BoC set to leave interest rate unchanged amid rising inflation and US trade war

- Bank of Canada (BoC) is expected to keep its policy rate unchanged.

- The Canadian Dollar has been persistently appreciating vs. the US Dollar.

- Headline inflation in Canada returned to above the BoC’s target.

- Governor Macklem’s press conference is seen focusing on US tariffs.

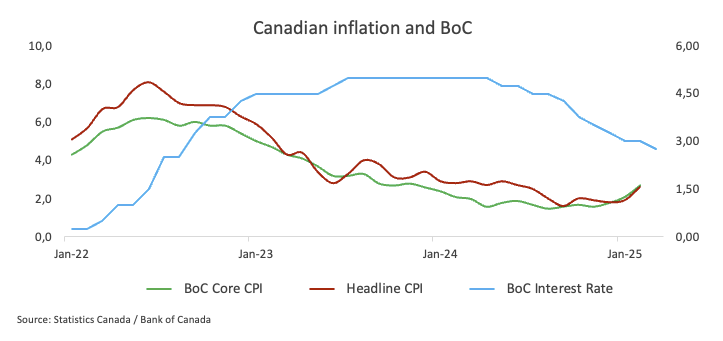

All the attention is expected to be on the Bank of Canada (BoC) this Wednesday, as market experts widely anticipate the central bank to maintain its interest rate at 2.75%, halting seven consecutive interest rate cuts.

At the same time, the Canadian Dollar (CAD) has been gathering momentum in the last couple of weeks, appreciating the 1.3840 region vs. the US Dollar (USD) from monthly lows around the 1.4400 zone.

Since United States (US) President Trump returned to the Oval office in January, it has been all about his trade policies, in particular those regarding tariffs. This specific subject is predicted to dominate the BoC’s event, including comments from Governor Tiff Macklem as well as questions from the media.

The Bank of Canada is strategising a pause in its easing cycle for April as mounting global uncertainties—largely driven by the White House's erratic approach to tariffs—force a rethink of trade policies. This backdrop of unpredictability suggests that a cautious tone will likely define both the BoC’s statement and Governor Macklem's follow-up press conference this week.

At his most recent news conference on March 20, Governor Macklem explained that the ambiguity surrounding the impact of US tariffs had compelled the bank to adjust its monetary policy, making it less forward-looking than usual. He stressed that despite these challenges, there was no doubt about the bank's unwavering commitment to maintaining low inflation.

In addition, from the central bank’s Business Outlook Survey published on April 7, Canadian firms and consumers are now bracing for a much higher risk of recession in the coming year, as US President Trump's tariffs and potential retaliatory measures fuel widespread uncertainty. According to the survey, many companies have paused their investment and hiring plans, with employment expectations now lower than at any point during the pandemic.

The BoC noted that businesses no longer anticipate a slowdown in rising input prices—a notable shift from recent trends—suggesting that inflationary pressures are likely to intensify. In fact, inflation in Canada surged to an eight-month high of 2.6% in February. The survey revealed that 65% of firms expect their costs to climb if tariffs become more widespread, leading 40% of respondents to plan an increase in their selling prices.

Previewing the BoC’s interest rate decision, analysts at TD Securities noted: "We look for the BoC to pause at 2.75% in April as it waits for more clarity around tariff impacts before easing further. Governor Macklem hinted the Bank would be less forward-looking in his March 20th speech, and with the economy showing more strength over January/February, that should be enough for a move back to the sidelines. Look for a cautious tone to the policy statement with more emphasis on tariff risks as the Bank reaffirms its commitment to price stability.”

When will the BoC release its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada is scheduled to reveal its policy decision on Wednesday at 13:45 GMT, followed by Governor Tiff Macklem’s press conference at 14:30 GMT.

Although major surprises are not anticipated, market watchers believe the central bank's message will continue to focus on the implications of US tariffs for the Canadian economy—a sentiment that could also influence currency movements.

Senior Analyst Pablo Piovano from FXStreet highlighted that “USD/CAD has recently broken below its key 200-day Simple Moving Average (SMA) at 1.3995, which could open the taps for extra weakness in the short-term horizon”.

“If the Canadian Dollar extends its recovery, USD/CAD is likely to revisit its 2025 floor at 1.3838 (April 11), closely followed by the November 2024 trough at 1.3817, and ahead of the September 2024 low at 1.3418 (September 25)”, Piovano added.

Piovano notes that “on the upside, the pair should encounter initial resistance at its April peak at 1.4414 (April 1), prior to the March top at 1.4542 (March 4). The breakout of the latter could put a potential test of the 2025 high of 1.4792 (February 3) back on the radar”.

“Currently, spot is trading in oversold conditions as per the Relative Strength Index (RSI), thus, a technical bounce should not be ruled out. However, the ongoing bearish trend could gather extra strength as well, as suggested by the Average Directional Index (ADX) near the 25 level”, Piovano concludes.

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Next release: Wed Apr 16, 2025 13:45

Frequency: Irregular

Consensus: 2.75%

Previous: 2.75%

Source: Bank of Canada