Crypto ETF adoption should pick up pace despite slow start, analysts say

- Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors.

- Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

- Ethereum ETF demand is expected to continue lagging behind that of Bitcoin’s.

The approval of US-listed spot Exchange Traded Funds (ETFs) tracking Bitcoin (BTC) and Ethereum (ETH) prices this year was considered a game-changer for the crypto industry. Months after their launch, these investment products have gained some acceptance among institutional investors, but the amount of capital they attracted has failed to meet the bullish expectations that drove BTC prices to a new all-time high in March. Are ETFs a victim of overhyped optimism or a key tool for crypto adoption in the long term?

The US Securities and Exchange Commission (SEC) gave the green light in January to the listing of 11 ETFs for Bitcoin, opening the door of the largest crypto asset by market capitalization to many new investors. Money quickly flew into these funds, propelling Bitcoin price to a fresh all-time high above $73,000 in mid-March. Back then, talks about BTC reaching $100,000 were widespread, riding on expectations of even more demand ahead.

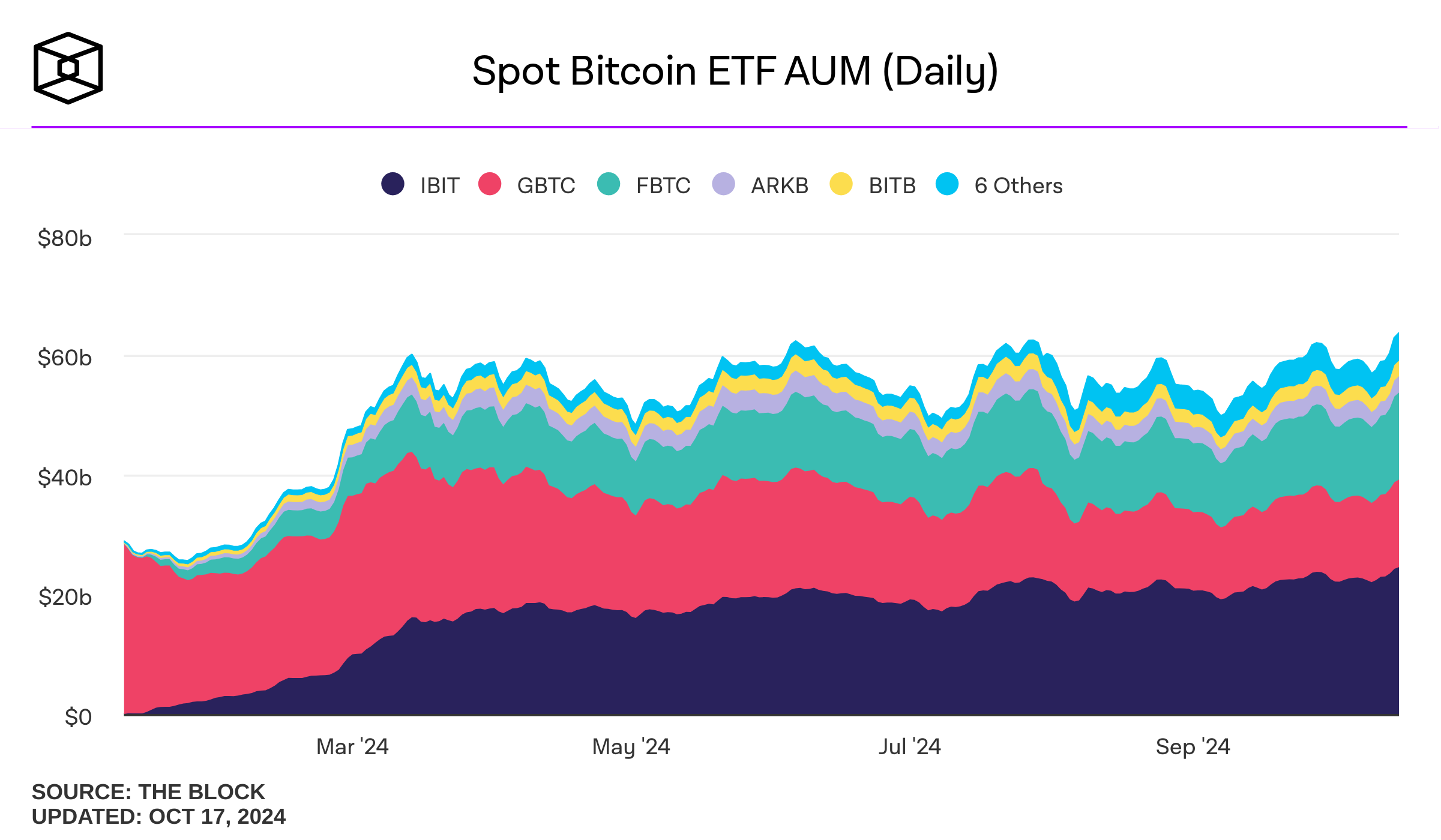

Six months later, the volume of Assets Under Management (AUM) in BTC ETFs is at around $60 billion, broadly steadying since mid-March, according to data from The Block. This rangebound performance has raised doubts among the community, which wonders if expectations about the role of ETFs in driving the next wave of crypto adoption were overdone.

Evolution of Assets Under Management in Bitcoin spot ETFs since their launch. Source: The Block.

Big institutional players still haven’t made the move

“Most institutions aren’t here yet,” said Elliot Johnson, Chief Investment Officer at Canadian investment firm Evolve ETFs in a panel at the European Blockchain Convention, which was held in Barcelona in late September.

In his opinion, the slower-than-expected adoption of the Bitcoin ETFs among big institutions is because of barriers such as bureaucracy inside these big players (approvals from investment committees, for example) and Dollar liquidity.

“If you want to do a $50 billion allocation because this is the smallest unit of allocation you can do as a big institution (...), you would need Bitcoin price to go higher for the Dollar liquidity to match the size that you are looking for,” he illustrates.

Dina Tsarapkina, partner at venture capital firm Agnostic Fund, said the possibility of one big institution starting to offer Bitcoin ETFs to its customers in the next six months is quite probable.

“Putting crypto in your portfolio for institutional allocators is still considered a career risk. But once the first couple of endowments or pension [funds] start to make the move, the others will have to follow (...) When that floodgate really starts opening, it is going to open really fast and everyone will want to invest in the [crypto] asset class,” she said.

Ethereum spot ETFs see tepid start

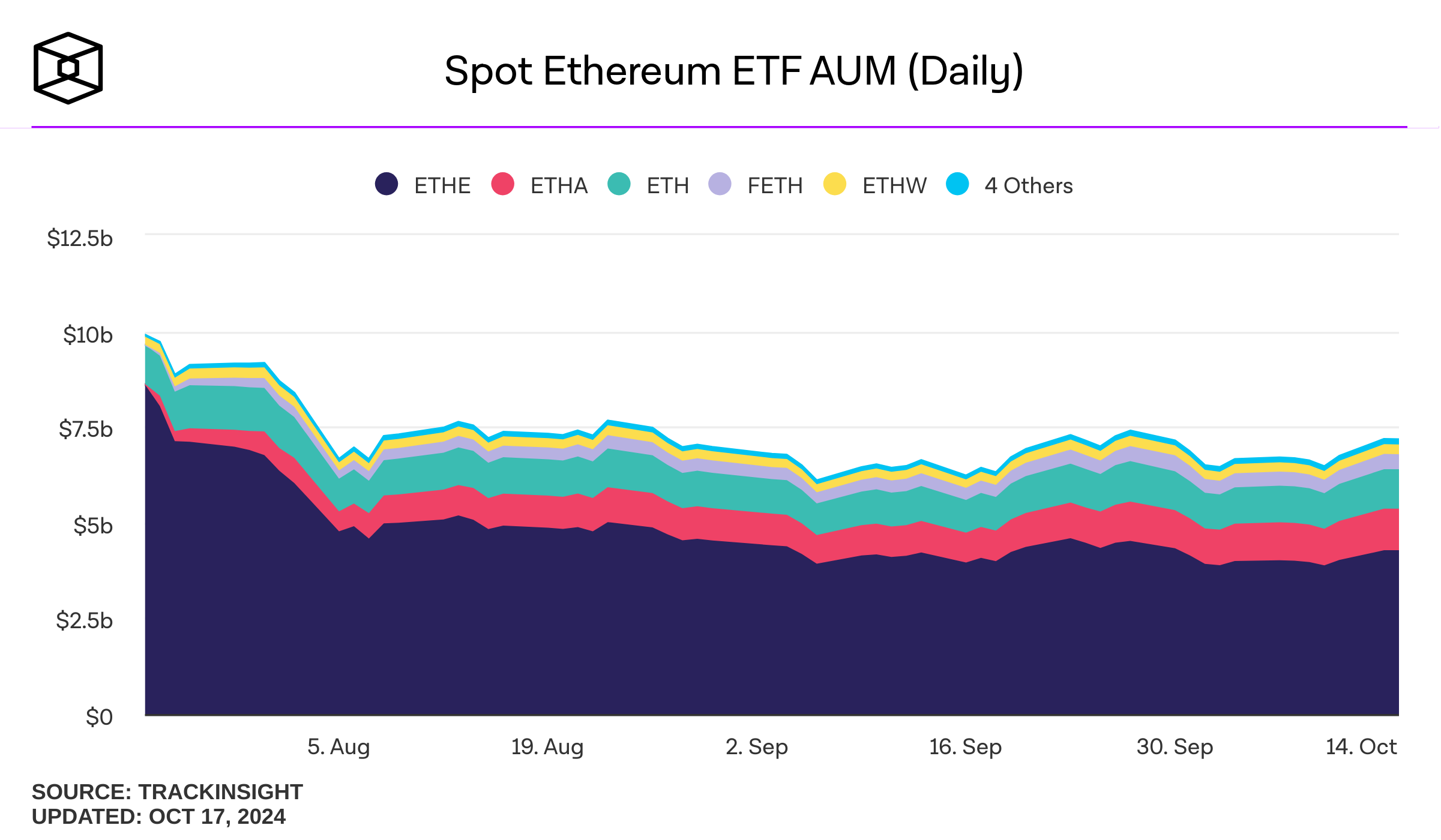

The US SEC allowed the first spot Ethereum ETFs to start trading on July 23, just six months after the approval of Bitcoin ETFs. As of October 17, the total AUM in these investment products is at $7.17 billion, according to Trackinsight data, well below the amount seen in Bitcoin ETFs and underlying the different fortunes of both products in terms of demand.

Evolution of Assets Under Management in Ethereum ETFs since their launch. Source: Trackinsight.

“The big issue with ETH ETFs is that they came too soon,” says Matthew Hougan, Chief Investment Officer at Bitwise Asset Management. “They [the ETFs] would have raised five times more assets if [the approval] had waited another year as it takes people a long time to digest Bitcoin and be ready for the next thing,” he adds.

Still, Hougan expects that the AUM in ETH ETFs will be around $20 billion in a year as the crypto market recovers and investors become more comfortable with this asset class.

Some other analysts suggest that the struggle of ETH ETFs to attract new capital may continue in the short term.

“The ETH story is more difficult to tell,” says Adrian Fritz, head of crypto research at 21shares. “The narrative for Bitcoin is pretty straightforward, while with Ethereum there is a lot to unpack. I think it will just take a bit more education, more time, until institutional investors pick up on this investment opportunity,” he says.