Crypto Today: ETH and SOL remain bullish, BTC price hits $85K amid Michael Sayor’s latest signal

- The global crypto market capitalization dips 2% on Monday, consolidating at $2.8 trillion.

- US spot Bitcoin ETFs' outflows flattened on Friday, raising hopes of a potential buying phase.

- The share of trade from non-US crypto markets has increased from 18% to 20% in the past week, emphasising the global impact of the US trade war.

The global crypto market momentum retreated 2% on Monday after United States (US) inflation data triggered double-digit gains for top-ranked over the weekend.

In terms of positive discourse, Solana and Ethereum markets are leaning bullish after Donald Trump recently repealed a Biden-approved law involving DeFi platforms.

However, markets continue to hang in the balance as non-US markets remain jittery.

Bitcoin market updates:

- BTC price rebounded above $85,100 on Monday, up 15% from last week’s lows around $74,500.

- Over the weekend, Michael Saylor announced plans to acquire more BTC imminently.

Saylor’s cryptic statement on Sunday came after Strategy Q1 filings revealed $6 billion unrealized losses on all Bitcoin acquisitions since the year began.

The company acquired 80,785 BTC to its balances since the beginning of the year after raising $7.69 billion in Q1, majorly through common stock sales.

- Bitcoin ETFs have posted seven consecutive days of outflows, but figures observed last Friday suggest the selling pressure could be thinning out.

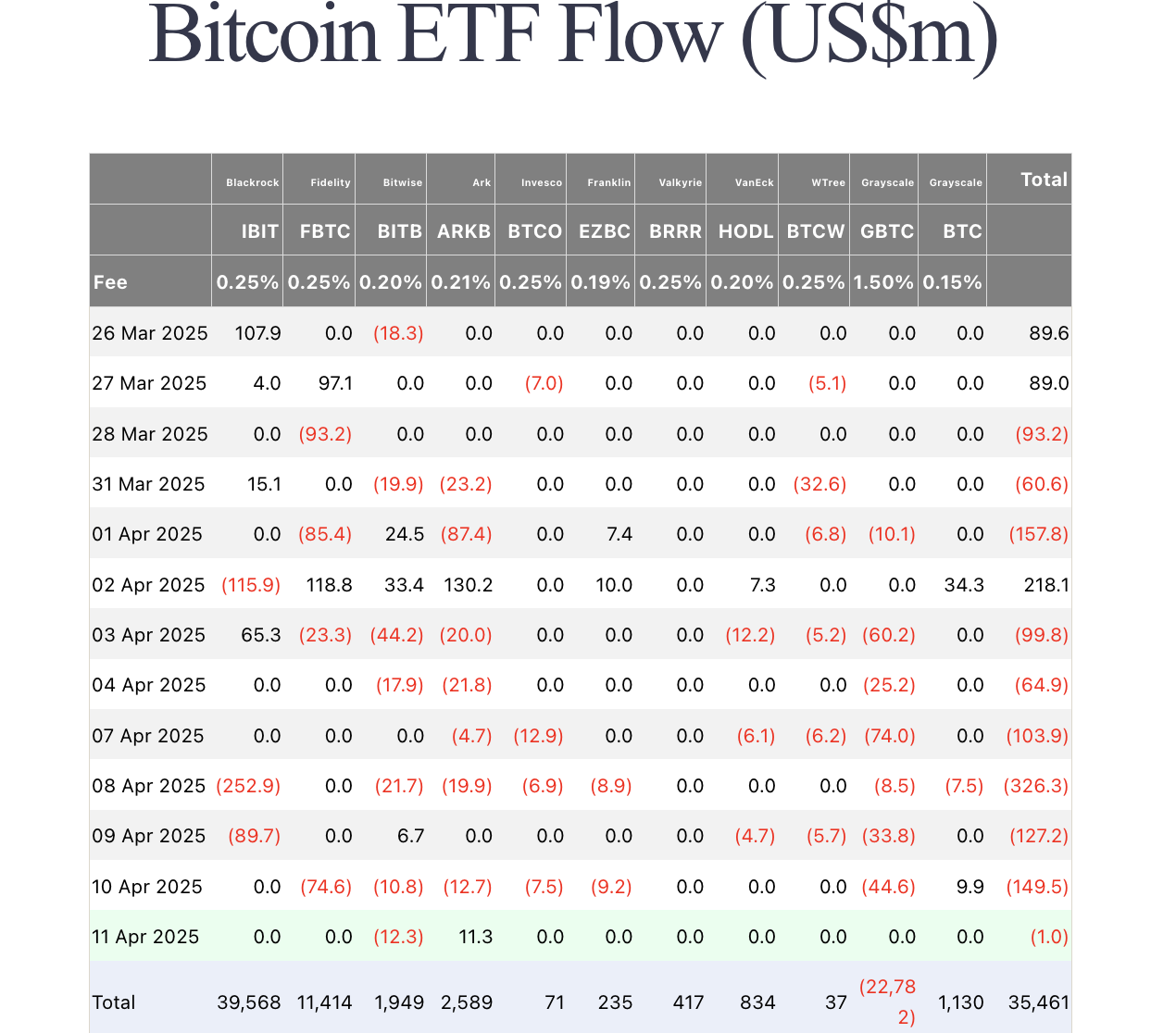

Bitcoin ETF Flows April 2025 | Source: Farside data

According to Farside data, Bitcoin ETFs shed over $872 million in a seven-day selling spree on April 3.

However, a closer look shows that the outflows declined to just $1 million on Friday, after an over $700 million sell-off in the first four days of the week.

This signals that the selling pressure from US-based corporate investors declined significantly after the US CPI data report. If the improvement in sentiment lingers through Monday, BTC ETFs could flip into buying mode, potentially keeping Bitcoin prices above $85,000 as the US trading session kicks off.

Altcoin market update: Mantra token plunges; Solana and Ethereum traders maintain bullish outlook

Altcoins showed mixed performances on Monday, as investors continue to rotate capital to capitalize on volatile market trends and news narratives for short-term gains.

-1744649138638.png)

Crypto Market Performance, April 14 2025 | Coingecko

Shedding 2% each, Bitcoin Cash (BCH), Toncoin (TON), Hedera (HBAR) are the only top 25 ranked altcoins posting losses on the 24-hour timeframe. Mantra (OM) tumbled nearly 91.2% on Monday amid speculation of insider trading and market manipulation.

Meanwhile, Solana (SOL) and Ethereum (ETH) traders are in green with 2% and 4% upticks, respectively.

This shows a narrative that investors are rotating funds into DeFi-focused protocols to capitalize on the positive headwinds from Trump’s decision to repeal a Biden-approved law that classified DeFi platforms as brokers to compel stringent KYC measures.

Chart of the day: DeFi sector in focus as Trump repeals Biden’s ruling

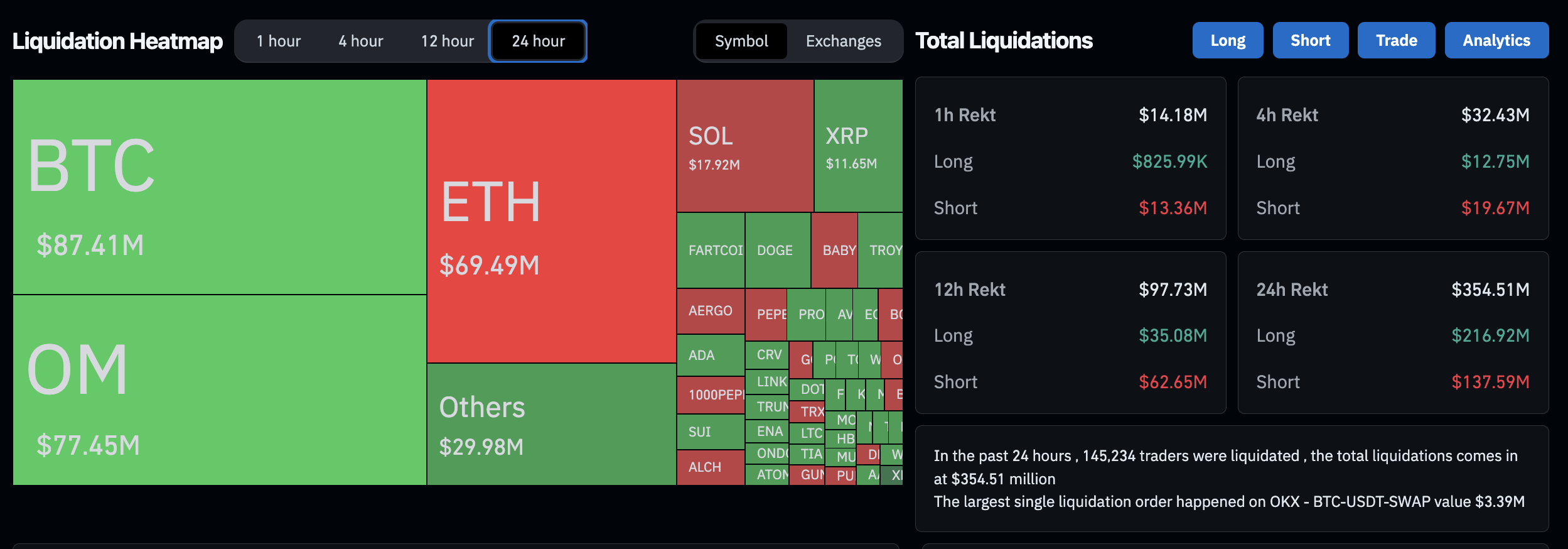

Combining derivatives trading data observed on Monday, the data aligns with the narrative that ETH and SOL are receiving unusual bullish bets relative to the rest of the market.

Crypto derivative market performance | Source: Coinglass

Looking at the broader market trends, total long liquidations hit $216.7 million, exceeding short liquidations of $137.6 million. However, ETH and SOL markets stood out, with short traders booking the majority of the 24-hour losses in both markets.

Trump’s move to repeal a Biden-era rule that classified DeFi platforms as brokers has triggered fresh optimism across the decentralized finance space. This regulatory U-turn appears to be fueling capital rotation into DeFi-aligned Layer-1s like Ethereum and Solana.

ETH and SOL traders, supported by this positive legislative backdrop, appear to be doubling down on long positions despite rising liquidation risks. Their 24-hour gains and resilience amid market volatility support the idea that a new bullish narrative is forming.

Crypto news updates:

CryptoPunk NFT seller admits to $13 million tax evasion in Pennsylvania

Waylon Wilcox of Dillsburg, Pennsylvania, has pleaded guilty to federal tax evasion charges after failing to report over $13 million in profits from the sale of 97 CryptoPunk NFTs. According to the US Attorney's Office for the Middle District of Pennsylvania, Wilcox deliberately avoided paying approximately $3.3 million in taxes owed on the income.

The case marks a significant enforcement action in the realm of digital asset taxation. The IRS reiterated the legal obligation to report virtual currency transactions, including those involving NFTs. Wilcox’s guilty plea underscores the growing scrutiny of crypto-related income as US authorities intensify oversight of blockchain-based financial activities.

Lomond School becomes first UK school to accept Bitcoin for tuition payments

Lomond School in Helensburgh, Scotland, has announced it will begin accepting Bitcoin as a form of tuition payment, making it the first school in the United Kingdom to do so. The decision comes in response to increasing demand from both local and international parents seeking alternative payment methods.

The school plans to implement Bitcoin payments in phases and will convert the received cryptocurrency into pound sterling to mitigate financial risks. In addition, Lomond School is considering creating a Bitcoin reserve, contingent on broader national and international acceptance of the digital asset.

JPMorgan launches blockchain-based GBP payment services for real-time settlements

JPMorgan's blockchain-focused subsidiary, Kinexys, has introduced British pound-denominated deposit accounts in the UK, expanding its blockchain-based payment services. The new feature adds GBP functionality to existing euro and dollar offerings, enabling around-the-clock cross-border transactions and more flexible foreign exchange settlement options.

Since its launch, Kinexys has processed over $1.5 trillion in transactions. Corporate clients, including LSEG's SwapAgent and commodities trading firm Trafigura are among the first users of the new GBP blockchain service.