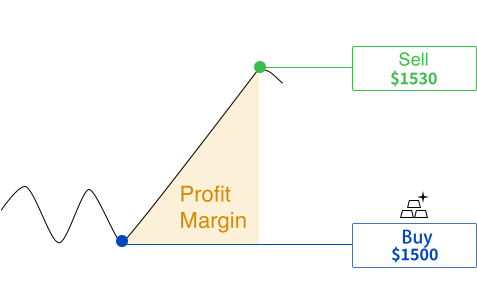

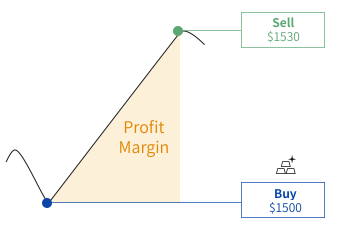

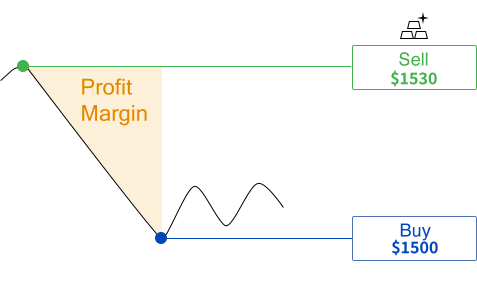

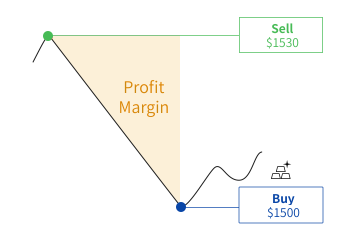

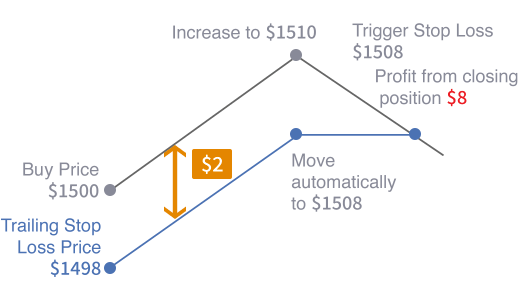

Market Risk

When the market trend is going on a different direction than your trading position, you may face the risk of losses.

Margin Call

When your account balance is lower than the maintenance margin level, part of or all your positions may be forced to close. To prevent this from happening, please monitor your account balance regularly.

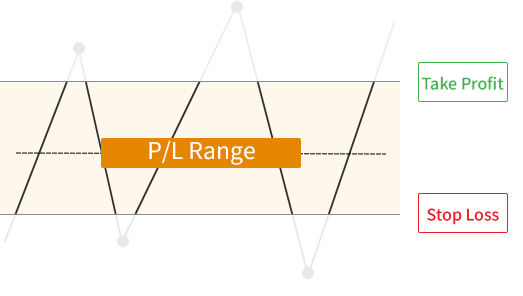

Gaps

Gaps in market prices happen when unexpected news or events occur, which cause orders with Take Profit/Stop Loss settings to not execute at set prices.

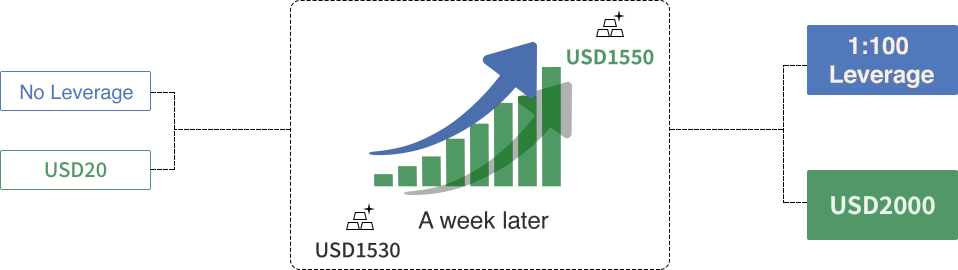

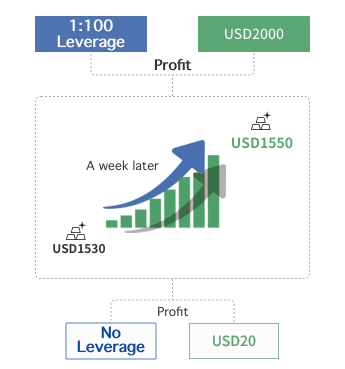

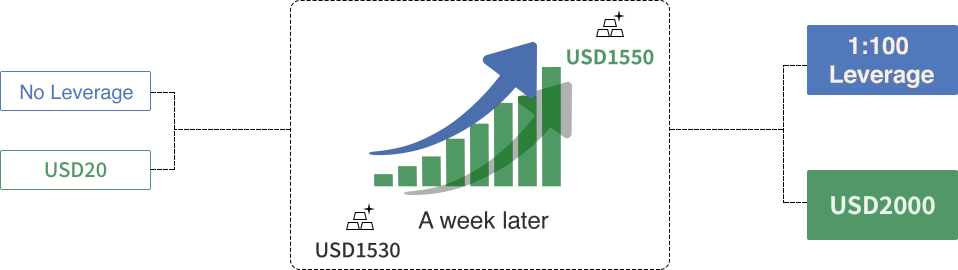

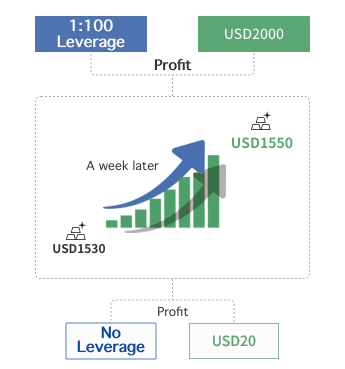

Leverage Risk

Risk Warning: leveraged contracts are a high leveraged product and may not be suitable for everyone. Leveraged provides magnify gains but also magnify losses. Therefore it may not be suitable for everyone.