XRP could rally as Grayscale XRP Trust NAV jumps to $11.49, likely catalyst for Ripple

- XRP trades at $0.5879, climbs closer to the psychologically important $0.60 level.

- Ripple prepares for launch of its stablecoin even as SEC head maintains harsh stance on crypto regulation.

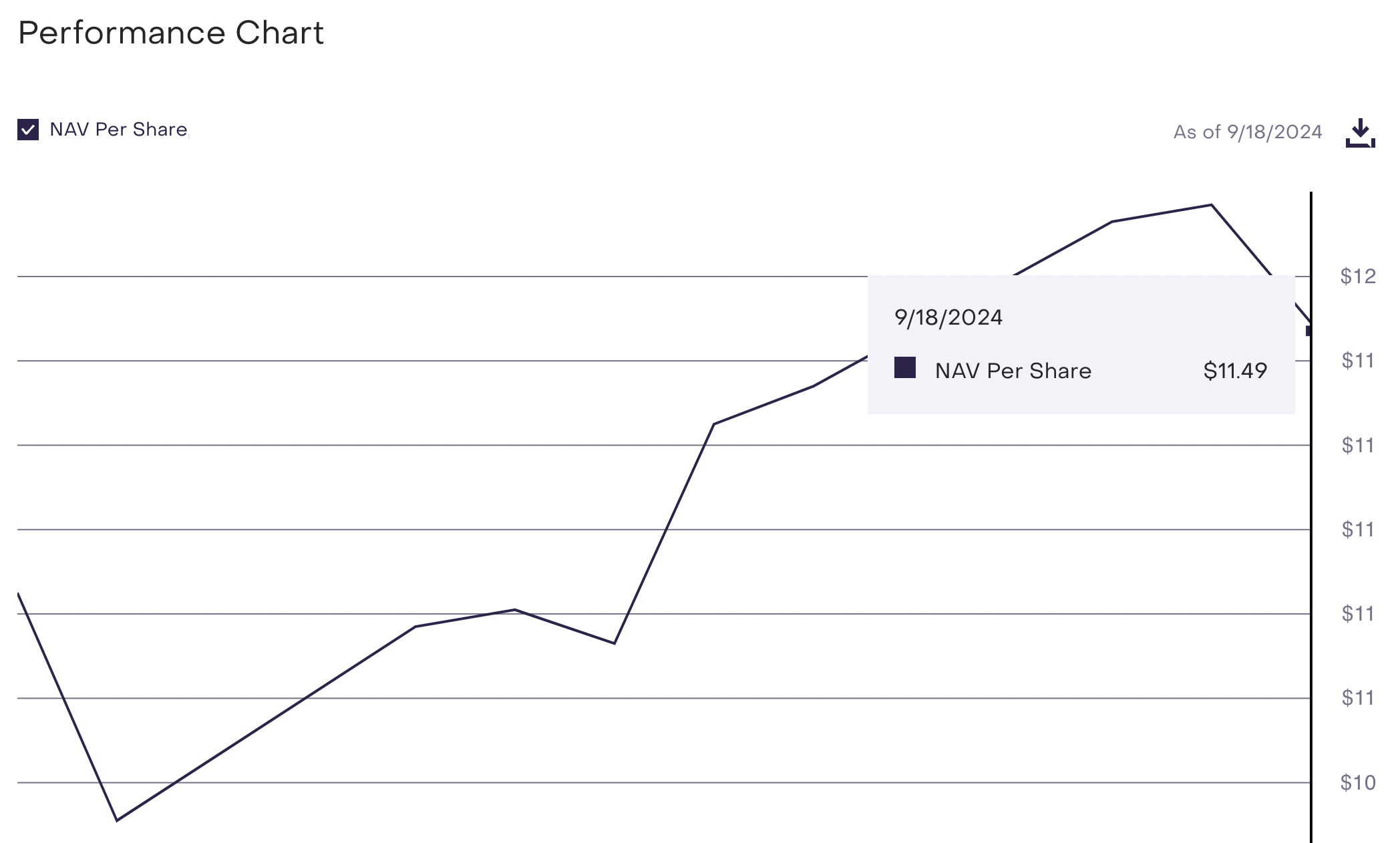

- Grayscale XRP Trust NAV climbs to $11.49, suggesting growth in institutional demand for the asset.

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

The Net Asset Value (NAV) of Grayscale XRP Trust, a measure of the intrinsic value per share, is calculated at the end of each business day, according to the official website. While the NAV does not influence the underlying asset’s price, its trend helps identify the general direction in which the share price is headed. Investors use NAV to determine how the fund’s value has changed, likely indicative of its demand among institutional investors.

Additionally, in a recent interview the head of the Securities & Exchange Commission (SEC) said that crypto wasn’t “incompatible” with existing securities law.

Daily digest market movers: XRP could rally on the back of these catalysts

- XRP inches closer to the psychologically important $0.6000 level, trades at $0.5843, early on Thursday.

- Ripple, the cross-border payment remittance firm, recently shared its plans for launching the Ripple USD (RUSD) stablecoin. The stablecoin plans to connect global financial firms and institutions, as well as enable cross-border payments through its stablecoin on the XRP Ledger (XRPL) and the Ethereum mainnet.

- XRP holders await a launch date for the stablecoin, further regulatory clarity from the Securities & Exchange Commission is awaited for RUSD roll-out in the US.

- Second market mover is Grayscale’s single asset investment fund, Grayscale XRP Trust’s performance. The official website shows NAV is at $11.49. The metric rallied to a peak of $11.77 on Tuesday, earlier this week.

NAV per share for Grayscale XRP Trust

- The SEC vs. Ripple lawsuit is the third market mover, while the lawsuit ended with what seems to be a partial win for both parties, there is a likelihood of an appeal from the regulator. There is no comment on the appeal from the SEC. However, in a recent interview with CNBC on Wednesday, Chair Gary Gensler reiterated the clarity provided by existing securities laws and said that “there’s nothing incompatible about the field with the basic protections that are in the securities laws.”

- Even as XRP has legal clarity as a non-security in transactions on secondary-market platforms or crypto exchanges, it was treated as a security in its sales to institutions. Further, if the SEC appeals the July 2023 ruling of Judge Analisa Torres, it could strip the altcoin of its status as a non-security. The “what ifs” have XRP traders gripped to every move of the regulator.

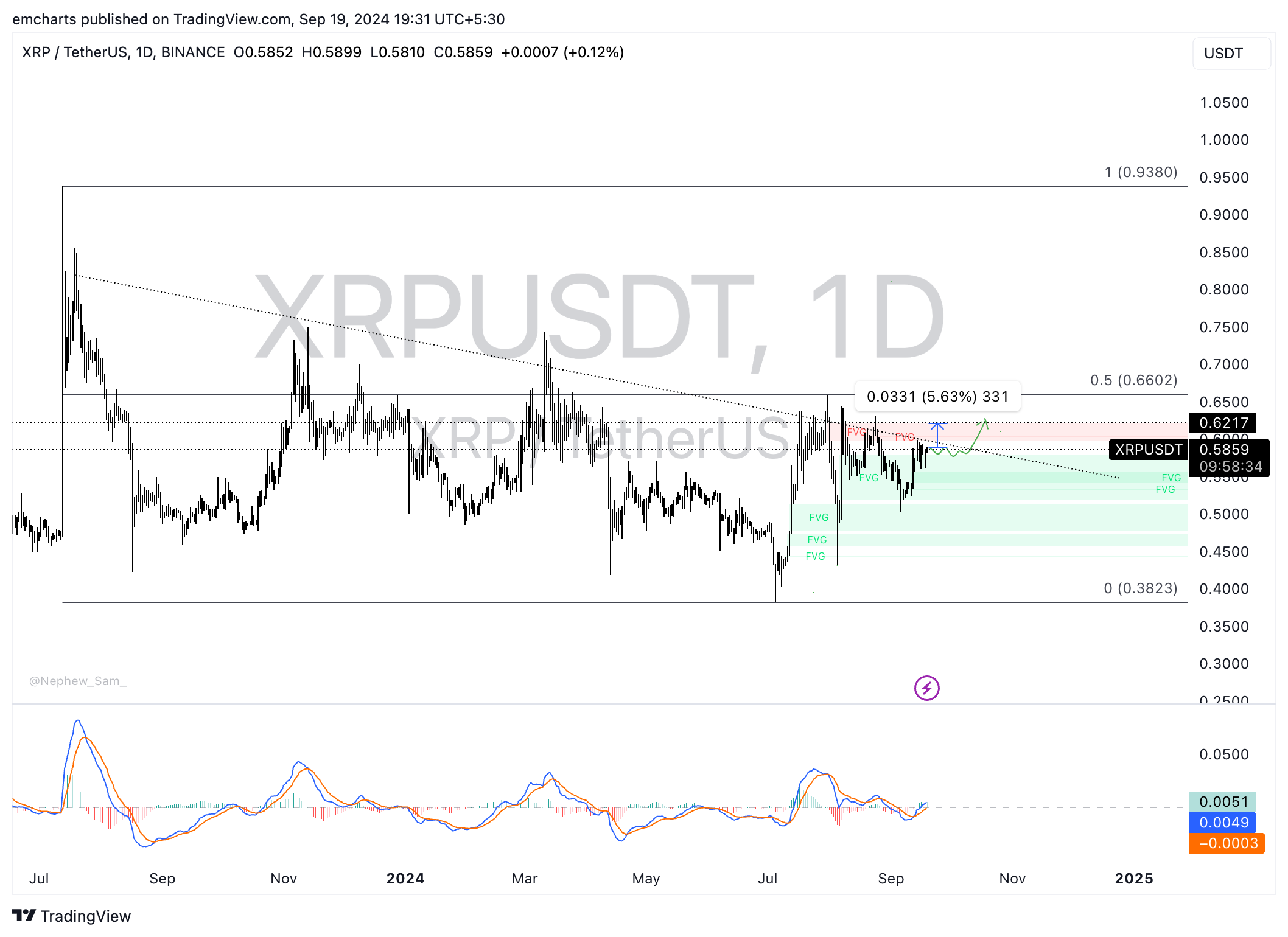

Technical analysis: XRP ready for nearly 6% gains if $0.5500 support holds

XRP attempted to break out of its downward trend on several occasions throughout July, August and September to no avail. The altcoin has traded in a range-bound manner between the August 7 top of $0.6434 and the September 6 low of $0.5026.

XRP held steady above support at $0.5026 for nearly 12 days. The asset has found support at $0.5500. If XRP sustains above this level, a rally to $0.6217 is likely. This would mark nearly 6% gains in the altcoin.

The Moving Average Convergence Divergence (MACD) indicator supports the bullish thesis. Green histogram bars above the neutral line signal an underlying positive momentum in XRP price.

XRP/USDT daily chart

A daily candlestick close under $0.5500, a key support for the asset could invalidate the bullish thesis. XRP could sweep liquidity in the imbalance zone between $0.5413 and $0.5556.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.