Risk Management

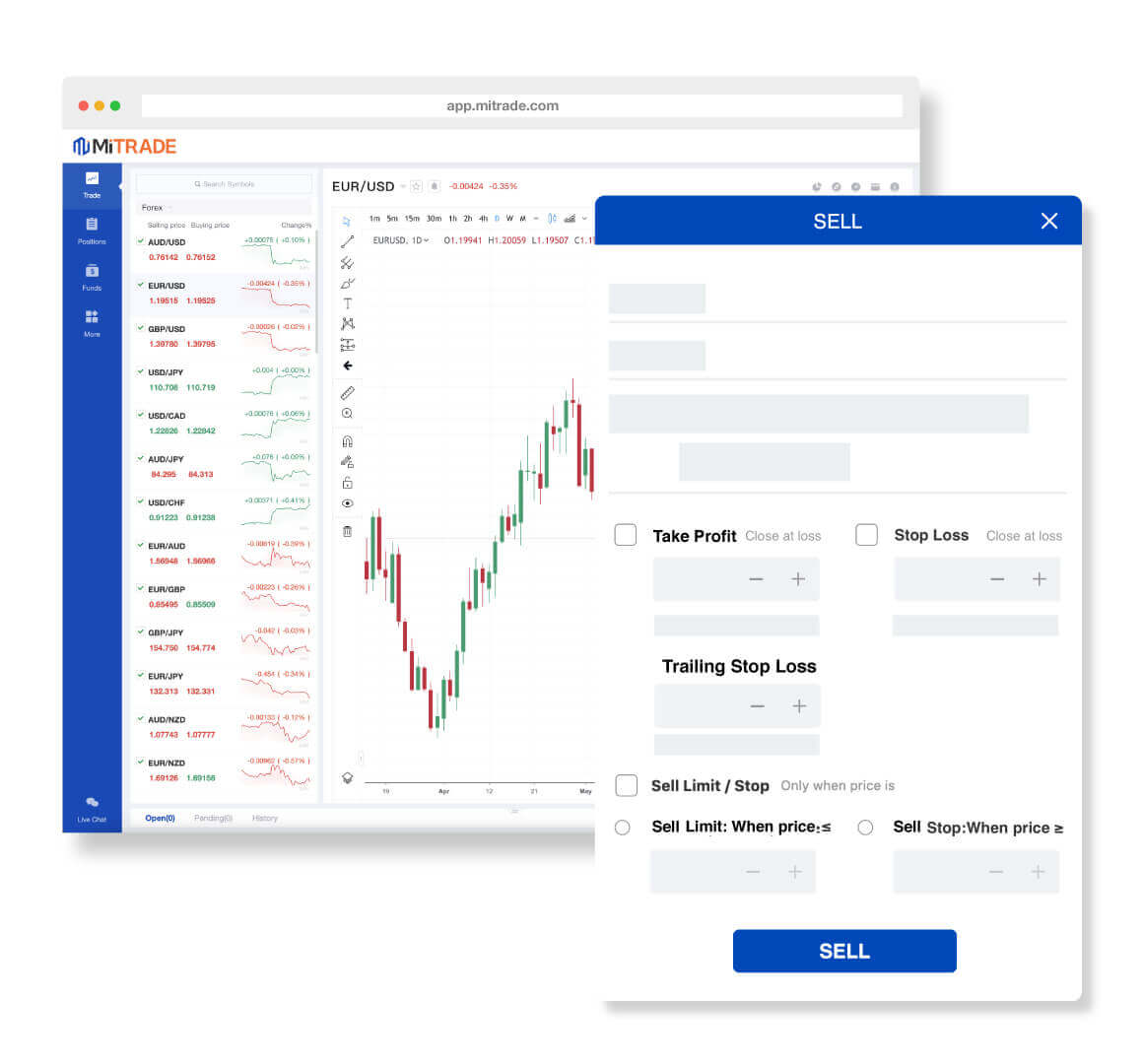

Take Profit/Stop Loss

Lock-in profitLimit lossesTrailing Stop Loss

Help locked-in profitAutomatically move as the price moveswithout having to amend constantly

Take Profit/Stop Loss

When setting up a new order or modifying an existing order, you have a choice to set your "Take Profit" and "Stop Loss". Once the order is set, it normally closes according to the target price, so as to help you lock in the profit when the target price is reached, or minimises the loss if the market moves unfavourably.

Please note that, with any order, gaps may appear due to market conditions, in which case the system cannot execute the order at the default price, but will close the position at the next-most favourable price from the target price.

Example

The current price of EUR/USD is 1.13816/1.13837 (sell/buy). You have created a 1-lot (1 lot = 100,000 EUR) buy order at 1.13837 and have set a Stop Loss order at 1.13806.

Under normal circumstances, when the price falls to 1.13806, your stop loss order will be triggered and the position will be closed at 1.13806, with a total loss of USD31.However, when the market situation suddenly changes, and the price directly falls from 1.13837 to 1.13795, directly gapping over your stop loss target, a market gap appears, and so the system will not be able to close the position at 1.13806, but will choose the next most favorable price, which is 1.13795, to close your position, and the final loss will be USD42.

Trailing Stop Loss

Trailing Stop Loss (or "Trailing Stop") is a useful tool. The stop-loss price get adjusted in accordance to market price movement so you can maximize your profit or reduce losses. You may set a Trailing Stop Loss when you create a new order. When the market price is moving in favour of your position, the stop-loss price will be adjusted accordingly to the pre-determined distance within the order. However, the stop-loss price will remain if the market price move against your position until it get trigger to close your position. Please note that, with any order, gaps may occur due to market conditions resulting in the executed price being the next-most favourable price from the stop-loss price.

Example

The current price of EUR/USD is 1.13816/1.13837 (sell/buy). You have created a 1-lot buy order at 1.13837 and set a 100-point (0.00100) Trailing Stop Loss.

When the price of the product is 1.13816, your stop price is 1.13716. If the product sell price rises to 1.13846, the stop price will be updated according to the distance you set, and the updated stop price will be 1.13746. Conversely, when the product price falls from 1.13846 to 1.13746, the Trailing Stop Loss will be triggered and the position will be closed at 1.13746.

Why Choose Mitrade?

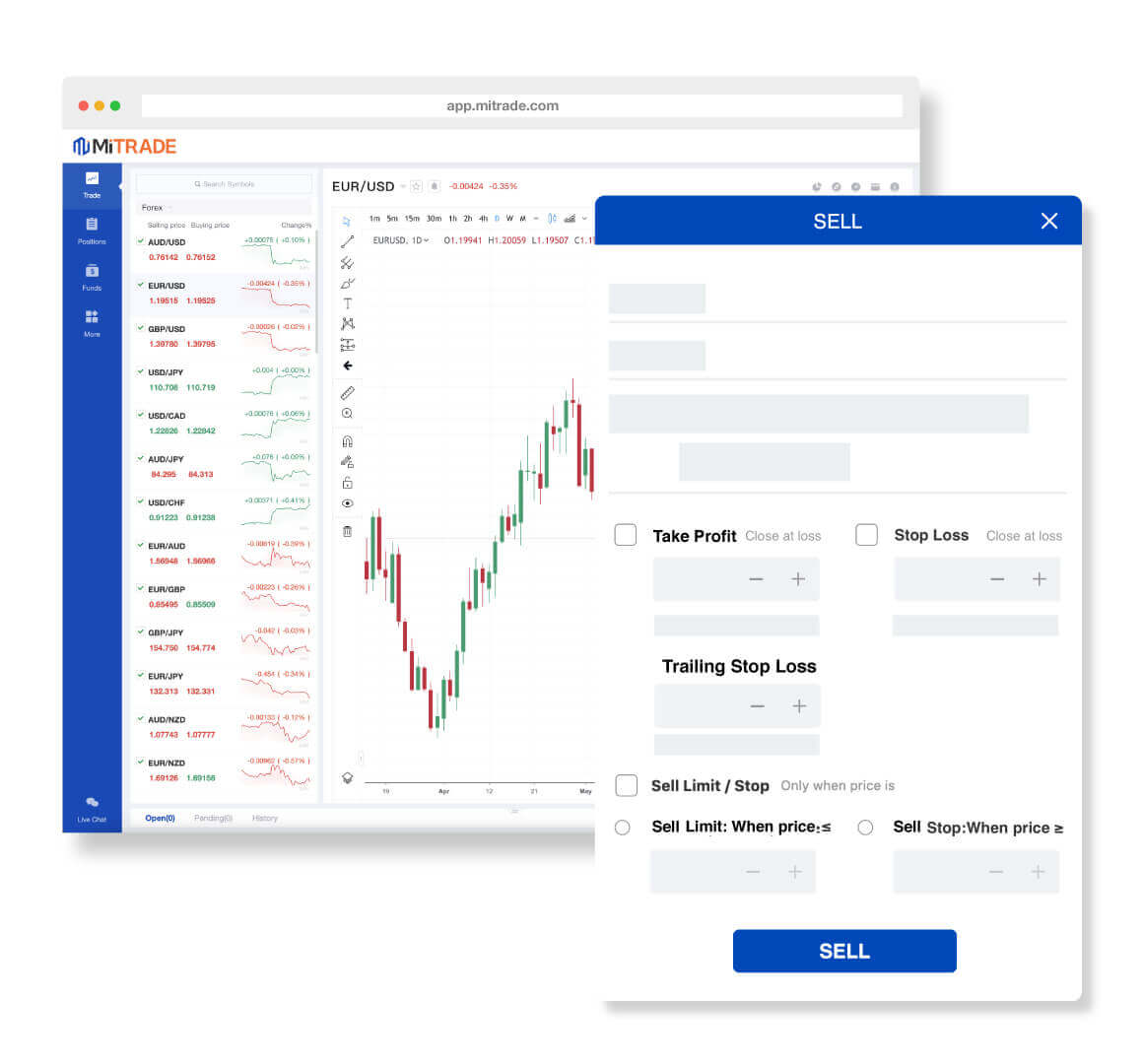

Simple and Intuitive Platform

Experience a platform that integrates market updates, trading analysis, trading and account management with risk management tools and more.

Competitive Trading Costs

Enjoy low-cost trading, zero commissions, low overnight fees, and competitive and transparent spreads.

Low Threshold Amount

The minimum size per trade is as low as 0.01 lots.

Regulated by the Relevant Regulatory Bodies

We understand the safety of your funds is of paramount importance. Therefore, all client funds are segregated from our operational funds.

Negative Balance Protection

You will not lose more than your deposit with our negative balance protection for your account.

Exceptional Customer Support

Enjoy fast and responsive customer service from a team of dedicated professionals.