Crypto Today: Crypto founders seek banking licenses as BTC and XRP lead $17B recovery ahead of Fed meeting

- Cryptocurrencies market capitalization bounces 4% adding over $50 billion to hit $2.8 trillion on Wednesday.

- Bitcoin price topped out at $84,900 as markets strengthened, anticipating the US Fed’s confirmation of a rate pause decision.

- SEC ends long-running lawsuit against Ripple, driving XRP price above $2.59 for the first time in two weeks.

Bitcoin market updates:

- Bitcoin’s price rose 4% on Wednesday, consolidating nearly the 24-hour peaks of $84,800 at press time.

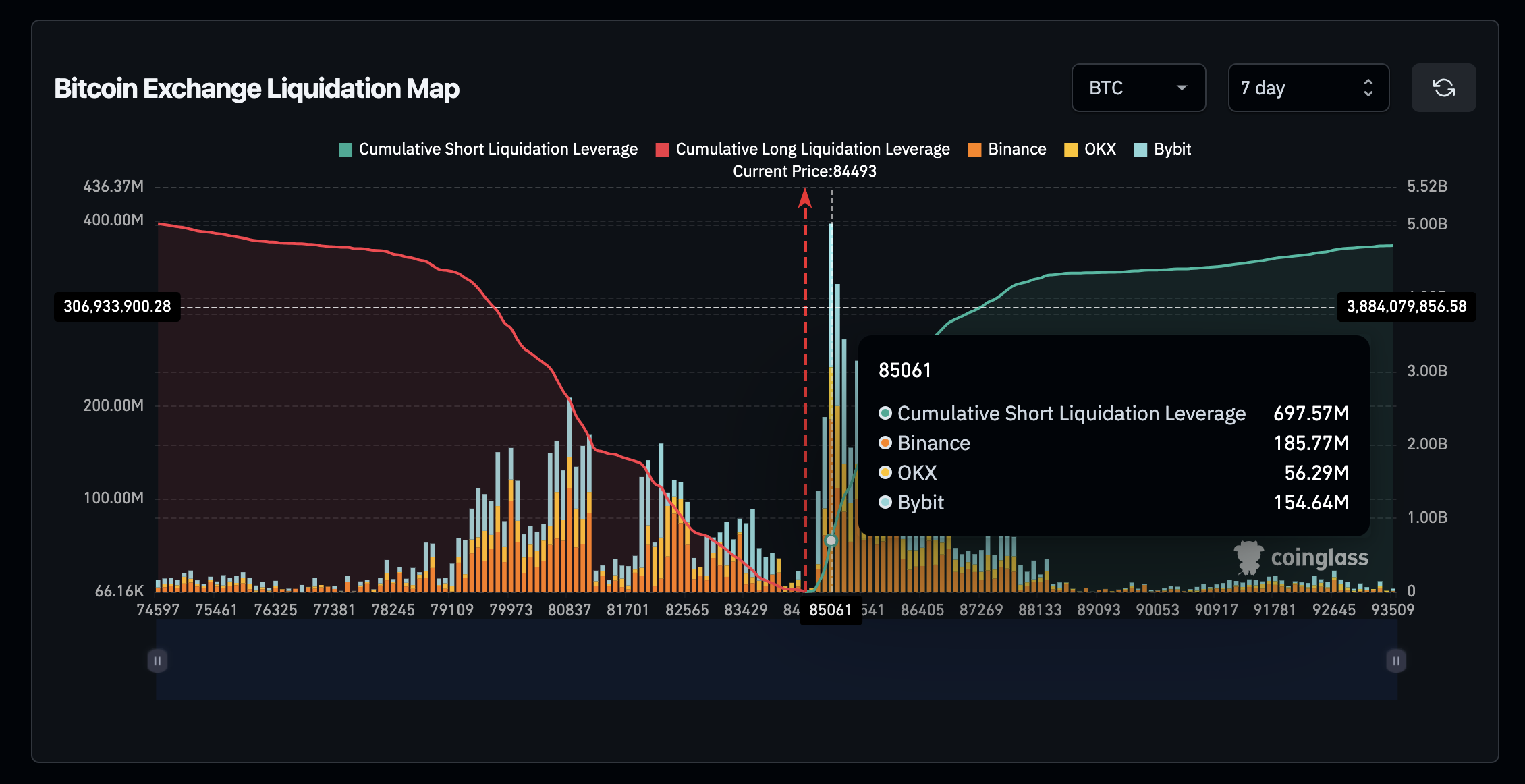

Bitcoin Liquidation Map, March 19 | Coinglass

BTC price is struggling to break past the $85,000 as short traders make last-ditch efforts to avert cascading liquidations on $697 million in leveraged BTC short positions clustered at this level.

- Bitcoin ETFs posted $209 million in inflows on Tuesday.

Bitcoin ETF Flows, March 19, 2025

Since its launch, Bitcoin ETF demand often serves as an anchor for estimating short-term sentiment among corporate Bitcoin investors in the US.

With $515 million worth of Bitcoin ETF purchases in three consecutive days of inflows, a US Fed rate pause aligning with market expectations could boost BTC inflows from corporate US-based investors in the coming trading sessions.

Altcoin market updates: XRP sparks altcoin rally as SEC lawsuits grinds to a halt

Altcoin markets are experiencing a surge in trading activity on Wednesday, even as Bitcoin remains pinned below the $85,000 mark, pressured by short traders employing conservative strategies.

The US Federal Reserve's anticipated decision to maintain interest rates could provide a mild boost to the market.

However, the real catalyst for altcoins came from Ripple CEO Brad Garlinghouse, who confirmed in a four-minute video that the SEC has dropped its long-running lawsuit against the company.

This news ignited a wave of bullish sentiment across the altcoin market, particularly benefiting regulatory-sensitive projects and those with ETF filings.

Chart of the day: BNB lagging as Solana, Cardano join XRP rally

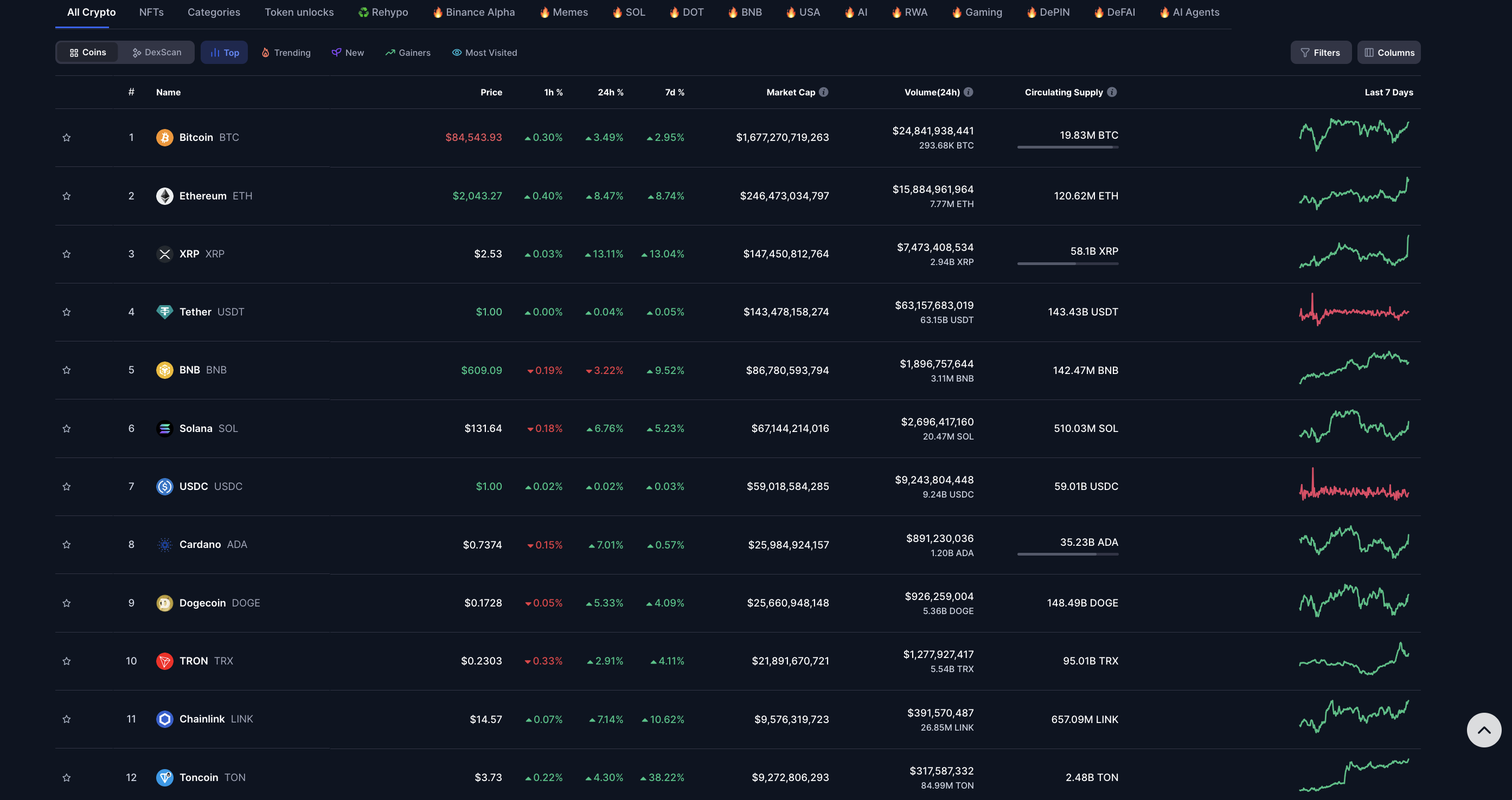

Among the biggest movers, XRP soared 13.11% to $2.53, reflecting renewed investor confidence following the lawsuit’s closure. Toncoin (TON) extended its breakout run, climbing 38.22% to $3.73, fueled by news that Telegram founder Pavel Durov has secured a return to Dubai after his recent arrest in France.

Ethereum rose by 9%, reclaiming the $2,000 resistance. Similarly, Cardano (ADA) and Solana (SOL) added 5.70% and 6.76%, respectively, as the Ripple lawsuit outcome shored up investor confidence in Trump’s administration’s body language to back the crypto market.

Crypto market performance, March 19, BNB lagging as Solana, Cardano join XRP rally | Coinmarketcap

Chainlink (LINK) jumped 7.14% to $14.57, riding the wave of renewed DeFi activity.

Interestingly, BNB was the only top-10 asset to post losses, dipping 3.22% to $609.09.

When an exchange token like BNB declines during a broader market rebound, it often indicates that the rally is being driven by fresh spot purchases rather than traders rotating positions at high volumes, which typically involves staking exchange tokens for fee discounts.

Crypto news updates:

-

Filmmaker Carl Erik Rinsch charged with fraud for misusing $11M from Netflix

US federal authorities have charged filmmaker Carl Erik Rinsch with fraud and money laundering, alleging he misused $11 million from Netflix intended for the production of the sci-fi series Conquest.

Prosecutors claim that instead of funding the project, Rinsch diverted the money into speculative stock and cryptocurrency trades.

According to court documents, Rinsch made risky stock investments and engaged in crypto trading, using some of his gains to purchase luxury cars and high-end items.

The filmmaker, best known for directing 47 Ronin, now faces multiple counts of fraud and money laundering, with each charge carrying a potential sentence of up to 20 years in prison.

-

North Carolina proposes $950M Bitcoin investment under new bill

North Carolina lawmakers have introduced SB327, a bill that could allocate up to $950 million from the state’s general fund into Bitcoin (BTC) as part of a long-term financial strategy. The proposal would authorize the State Treasurer to invest up to 10% of public funds in BTC, forming a Bitcoin Reserve aimed at financial innovation.

The bill mandates multi-signature cold storage for security and would require monthly audits of the holdings.

The state may also explore staking, lending, and Bitcoin mining to grow reserves.

According to the bill, any liquidation of the fund would require two-thirds approval from both legislative chambers, with permitted uses including financial crisis response, infrastructure funding, and Bitcoin-related research.

-

Crypto.com faces backlash over 70B CRO re-issuance vote

Crypto.com is under fire after a controversial governance vote reversed a 70 billion CRO token burn originally announced in 2021.

Critics claim the decision, which led to the re-issuance of the tokens, was manipulated, with some alleging that Crypto.com controls up to 80% of the voting power on its Cronos blockchain.

CEO Kris Marszalek addressed the exchange’s financial and regulatory stability on Wednesday but did not directly respond to the backlash.

Community members accused the firm of prioritizing profit over decentralization, questioning why it reissued CRO instead of buying tokens from the market to support investors

-

Fintech and crypto firms push for bank charters under Trump administration

According to a Reuters report, global fintech firms and crypto companies are increasingly seeking state or national bank charters to expand operations, lower borrowing costs, and gain legitimacy.

Industry insiders report a surge in applications, encouraged by expectations that the Trump administration will be more receptive to approving licenses that regulators previously delayed.

Legal experts note that while applicants remain cautious, preparations for bank charter applications have ramped up.

Becoming a bank introduces stricter regulatory oversight but offers benefits such as lower capital costs and the ability to draw on deposits.

Analysts believe new banking entrants could increase competition or deliver niche services to complement the cryptocurrency sector.