Ripple co-founder Chris Larsen supports Kamala Harris in US presidential election, XRP slips to one- month low

- Ripple co-founder and executive chairman Chris Larsen extends support to Vice President Kamala Harris in the US Presidential election.

- Former Ripple board member Gene Sperling left the White House in August to join Kamala Harris’ 2024 presidential campaign.

- XRP dipped to a one-month low of $0.5323 on Friday.

Ripple (XRP) co-founder Chris Larsen joined 88 other business leaders in supporting Vice President Kamala Harris in the upcoming US Presidential election, per a CNBC report. The payment-remittance firm recently received the Securities & Exchange Commission’s (SEC) consent on a stay on the monetary portion of the final ruling in the SEC vs. Ripple lawsuit.

XRP slipped to $0.5323, a one-month low for the altcoin’s price.

Daily digest market movers: Ripple co-founder and former board member backs Kamala Harris

- SEC vs. Ripple lawsuit updates, actions of co-founder, and former board member and on-chain metrics are the key market movers for XRP on Friday.

- Ripple co-founder Chris Larsen joined key business leaders and expressed support for Kamala Harris’ Presidential campaign, signing a letter to endorse Harris for president.

- A former Ripple board member, Gene Sperling, left the White House to join Vice President Harris’ 2024 Presidential campaign in August.

- As the November elections draw close, leaders in the crypto community are backing pro-crypto candidates.

- Several crypto community members backed former US President Trump for his promise to put an end to Gary Gensler’s crusade against crypto. In this regard, Ripple CEO Brad Garlinghouse said on Tuesday in Seoul that he will make a “gentleman’s bet” that the SEC Chair’s tenure is up irrespective of who wins the US Presidential election, according to The Korea Herald.

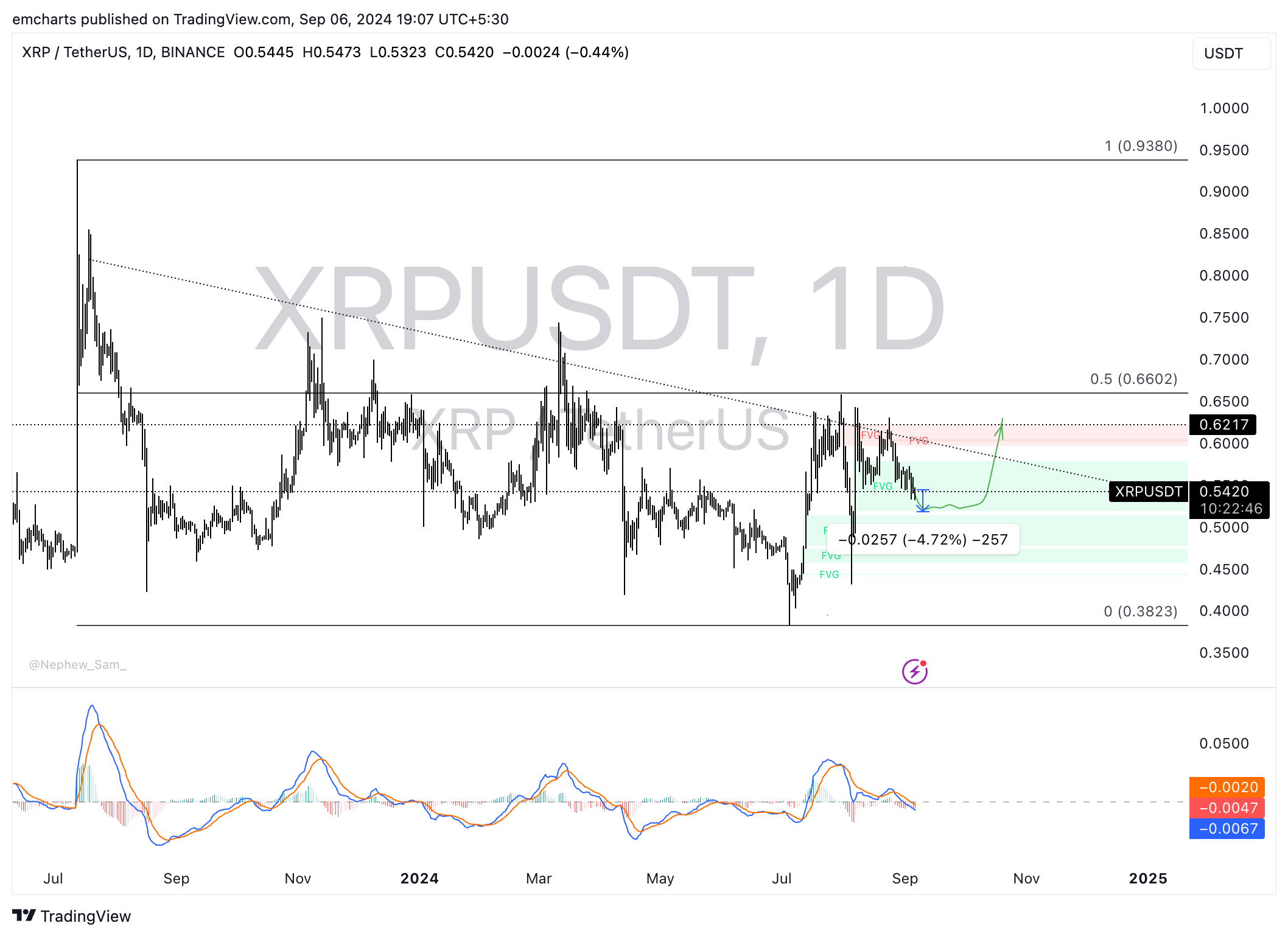

Technical analysis: XRP corrects to one-month low at $0.5323

XRP is in a multi-month downtrend. The altcoin dipped to $0.5323 early on Friday, a one-month low, and recovered slightly afterwards. Still, XRP looks set to post losses for a second consecutive week, losing around 2% this week so far.

If the downtrend persists, XRP could extend losses by another 4.72% and sweep liquidity at $0.5188, the lower boundary of the imbalance zone in the XRP/USDT daily chart. Once there, buyers could take control to let the altcoin attempt a recovery towards a key resistance at $0.6217. This marks a key level that XRP has tested as resistance several times since July.

The Moving Average Convergence Divergence (MACD) momentum indicator shows red histogram bars under the neutral line, suggesting the bearish momentum prevails.

XRP/USDT daily chart

Still, a daily candlestick close above the upper boundary of the Fair Value Gap (FVG) at $0.5785 could invalidate the bearish thesis. In this scenario, XRP could rally towards the mentioned $0.6217 resistance level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.