Crypto Today: BTC stalls below $90k, Binance ecosystem surges as Trump’s WLFI launches USD1

- Cryptocurrency markets are down 1.75% on Tuesday, with a $60 billion outflow bringing aggregate valuation below $3 trillion

- Bitcoin price failed to break out above as Trump’s hints at secondary tariffs triggered skittish sentiment across global markets.

- BlackRock moves to launch an ETP Europe, with an initial fee discount to attract investors.

BNB ecosystem is up 1.2% reacting to the launch of a Trump-backed USD1 stablecoin on the BNB chain.

Bitcoin market updates: Why is BTC price going down today?

- Bitcoin price retraces towards $87,100 on Tuesday, hours after hitting a 17-day peak of $88,700.

- Bitcoin’s pullback on Tuesday mirrors the global financial markets’ downtrend after US President Donald Trump issued an order to impose 25% tariffs on any nation purchasing oil and gas from Venezuela in what he dubbed “secondary tariffs.”

Bitcoin ETF Flows at close of March 24 | Source: SosoValue

- Bitcoin ETFs started the week on the front foot with another $84 million in inflows on Monday, marking seven consecutive days in the green.

- Japanese investment firm Metaplanet announced another purchase on Monday.

- Defunct crypto exchange was spotted moving another 11,000 BTC, potentially introducing downward volatility risks in the day ahead.

Altcoin market updates: BNB chain stands out and altcoin traders take profits on Trump tariff hint

The market rally on Monday saw crypto market capitalization cross $3 trillion before Trump’s secondary tariffs hint prompted many crypto investors to sell early.

At press time on Tuesday, Coingecko data shows that the global crypto market capitalization has plunged 1.7%, which accounts for more than a $60 billion dip within the last 24 hours.

With market valuation trending at $2.9 trillion, market data shows that while large-cap assets are all in the red, mid-cap altcoin traders are still holding on to considerable gains from Monday.

- Ripple (XRP) price is consolidating at $2.37 after gains from the closure of its long-running case against the US Securities and Exchange Commission (SEC).

- Solana (SOL) price is holding steady above the $140 support level, with active bullish tailwinds from Trump’s recent post promoting the $TRUMP token on Monday.

Chart of the day: BNB Chain ecosystem stands out on USD1 stablecoin confirmation

Trump-backed World Liberty Financial Inc. (“WLFI”) has announced its plans to launch USD1, a stablecoin redeemable 1:1 for the US Dollar (USD).

According to the team, WLFI’s USD1 will be 100% backed by short-term US government treasuries, US Dollar deposits, and other cash equivalents.

“USD1 provides what algorithmic and anonymous crypto projects cannot—access to the power of DeFi underpinned by the credibility and safeguards of the most respected names in traditional finance.

We’re offering a digital dollar stablecoin that sovereign investors and major institutions can confidently integrate into their strategies for seamless, secure cross-border transactions.”

- Zach Witkoff, WLFI co-founder

Hours after Blockchain analyst Lookonchain alerted market watchers to a contract deployed on the BNB Chain, the team has confirmed that the stablecoin will also be minted on the Ethereum (ETH), with plans to expand to other protocols in the future.

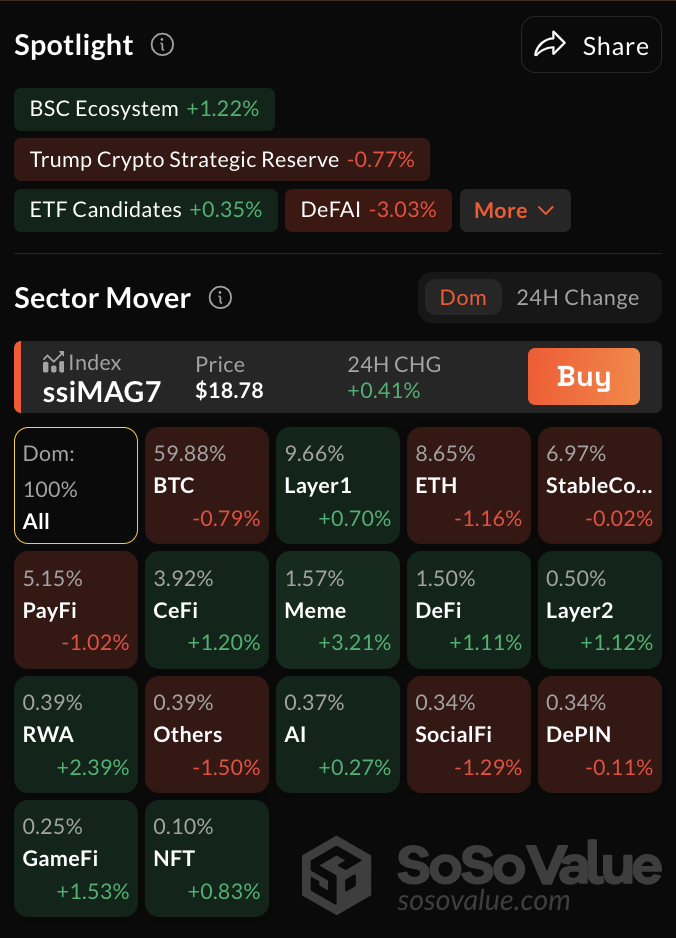

Crypto Market Performance by Sector, March 25 2025 | Source: SosoValue

In reaction, the BNB Chain stood out with 1.2% gains, according to SosoValue data, bucking the market-wide correction trend.

With the USD1 launch now confirmed on the BNB Chain and Ethereum blockchain network, the Binance native coin is expected to attract more speculative interest in the coming trading sessions.

Crypto news updates:

-

Standard Chartered replaces Tesla with Bitcoin in new Mag 7B index

Standard Chartered introduced a modified version of the "Magnificent 7" tech index, naming it "Mag 7B" by replacing Tesla with Bitcoin.

The bank's analysis showed that this new index outperformed the original, delivering higher returns and reduced volatility.

This adjustment reflects a growing recognition of Bitcoin’s potential to function as both a tech asset and a financial hedge.

The findings suggest that Bitcoin may offer more stability compared to Tesla within the index, making it an attractive option for institutional investors.

Standard Chartered's move highlights the increasing role of digital assets in traditional finance as institutions explore Bitcoin’s utility beyond speculative trading.

-

Kentucky governor Andy Beshear enacts Bitcoin Rights bill

Kentucky governor Andy Beshear signed the Bitcoin Rights bill into law, establishing legal protections for crypto users’ rights, such as self-custody and operation of nodes without discrimination.

The bill, HB701, introduced by Rep Adam Bowling, also safeguards crypto mining activities from local zoning changes and clarifies that crypto mining and staking are not considered securities.

This comes as Bitcoin legislation progresses in another US state, where Oklahoma and Arizona are advancing their digital asset initiatives.

-

Binance suspends employee for insider trading

Binance has suspended an employee following an internal investigation that uncovered insider trading related to a token generation event (TGE).

The individual, who recently moved from a business development role at BNB Chain to Binance’s Wallet team, allegedly used multiple wallet addresses to buy tokens before their public launch.

After the TGE was announced, the employee sold a portion of their holdings for significant profits while holding onto additional tokens with unrealized gains. Binance has offered a $100,000 reward to whistleblowers who reported the misconduct.