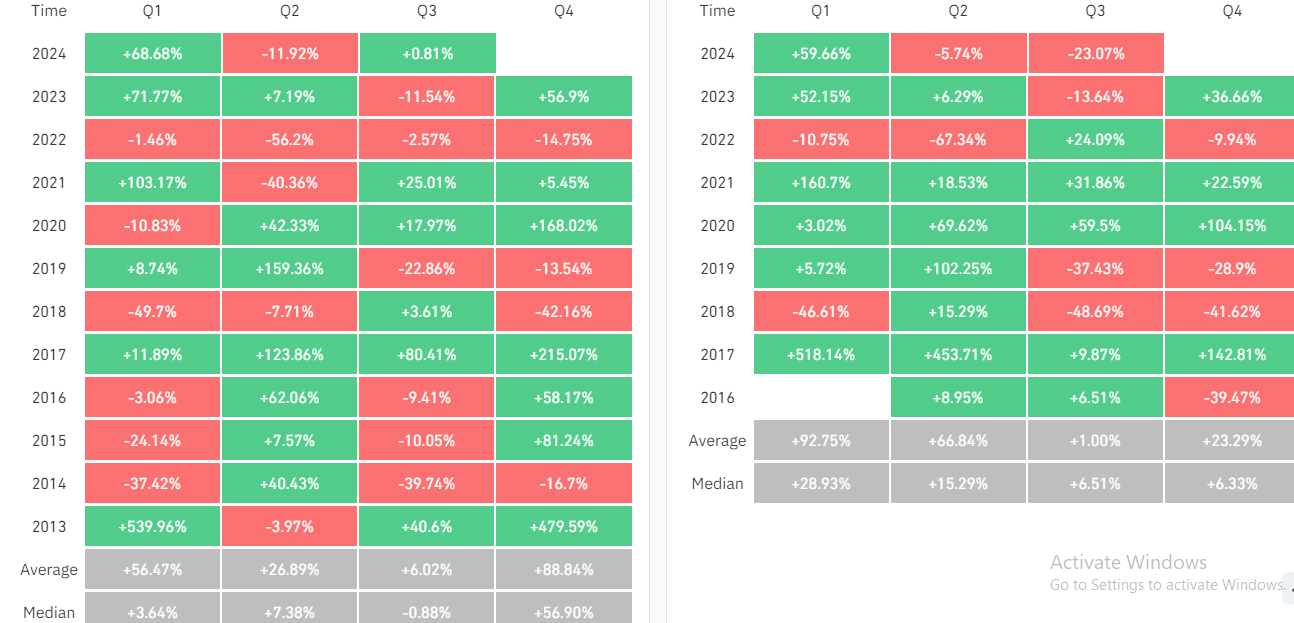

According to Coinglass data, Bitcoin and Ethereum have given investors an average Q4 return of 88.84% and 23.29%.

Bitcoin & Ethereum Quarterly Returns

Furthermore, following transparency concerns about BlackRock's decision to reduce on-chain withdrawal time for its Bitcoin ETF and not publicly displaying its balance on-chain, Bloomberg analyst Eric Balchunas stated that the asset manager aims to avoid spam.

"They will show this [balance] to institutional clients upon request but not gonna publish to the world because they get plenty of spam already (e.g. sanctioned bitcoin, NFTs) and this would only cause an explosion in said spam," said Balchunas.

Meanwhile, the crypto-based prediction marketplace Polymarket seeks $50 million in a fresh funding round and is considering launching a token.

Chart of the day: SUI

SUI/USDT 4-hour chart

SUI is one of the best performers in the top 100 on a monthly time frame, rising more than 65%. The Layer 1 token is up nearly 7% in the past 24 hours, breaking above a key rectangle's resistance and stretching its weekly gains to 44%.

The key drivers of SUI's impressive run include:

- Rising user activity within its DeFi ecosystem as total value locked nears the $1 billion mark.

- Launching the Mysticeti that allegedly reduces consensus to 390 millisecond.

- The opening of Grayscale's SUI Trust to accredited investors.