EUR/JPY surges on sentiment improvement yet struggles at 160.00

- EUR/JPY gains 0.80% as risk-on sentiment pressures safe-haven currencies like the Yen and Swiss Franc.

- ECB’s Klas Knot suggests room for further rate cuts, while Isabel Schnabel pushes back, citing sticky services inflation in the Eurozone.

- BoJ expected to leave rates unchanged, but Governor Ueda hints at potential future hikes if the economy meets expectations.

The Euro rallied sharply against the Japanese Yen on Thursday amid a scarce economic docket. The aftermath of the Federal Reserve’s decision keeps the FX space seesawing as traders scramble after a 50-basis point “hawkish” rate cut. The EUR/JPY trades at 159.54, a gain of over 0.80%.

EUR/JPY rises on upbeat market mood, as ECB members divided on rate cuts and BoJ expected to hold rates

A risk-on impulse has weighed on safe-haven currencies like the Yen and the Swiss Franc. In addition, the rise of the USD/JPY boosted the EUR/JPY, alongside some European Central Bank (ECB) speakers crossing the wires.

Dutch Central Bank President Klas Knot stated that there’s room for further cuts attuned to market expectations. On the other hand, Isabel Schnabel pushed back against easing, commenting that services inflation remains stickier in large parts of the Euro area (EU) and that signs of transmission of monetary policy tightening are weakening.

On the Japanese front, the Bank of Japan is expected to keep rates unchanged at the upcoming meeting, though it’s expected to adjust its quantitative easing policy. The BoJ’s last policy meeting triggered market volatility, which the Japanese parliament questioned.

BoJ Governor Kazuo Ueda appeared in parliament and justified the bank’s decision, hinting that further hikes are coming if the economy performs as foreseen. Other BoJ members supported his view to continue to tighten monetary policy with the likes of Takata, Nakagawa, and Tamura, signaling that further rates are needed if firms increase capex, wages, and prices.

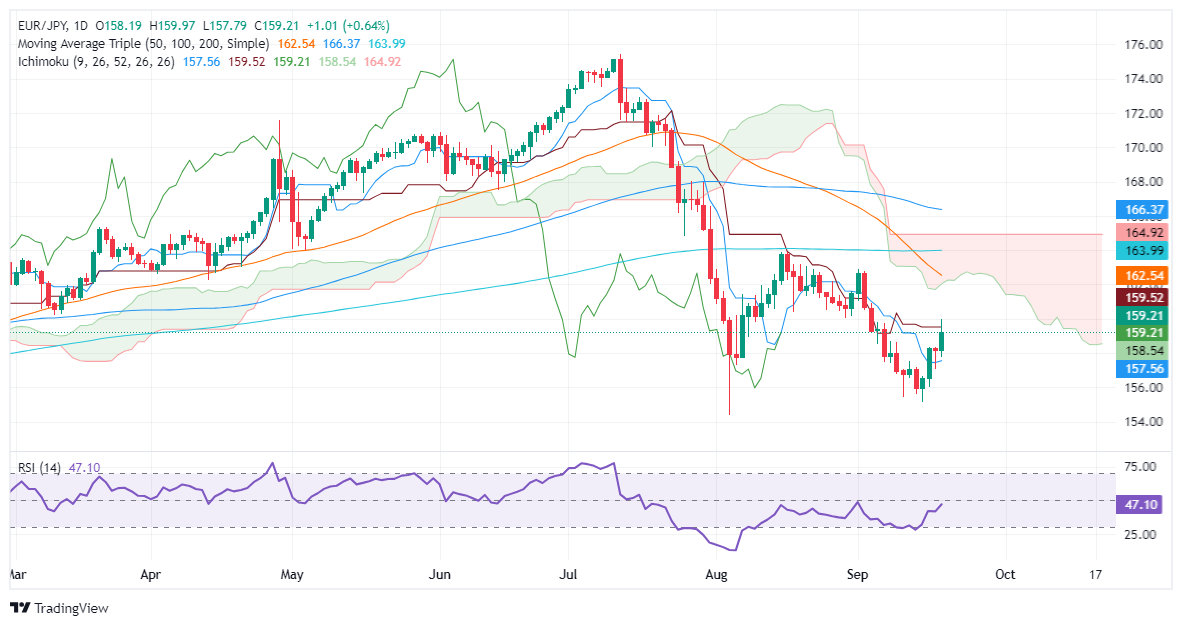

EUR/JPY Price Forecast: Technical outlook

From a technical standpoint, the EUR/JPY remains bearish, with price action standing below the Ichimoku Cloud (Kumo) and the 200-day moving average (DMA). Although the cross spiked toward 160.00 in a short time, it has failed to remain above the Kijun-Sen at 159.51, which opens the door for a pullback. If EUR/JPY drops decisively below 159.00, the next support would be the Senkou Span A at 158.53, followed by the psychological 158.00 figure ahead of the Tenkan-Sen at 157.55.

On the other hand, if buyers reclaim 160.00, look for a test of the bottom of the Kumo at 161.90-162.00.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. With wage inflation becoming a cause of concern, the BoJ looks to move away from ultra loose policy, while trying to avoid slowing the activity too much.