Bitcoin vs. Nasdaq 100 Index correlation hits 70% – Matrixport analysts hint at what to expect

- Bitcoin’s 30-day NASDAQ 100 correlation hits 70%, signaling increase in BTC sensitivity to macro risks.

- Matrixport analysts warn high Bitcoin-NDX correlations are short-lived, suggesting an imminent divergence trend from tech stocks.

- Mt. Gox’s $1B BTC movement fuels bearish pressure, while a whale’s $200M Binance withdrawal props up bullish sentiment.

Matrixport analysts raise bearish concerns as Bitcoin's correlation with NASDAQ 100 hits 70%

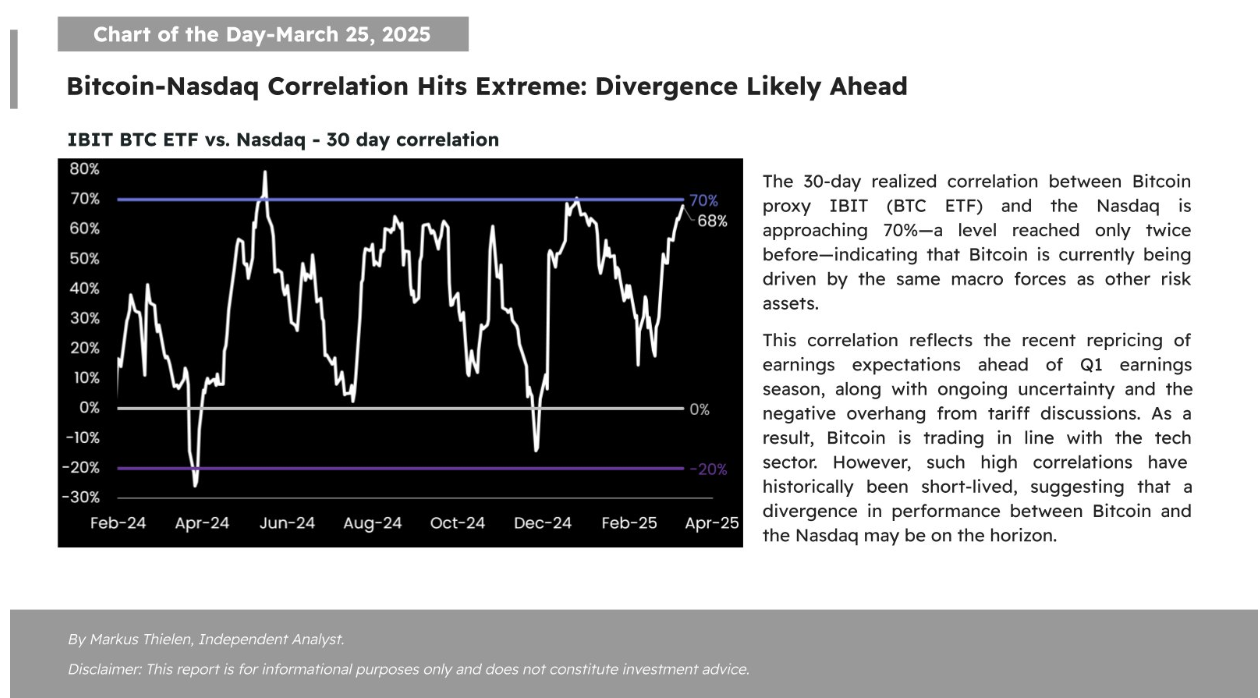

Bitcoin's 30-day price correlation with the NASDAQ 100 (NDX) has surged to 70%, a level seen only twice before, according to a recent analysis by Matrixport. This high correlation suggests that Bitcoin is currently moving in lockstep with the broader tech sector, driven by similar macroeconomic forces.

Matrixport reports Bitcoin's 30-day price correlation with the NASDAQ 100 (NDX) has surged to 70% | March 24

The report highlights that the rising correlation is fueled by a repricing of earnings expectations ahead of the Q1 earnings season, as well as ongoing market uncertainty and trade tariff concerns.

Historically, Bitcoin has been viewed as an asset class that moves independently of traditional equities. However, the current trend indicates that institutional adoption and macroeconomic pressures may be aligning Bitcoin's movements with the NASDAQ 100.

Mt. Gox to Move $1 Billion in BTC, unleashing potential selling pressure

Adding to the bearish outlook, reports indicate that Mt. Gox, the now-defunct Bitcoin exchange, is preparing to move $1 billion worth of BTC.

Market analysts fear that if these holdings are liquidated, it could intensify downward pressure on BTC prices, having already seen a 2% decline as it settled above $87,100 on Tuesday.

Mt. Gox creditors have been waiting for years to receive their repayments, and if a large portion of the funds is sold upon release, it could flood the market with Bitcoin, potentially driving prices downward.

This uncertainty has led to increased caution among investors, who are closely monitoring any movements from Mt. Gox wallets.

Whale spotted moving BTC worth $200 million into long-term storage

Despite the bearish signals, some bullish developments suggest that Bitcoin may still have strong support.

According to on-chain data from Arkham, a Bitcoin whale recently withdrew $200 million worth of BTC from Binance, signaling long-term accumulation.

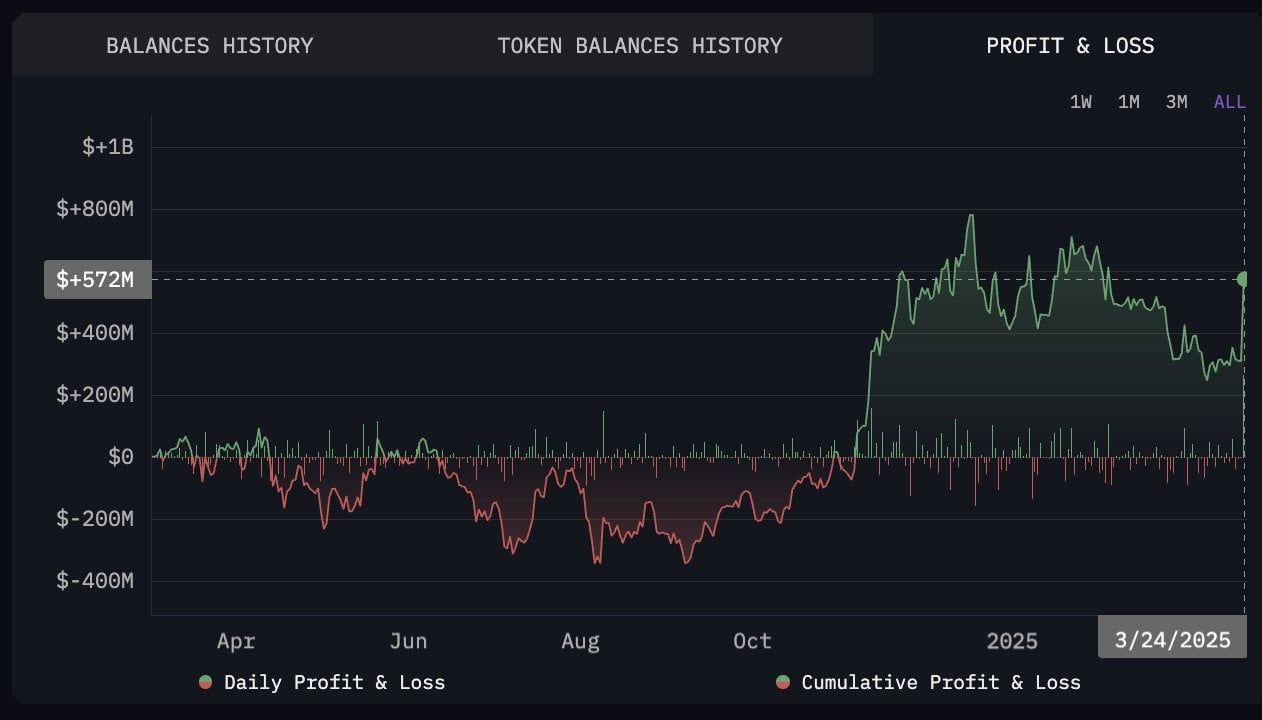

Bitcoin whales shifts $200 million from Binance | March 24 | Source: Arkham

This whale had previously sold large amounts of Bitcoin during February's price downturn but has now resumed accumulation.

According to Arkham, the whale acquired BTC five days ago after selling between $100K and $86K in February.

Such actions typically indicate confidence in Bitcoin’s long-term prospects since large investors often buy during market corrections to position themselves for future price increases.

Bitcoin Market Outlook: Prolonged consolidation phase ahead?

While Bitcoin's current correlation with the NASDAQ 100 remains elevated, historical trends suggest that such correlations tend to be short-lived.

Analysts believe a divergence in performance may be on the horizon as Bitcoin traditionally decouples from equity markets during periods of heightened volatility.

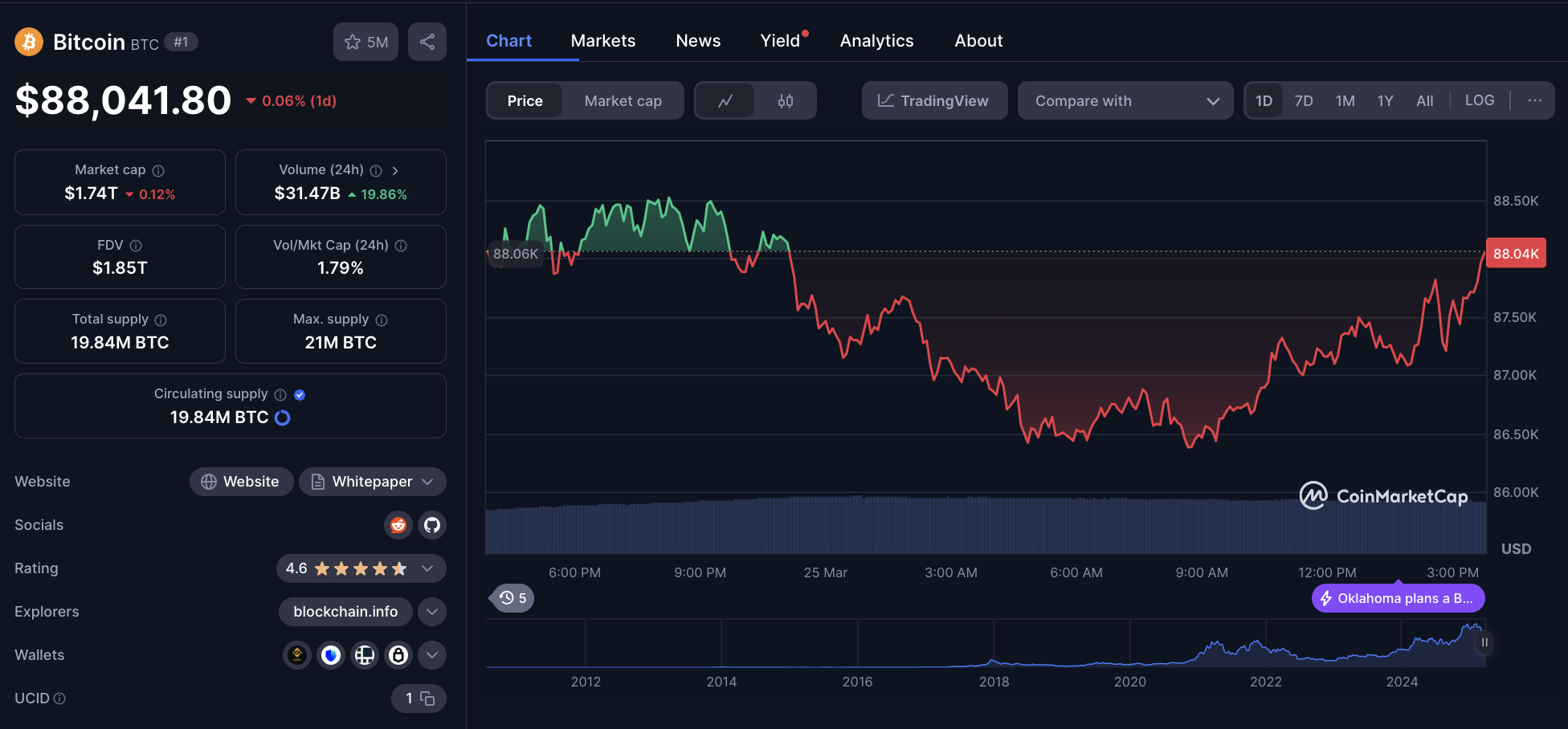

Bitcoin price action | CoinmarketCap

At press time on Tuesday, Bitcoin price was trading at $88,000, according to Coinmarketcap data, as bulls make an attempt to reach multi-week resistance around the $90,000 level.

However, correlation of Bitcoin price to the NDX as shown in the Matrixport reports demonstrates that BTC investors are increasingly weighing the impact of macroeconomic factors like the Trump administration’s tariffs and regulatory developments.

With mixed signals from the marke t— ranging from Mt. Gox's impending BTC transfer to continued whale accumulation — Bitcoin’s price trajectory could enter a neutral consolidation phase above the $85,000 mark, as traders and analysts digest recent trade policy tweaks by the Trump administration.