Bitcoin Price Forecast: MicroStrategy’s SEC form 8-K filing hints at possible Bitcoin sales to meet financial obligations

- Bitcoin price stabilizes around $80,000 on Tuesday after reaching a new year-to-date low of $74,508 the previous day.

- MicroStrategy’s SEC Form 8-K filing reports a loss of $5.91 billion, hinting at possible BTC sales to meet financial obligations.

- The “fake news” on the tariff pause brings volatility spikes in risky assets like Bitcoin.

- The technical outlook suggests a ‘dead cat bounce’ scenario with a recovery towards $85,000 and dumping to $76,606.

Bitcoin (BTC) price stabilizes around $79,000 at the time of writing on Tuesday after reaching a new year-to-date low of $74,508 the previous day. MicroStrategy’s SEC Form 8-K filing on Monday highlights an unrealized loss of $5.91 billion in BTC holding during the first quarter, hinting at possible sales to meet financial obligations. Moreover, the ‘fake news’ regarding a pause in the US tariff policy brought volatility spikes in risky assets like Bitcoin. Looking down on the technical outlook, it suggests a ‘dead cat bounce’ scenario with a recovery towards $85,000 and dumping to $76,606.

MicroStrategy could fuel BTC crash

Michael Salyor’s MicroStrategy (MSTR) filed a Form 8-K with the SEC on Monday. This filing details significant financial updates for the first quarter of 2025.

According to the filing, MSTR reported an unrealized loss of approximately $5.91 billion on its Bitcoin holdings for Q1. The firm currently holds 528,185 Bitcoins. Moreover, no new Bitcoin or stock acquisitions were reported between March 31 and April 6, suggesting the filing focused on existing assets and their valuation. The filing reportedly highlighted a total debt of $8.22 billion.

“As Bitcoin constitutes the vast bulk of assets on our balance sheet, if we are unable to secure equity or debt financing in a timely manner, on favorable terms, or at all, we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable,” say MSTR on the filing.

If MSTR sells some of its Bitcoin holdings to cover its financial obligation, the effect hinges on execution and context. A small, planned OTC sale might barely ripple the market, while a large, rapid exchange sale during a downturn could slash prices and shake confidence, leading to a sharp fall in Bitcoin’s price.

This sell-off might encourage other corporate holders (Marathon Digital with 46,376 BTC, Metaplanet with 4,206 BTC) to follow, compounding supply pressure. Conversely, it could cool the trend of corporate Bitcoin adoption.

Fake news on Donald Trump’s tariff pause brings volatility to the market

According to The Kobeissi Letter report, at 10:15 AM ET, US stocks swung $7 trillion in 30 minutes on a “fake” tariff deal headline that US President Donald Trump was considering a 90-day pause on tariffs. The crypto market followed this trend, with Bitcoin recovering from its yearly low of $74,508 to a high of $81,243 on Monday.

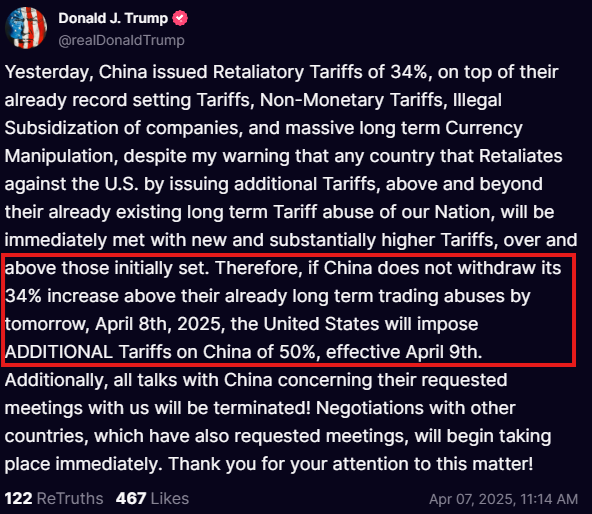

Minutes later, President Trump announced the biggest news of the day on his account at Truth Social: He is imposing another 50% tariff on China, taking effect on Wednesday, if the Asian country does not cancel the 34% retaliatory tariff by Tuesday. This adds to the previous 54% tariffs placed on the country.

According to CNBC, China stated it would fight “to the end” regarding tariffs, signalling that the market could begin to expect further volatility.

The announcement sparked further negativity in the market, with no tariff delay and also higher tariffs on China. The crypto markets fell slightly from their daily high, with Bitcoin closing at around $79,000 on Monday.

Lookonchian data shows that a wallet moved all 365 BTC worth $29 million on Tuesday after 10 years of dormancy. This wallet received the BTC 10 years ago when the price was only $284. This shows that early holders are loading off their BTC holdings. If this event continues and intensifies, BTC could see a further decline in its prices.

Bitcoin Price Forecast: BTC’s show dead cat bounce scenario

Bitcoin price recovered after reaching a year-to-date low of $74,508 during the early Asian session and closed around $79,000 on Monday. At the time of writing on Tuesday, it hovers around $79,000.

Bitcoin’s current price action resembles a ‘dead cat bounce’ scenario, in which a temporary, short-lived recovery towards the $85,000 resistance level could play out before continuing its downward trend.

If BTC continues its downward trend, it could extend the decline to retest its next daily support level at $73,072.

The daily chart’s Relative Strength Index (RSI) read 38, indicating strong bearish momentum and supporting the negative outlook.

BTC/USDT daily chart

However, if BTC recovers and closes above its daily resistance at $85,000, it could extend the recovery rally to the key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.