Dogecoin Price Prediction: DOGE extends losses despite Bitcoin rally to new high

- Dogecoin price fell below $0.40 on Monday, down 15% in the last seven days.

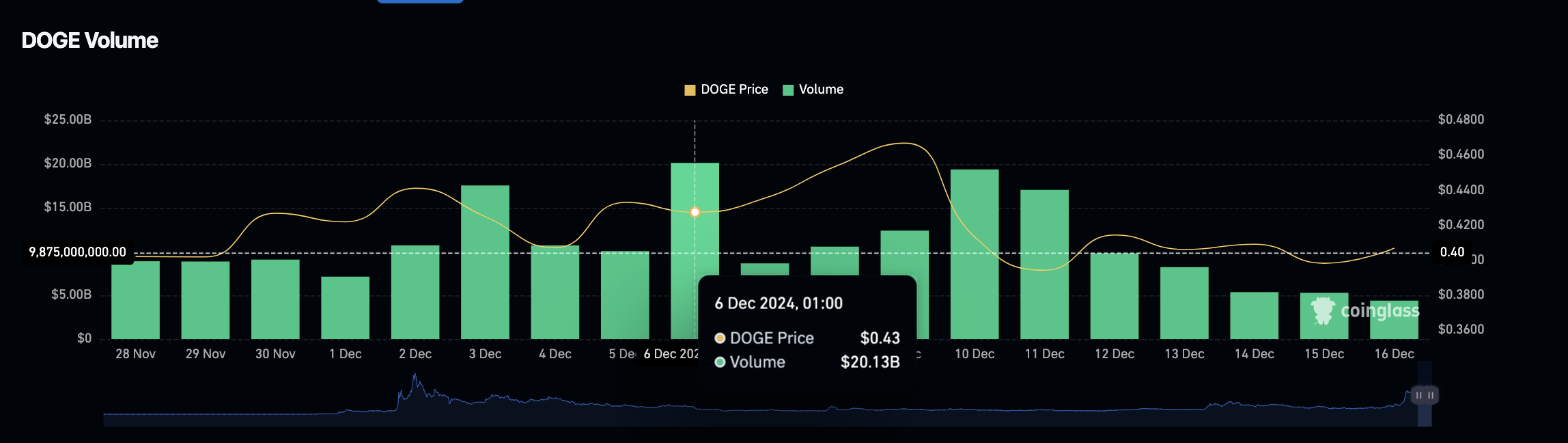

- The leading meme coin's trading volume has declined by $14.84 billion since December 6, hitting a 40-day low of $5.29 billion on Sunday.

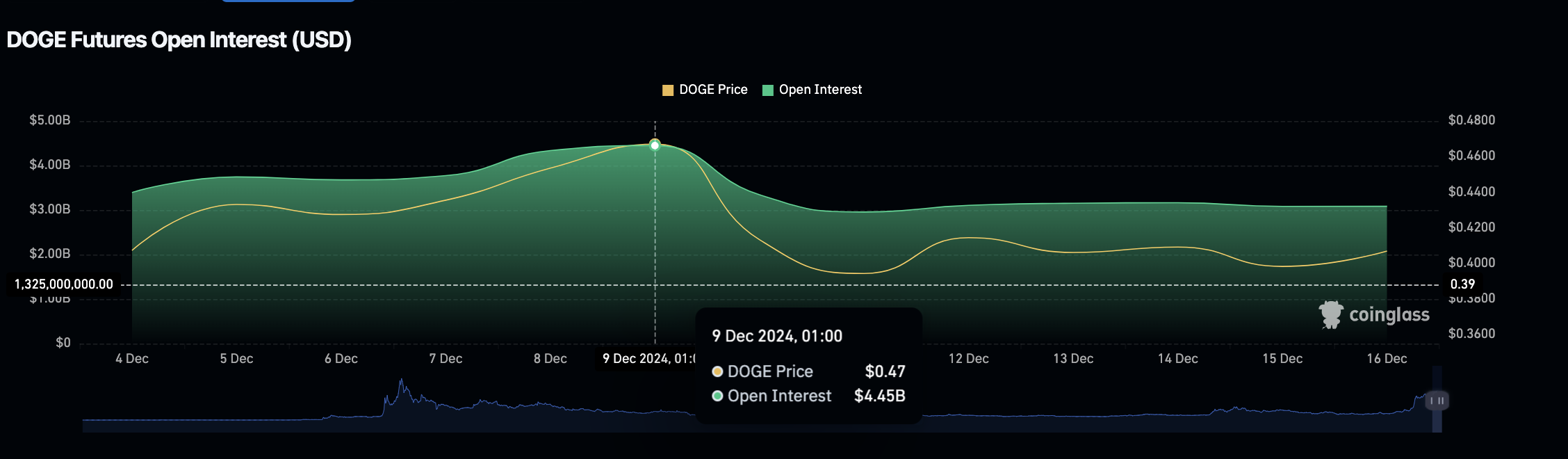

- In the derivatives markets, DOGE open interest also declined, signaling increasing disinterest among short-term traders.

Dogecoin price broke below the $0.40 support on Monday, tumbling 15% in the last seven days despite Bitcoin price hitting new all-time highs. Vital markets data shows DOGE has struggled to find new buyers since retracing from its 3-year peak on December 9.

Dogecoin price tumbles 15% despite Bitcoin new all-time high

Dogecoin has struggled to recover from the crypto market crash triggered by the flaring geopolitical crisis last week. While investors capitalized on the dovish macroeconomic landscape to drive Bitcoin to new all-time highs on Sunday, DOGE has extended its losses further, sparking major bearish concerns for the week ahead.

Dogecoin price (DOGE) vs. Bitcoin (BTC)

Dogecoin price (DOGE) vs. Bitcoin (BTC)

The chart above shows the divergence between Dogecoin price movements and Bitcoin price action over the past week.

DOGE has declined 15% in the last seven days, tumbling from $0.47 on December 9 to $0.39 at press time on Monday.

Meanwhile, Bitcoin price has headed in the opposite direction. During that period, BTC has led the crypto market resurgence with a 14.2% rally, hitting an all-time high of $106,648.

Dogecoin demand wobbles amid Bitcoin rally

When a mega-cap asset like Dogecoin decouples from the broader market uptrend it signals the presence of active internal bearish catalysts.

A closer look at the underlying market data shows DOGE has struggled to find new buyers since hitting a 3-year peak on December 9.

Affirming this stance, the Coinglass chart below depicts DOGE daily spot trading volumes and open interest flows.

DOGE spot trading volume plummets by 74%

The Coinglass data below highlights the concerning trends in Dogecoin’s daily spot trading volume and open interest flows.

Dogecoin spot trading volume surged to $20.1 billion on December 6. However, after DOGE prices retraced from the 3-year high of $0.47 on December 9, demand began to fade.

By Sunday, DOGE's spot trading volume fell to $5.3 billion, marking its lowest level in 42 days since November 3.

Dogecoin Spot Trading Volume vs. DOGE price | Source: Coinglass

Dogecoin Spot Trading Volume vs. DOGE price | Source: Coinglass

This decline of $14.84 billion indicates that Dogecoin's demand has dropped by 74% within the past week.

The sharp pullback has raised concerns about diminishing interest, particularly when contrasted with the Bitcoin-led market rally that has driven broader bullish sentiment.

$1.4 billion decline in open interest confirms bearish sentiment

Beyond spot market activity, recent Dogecoin derivatives trading data also paints a bearish picture. Following last week’s market dip, DOGE open interest—which measures the total value of outstanding futures contracts—has taken a significant hit.

Dogecoin price vs. Open Interest | Source: Coinglass

Dogecoin price vs. Open Interest | Source: Coinglass

Since December 9, traders have collectively scaled back their positions by nearly $1.4 billion, as open interest dropped from $4.5 billion to $3.03 billion.

When spot trading volume declines alongside open interest, it raises major bearish concerns.

With new buyers unwilling to enter the market and short-term speculative traders exiting their positions, DOGE price risks further corrections.

Combined with Bitcoin’s resurgence, it raises speculations that traders are side-stepping memecoins like DOGE and shifting capital towards BTC.

With the anticipated United States Federal Reserve (Fed) interest-rate cut later this week and President-elect Donald Trump’s bullish comments surrounding Bitcoin strategic reserve speculations, the negative price divergence between DOGE and BTC could persist in the days ahead.

Dogecoin Price Forecast: $0.35 support at risk

Dogecoin’s price action shows signs of weakness as it teeters around the midline of the Keltner Channel on the daily chart.

The drop below the $0.40 midline support signals that bears are beginning to gain a foothold over short-term market momentum.

A decisive daily close below this level could confirm a larger downside move toward the critical $0.35 support zone.

Dogecoin price forecast | DOGEUSDT (Binance)

Dogecoin price forecast | DOGEUSDT (Binance)

If the $0.35 psychological support caves, the lower KC band at $0.334 will act as the next key support level to watch.

A breach of this line could accelerate selling pressure and push DOGE into deeper bearish territory.

Meanwhile, on the upside, the first resistance line lies at $0.477, where the upper band aligns with recent highs.

Despite this bearish tilt, the Average Directional Index (ADX) reading of 39.14 suggests strong underlying momentum.

A rebound above $0.405 could invalidate the bearish outlook, with bulls reclaiming control and setting sights back toward $0.477.

Until then, strategic traders will remain cautious as bears currently have the upper hand.