Ripple protocol is not meant for retail sale, says analyst, XRP trades at $0.59

- Ripple protocol is not built for retail consumers and does not govern price, according to a crypto researcher.

- XRP trades at $0.59 on Wednesday.

- XRP could extend gains by 11% and target $0.66, a key level for the altcoin.

Ripple (XRP) trades at $0.59 at the time of writing on Wednesday, August 21. A crypto researcher is arguing that the native token of XRP Ledger is not built for retail traders and they do not govern retail price.

Daily digest market movers: Ripple protocol not meant for retail, says researcher

- Researcher behind the X handle @SMQEDQG says, “Ripple protocol is not built to interface with consumers and businesses and does not govern retail price”.

- The researcher states that the protocol allows financial institutions to pass on some of their cost savings to their end customers.

Yes, Ripple and XRP are MEANT FOR FINANCIAL INSTITUTIONS.

— SMQKE (@SMQKEDQG) August 16, 2024

Not retail.

“Ripple caters to FINANCIAL INSTITUTIONS”

Not retail.

“Ripple’s business model centers around the XRP Ledger—> financial institutions MUST INTEGRATE THEIR SYSTEMS WITH THE XRPL TO UTILIZE RIPPLE… pic.twitter.com/yvdLoJZrmm

- KUWL researcher Rob Cunningham asks XRP traders to ignore the uncertainty and developments in his recent tweet:

Please Know These XRP Facts

— Rob Cunningham | KUWL.show (@KuwlShow) August 16, 2024

️Shout out to @SMQKEDQG for his research, due diligence and bringing indisputable clarity to a world of FUD.

Two Essential Truth

1) “The @Ripple Protocol is not built to interface with consumers and businesses and does not govern retail… https://t.co/ifTWufSL6U pic.twitter.com/Br3YlJjbQm

- Ripple USD-related announcements and XRP Ledger testnet reset are the two key market movers for the native token of XRPL.

- Traders digest the final outcome of the Securities & Exchange Commission (SEC) lawsuit against Ripple, while it remains to be seen whether the US financial regulator appeals the ruling.

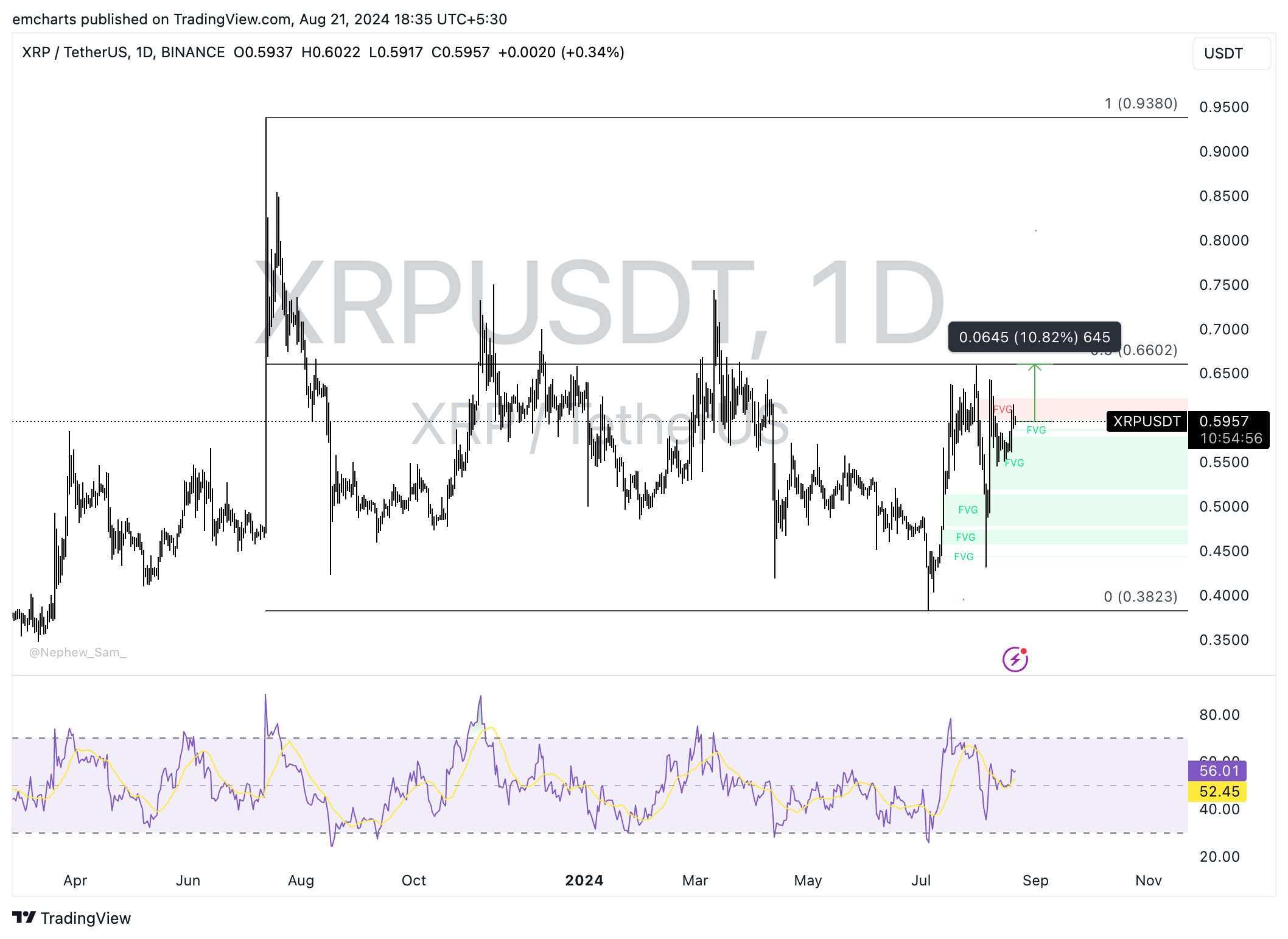

Technical analysis: XRP could rally 11% to $0.66 target

XRP hovered around the key psychological level of $0.60 on Wednesday. The native token of XRP Ledger is primed for further gains and could rally 12% to $0.66. This is the 50% Fibonacci retracement level of the decline from the July 13 top of $0.9380 to the July 5 low of $0.3823.

XRP could face resistance at the Fair Value Gap (FVG) between $0.5970 and $0.6217, however, as seen in the XRP/USDT daily chart below.

The Relative Strength Index (RSI) reads 55.97, which is above the neutral level.

XRP/USDT daily chart

XRP could find support at $0.5845, the August 18 high for the altcoin.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.