Crypto Morning: BlackRock spends $107 million on Bitcoin, stablecoin launches, Shiba Inu boss still offline

- BlackRock purchased over 1,200 BTC for $107.9 million, signaling strong market preference for Bitcoin among institutions.

- Trump backed World Liberty Financial, Custodia Bank, the US state of Wyoming and Fidelity have announced stablecoin launch plans.

- Shiba Inu boss Shytoshi Kusama has been offline for over a week now, raising concerns among SHIB holders.

- Bitcoin hovers around $87,000, and Shiba Inu tests key resistance at $0.00001428.

BlackRock, a giant with $11.5 trillion in assets under management, spent $107.9 million to fund its BTC purchase on Wednesday. The move is consistent with demand for BTC among institutional investors.

Amidst the demand revival among crypto traders, several financial institutions shared stablecoin plans this week.

While meme coins are the worst hit by US President Donald Trump’s tariff announcements week on week, Shiba Inu boss Shytoshi Kusama’s silence on X has raised concerns among users in the SHIB community.

BlackRock’s big Bitcoin purchase

Trump’s tariff war has taken a toll on crypto prices, and Bitcoin price hovers under the $87,000 level at the time of writing on Thursday. Institutional demand could fuel a BTC recovery alongside the nine-day streak of net positive flows to US-based spot ETFs.

BlackRock has spent $107.9 million to acquire 1,230 BTC, making headlines for driving institutional demand for the largest cryptocurrency.

Why this matters

Bitcoin traders remain fearful of the uncertainty from Trump’s tariff announcements and US macroeconomic developments. The Fear & Greed Index reads 40 on a scale from 0 to 100, and traders are more fearful than they were a week ago.

Amidst market uncertainty, institutional demand for Bitcoin is likely to fuel recovery and a positive thesis for BTC among market participants.

What to expect

Bitcoin could retest resistance at the $90,000 level, and a daily candlestick close above this level could see BTC rally toward the psychologically important $100,000 milestone.

Bitcoin is currently less than 4% away from the $90,000 resistance and close to support in the imbalance zone between $84,539 and $85,519.

BTC/USDT daily price chart

Institutions bet on stablecoins

Stablecoin announcements are lined up this week from Trump’s family business, World Liberty Financial’s USD1 stablecoin, as well as Custodia Bank’s AVIT, the state of Wyoming’s WYST and Fidelity’s money market fund FYHXX.

Why this matters

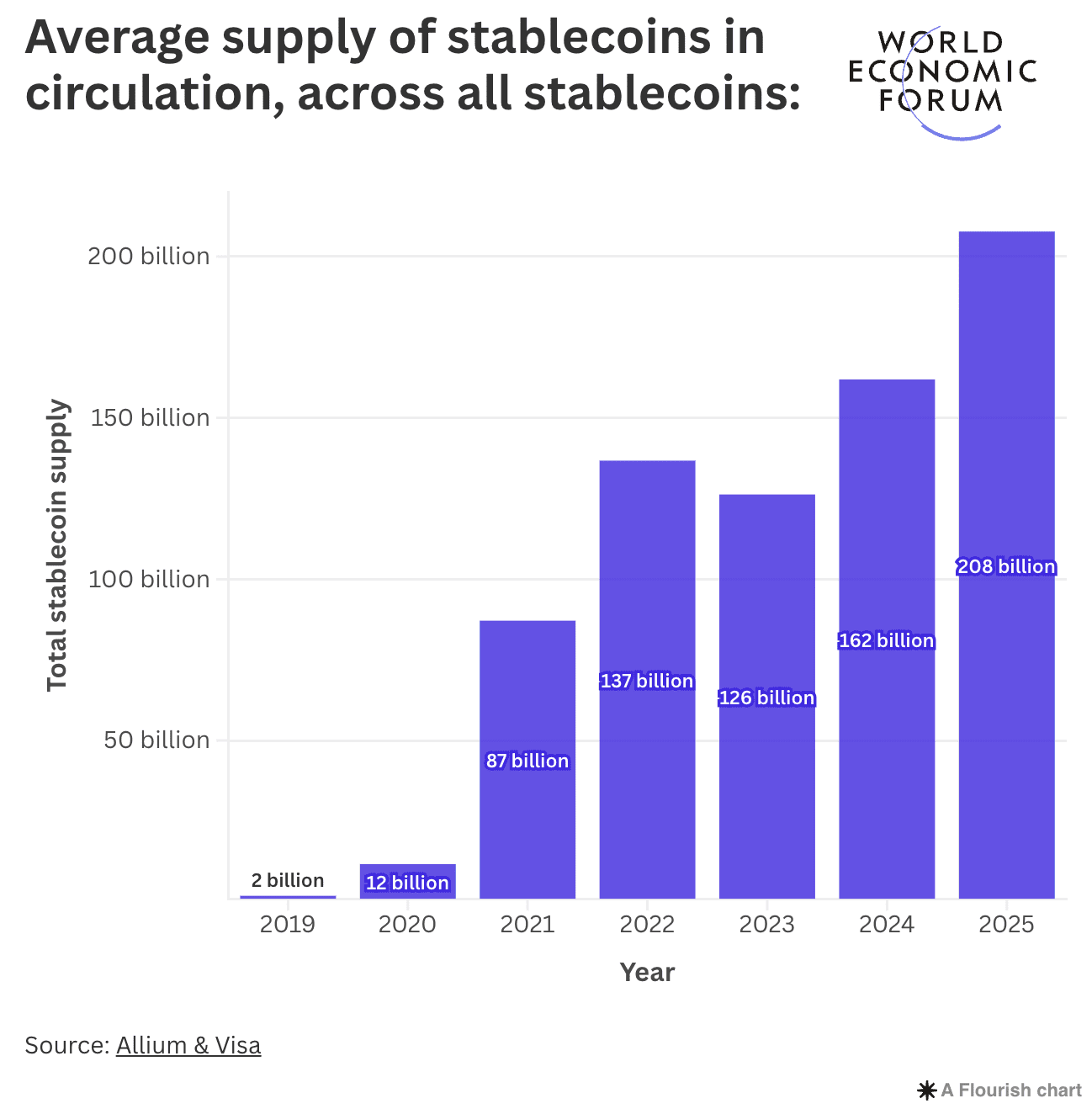

The average supply of stablecoins in circulation hit the $208 billion level in 2025, according to a World Economic Forum report. Stablecoins are considered fiat on and off-ramps for traders, emerging as a key indicator of crypto’s relevance and adoption. Higher circulation of stablecoins implies a wider adoption of crypto among market participants.

Average supply of stablecoins in circulation | Source: Allium & Visa

What to expect

Rising stablecoin adoption could increase capital inflow to crypto tokens, protocols and platforms. This could support higher liquidity for traders in the long term.

Shiba Inu boss still offline

Shytoshi Kusama, the lead of the Shiba Inu project ecosystem, has been missing in action for over a week now. The SHIB holder community has noticed the unresponsiveness online and raised concerns on X.

Previously, Kusama has been offline for a week or two and returned with new information about business partnerships and plans for SHIB’s ecosystem development. It remains to be seen what’s next for Shiba Inu and whether Kusama returns online.

Why this matters

The Shiba Inu ecosystem has observed an increase in holdings by investors in the longer time frame compared to projects like Bitcoin, Ethereum, Tron and Avalanche, according to IntoTheBlock data. Kusama’s return to the online community is key to assuage SHIB holders’ concerns and sustain ecosystem growth.

-638786816460818430.jpeg)

Percentage of long-term holders | Source: IntoTheBlock

What to expect

Shiba Inu could test key resistance at $0.00001532, the upper boundary of the Fair Value Gap on the SHIB/USDT daily price chart. A daily candlestick close above this level could support a thesis for a trend reversal in Shiba Inu.

Shiba Inu price is less than 10% away from the closest resistance level, and technical indicators on the daily timeframe support a bullish thesis for SHIB.

SHIB/USDT daily price chart