Bitcoin Price Forecast: Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

- Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA.

- Bloomberg reports that China is open to trade talks with President Trump’s administration.

- CryptoQuant’s weekly report highlights that BTC selling from large investors has declined while miners have increased.

- Semler Scientific announced plans to raise $500 million to purchase more BTC.

Bitcoin (BTC) is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead. In the meantime, according to Bloomberg, China is open to trade talks with US President Trump’s administration, signaling reduced trade war tensions, which could boost risk-on sentiment in the short term and benefit risky assets like Bitcoin.

Moreover, CryptoQuant’s weekly report highlights that BTC sales from large investors have declined while miners have increased, and Semler Scientific announced plans to raise $500 million to purchase more BTC.

China opens trade talks with the US – Bloomberg

According to the Bloomberg report on Wednesday, China is open to trade talks with US President Donald Trump’s administration, but only if the US shows respect by moderating disparaging remarks from Trump’s cabinet.

The report explains that the fate of the global economy and financial markets largely hinges on whether the US and China can find a way to avoid a protracted trade war.

“Trump has hit China with tariffs of 145% on most goods since taking office, prompting Beijing to retaliate and threatening to wipe out most trade between the world’s biggest economies,” says a Bloomberg analyst.

The Kobeissi Letter's post on X states that this news triggered a 100-point surge in S&P 500 futures on Wednesday, reflecting market sensitivity to US-China trade relations. However, Bitcoin stabilizes at around $83,000 during the early European session. If the trade war between the world’s two biggest economies settles or eases, it could be a positive sign and boost risk-on sentiment for risky assets like Bitcoin.

Semler Scientific announces plans to raise $500 million to purchase more BTC

Semler Scientific (SMLR), a medical technology company, filed with the US Securities and Exchange Commission (SEC) on Tuesday to raise $500 million through a shelf registration to purchase more BTC. The funds will support the company’s ongoing adoption of Bitcoin as its primary treasury reserve asset in May 2024. Currently, the firm holds 3,192 BTC.

In his X post, Eric Semler, SMLR's chairman, says, “We have reached a settlement in principle. I'm EXCITED TO BUY MORE BTC!”

The trend of corporate Bitcoin adoption is rising slowly. The growing acceptance of BTC as a strategic asset will positively impact Bitcoin's price in the long term due to increased demand, reduced circulating supply, and positive market sentiment.

Bitcoin selling from large investors declines while miners increase – CryptoQuant report

CryptoQuant’s weekly report on Tuesday highlights that BTC selling from large investors has declined while miners have increased.

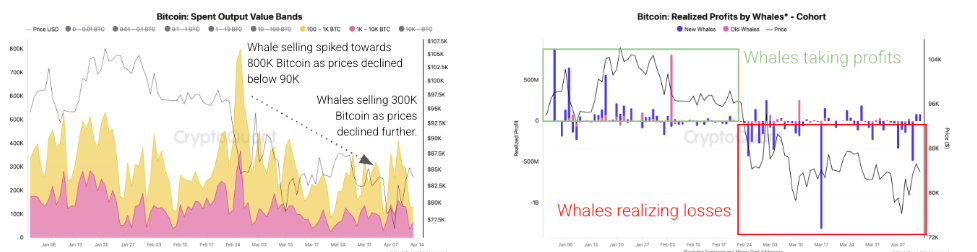

As shown in the graph below, Bitcoin sales by large investors have eased as they realize losses. The daily BTC sales from large investors have declined from a peak of 800K in late February to a daily rate of about 300K BTC (left chart below). The slowdown in selling has come as these investors have been realizing losses since late February amid low prices (red rectangle in the right chart). Contrarily, investors were taking profits in January and the first half of February as Bitcoin hit $100,000.

Bitcoin spent output value bands ( left chart). Bitcoin profit by whales cohort (right chart). Source: CryptoQuant

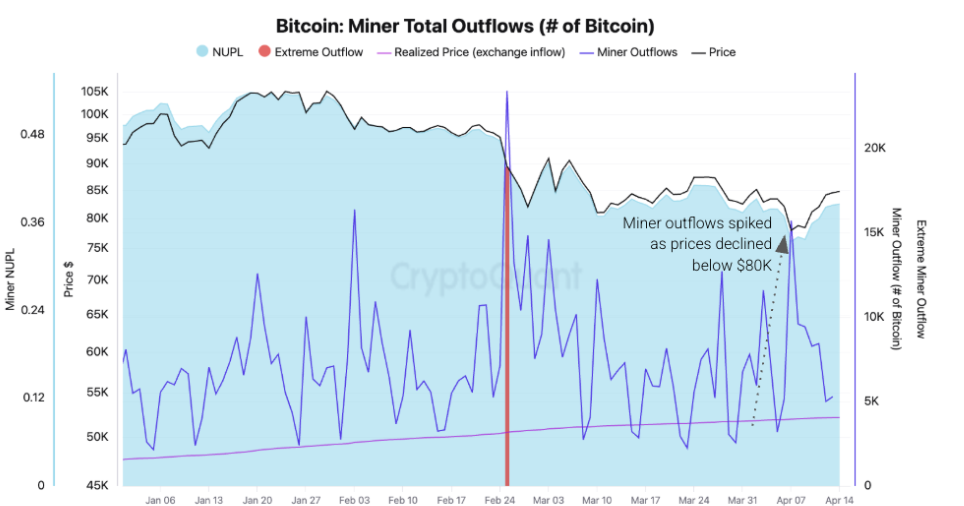

The report explains that BTC miners have increased their selling in response to lower profitability as prices fell below $80,000 last week. Bitcoin miners’ outflows (violet line) spiked to 15,000 BTC on April 7, when prices dipped to $74,000. This was the third-largest daily outflow so far in 2025. Bitcoin miners’ profitability has been hit with lower prices, depressed transaction fees, and a record-high Bitcoin network hashrate, which implies higher mining costs, sending their average operating margins down from 53% in late January to 33% on Tuesday (light blue area).

Bitcoin Miner total outflow (BTC) chart. Source: CryptoQuant

Moreover, the Coinbase Research report points out that Bitcoin and the COIN50 index have recently broken below their 200-day Moving Averages (MA), signaling that the market may be in the early stages of a long-term downward trend. This is consistent with the trend of declining total market capitalization and shrinking venture capital, both of which are important features of the possible arrival of a "crypto winter."

Bull and bear cycles in BTC markets as identified by the 200-day MA chart. Source: Coinbase

Bitcoin Price Forecast: BTC struggles to break out above the $85,000 resistance zone

Bitcoin has faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. On Tuesday, BTC tried breaking above this level but was rejected again and declined by 1.12%. At the time of writing on Wednesday, it hovers around $83,700.

If BTC closes above $85,000 on a daily basis, it could extend the rally to the key psychological level of $90,000. A successful close above this level could extend an additional rally to test its March 2 high of $95,000.

The Relative Strength Index (RSI) on the daily chart flattens around its neutral level of 50, indicating indecisiveness among traders. The RSI must move above its neutral level for the bullish momentum to be sustained.

BTC/USDT daily chart

However, if BTC continues its downward trend, it could extend the decline to retest its next daily support level at $78,258.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.