Metaverse narrative stalls as price action fades, but on-chain data signals continuing accumulation

- Metaverse tokens Sandbox, Decentraland and Axie Infinity continue to face correction since they topped in early December.

- A Glassnode report suggests that despite price pullback, on-chain activity suggests holders accumulation.

- FXStreet interviewed some crypto market experts regarding their views on the Metaverse sector.

Metaverse tokens are cryptocurrencies associated with virtual worlds, digital economies, and immersive online experiences. Tokens like Sandbox (SAND), Decentraland (MANA), and Axie Infinity (AXS), three of the most prominent assets during the Metaverse boom of 2021, continue to face correction since they topped in early December. A Glassnode report suggests that despite price pullback, on-chain activity suggests holders accumulation. Meanwhile, FXStreet interviewed some crypto market experts regarding their views on the Metaverse sector to gather insights.

Is the Metaverse crypto sector dead?

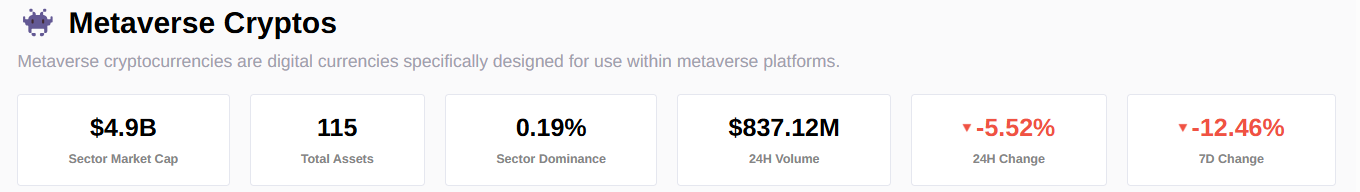

Looking down on market capitalization, data from CryptoSlate shows that Metaverse’s market capitalization dropped to $4.9 billion from $23.54 billion, a net loss of $18.64 billion since the Metaverse boom in 2021. Additionally, sector dominance decreased to 0.19% from 1.16%.

Metaverse sector information chart. Source: CryptoSlate

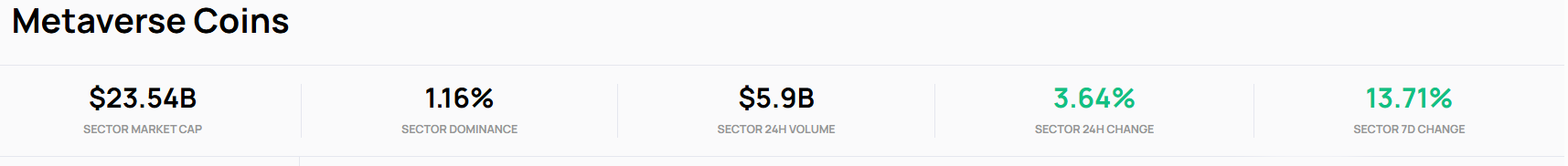

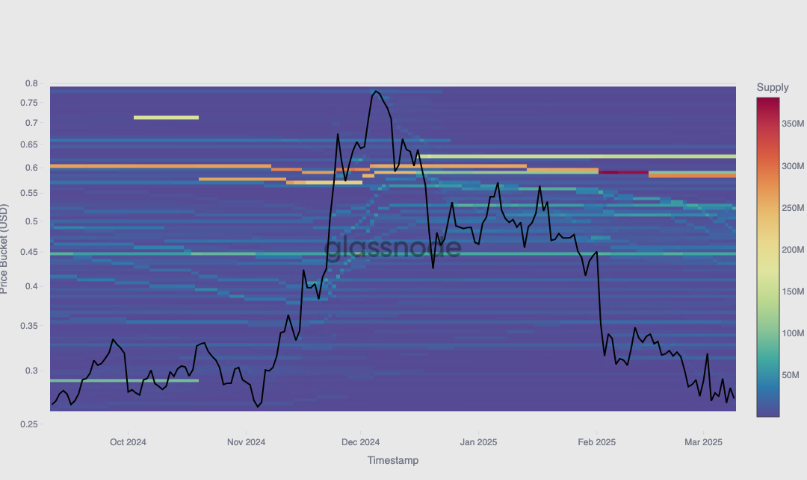

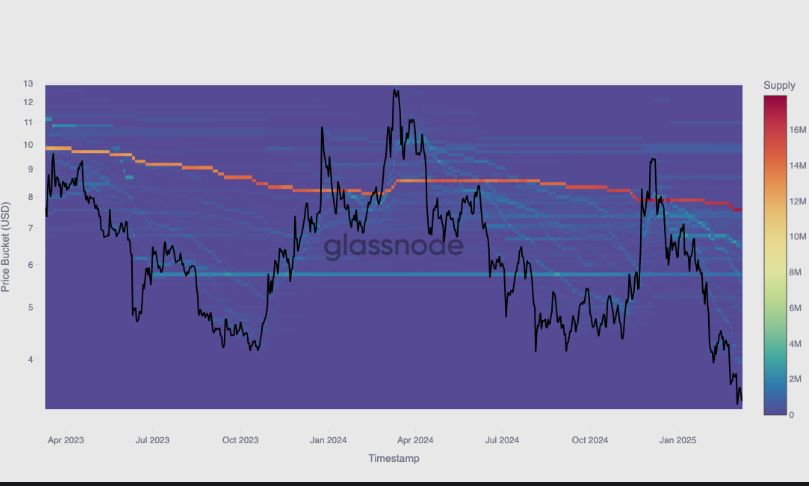

A Glassnode report shows that despite declining prices and fading hype in Metaverse tokens, on-chain data suggests that major investors remain active, steadily accumulating and lowering their cost basis.

The report focuses on top Metaverse tokens like The Sandbox (SAND), Decentraland (MANA), and Axie Infinity (AXS) - which were among the most prominent assets during the Metaverse boom of 2021. While the hype surrounding virtual worlds has faded, the cost Basis Distribution (CBD) data reveals that major players continue to invest dollar-cost average (DCA) into these assets.

The graph below shows how the CBD metric for SAND, MANA, and AXS continued accumulating despite price volatility. This accumulation indicates that holders with strong convictions steadily increase their positions, reinforcing their belief in the project’s long-term potential. They see these projects as undervalued opportunities rather than failures.

Sandbox chart. Source: Glassnode

MANA chart. Source: Glassnode

AXS chart. Source: Glassnode

FXStreet interviewed some experts in the crypto markets regarding the Metaverse sector. Their answers are stated below:

Tracy Jin, COO at MEXC

Q: What factors do you believe have contributed to the recent stagnation in metaverse coin prices?

The Metaverse was once seen as the next-gen technology that could serve as the centerpiece of digital interaction and communication like how the creation of the internet did in the early 2000s during the .com boom. This trend drove significant interest and investment in Metaverse-based tokens. However, the hype around these projects has faded considerably in recent years as there appear to be few application cases that prove their success and sustainability. The combination of shifts in market cycle dynamics, investors’ sentiment triggered by the rise of meme coins that prioritize community-driven and public figure influence, and changing trends in the Artificial Intelligence (AI) and Real World Assets (RWAs) sector have led to a sharp decline in user engagement, trading volume, and investor interest in metaverse tokens.

Q: Do you think the slowdown in price action reflects a waning interest in the Metaverse, or is it more about broader market conditions?

The key challenge that metaverse tokens have faced is the slow mainstream metaverse technology adoption in providing solutions to everyday problems. The rise of AI and RWAs has diverted attention from virtual worlds. Unlike Decentralized Finance (DeFi) and memecoins, which offer financial incentives and ROI possibilities, the metaverse tokens relied on high-level content and sustained user engagement and interaction to remain relevant and valuable.

Metaverse tokens provided limited utility and little value outside the Metaverse and their ecosystem. Without strong demand drivers beyond in-game transactions and purchases, these assets have found themselves in a liquidity trap, which has caused a significant decline in demand for these tokens. Additionally, broader technological and economic factors have also played a role in declining demand for metaverse tokens. The downturn in the crypto market, coupled with macroeconomic uncertainty, has made investors more risk-averse, favoring assets with clearer value propositions and utility.

Q: Are institutional investors still interested in metaverse-related projects, or has the focus shifted to other narratives like AI or DeFi?

Institutional interest in metaverse tokens faded, with investors switching towards AI, DeFi, and RWA sectors. As institutional capital flows into the AI and RWA sectors, metaverse projects faced the necessity of reasserting their relevance. This could mean integrating AI-driven experiences, enhancing interoperability, or expanding their use cases beyond gaming and digital real estate. However, writing off the metaverse technology entirely would be premature. Major tech firms like Meta, Apple, and Nvidia continue to make significant investments in virtual and augmented reality, which could indirectly benefit blockchain-based Metaverse projects. The concept of digital ownership remains relevant, and its future looks very promising.

As technology evolves, we may see a resurgence of interest in metaverse tokens. However, for them to regain traction, they need to prove their value beyond the hype and speculation. This requires not only technological improvements and innovations but also strong partnerships, developer incentives, and real-world adoption. The evolution of the Metaverse will likely take years, and success will depend on whether these projects can pivot effectively. The next wave of innovation will belong to those who can adapt, integrate new technologies, and provide real utility.

Christel Buchanan, co-founder and CEO of Pivotal

Q: Have any specific projects or developments within the metaverse space stood out to you recently as potential growth drivers?

We’re seeing the most promising metaverse growth coming from projects that focus on practical utility rather than speculative hype. Integrating AI with spatial computing platforms stands out particularly - projects that use conversational interfaces to bridge the technical gaps that previously limited metaverse adoption. The most successful metaverse implementations aren’t necessarily calling themselves “metaverse” anymore. They focus on specific use cases like collaborative design, education, or entertainment. Roblox’s recent integration of generative AI tools allows creators to build game elements and environments through text descriptions, significantly lowering the barrier to creation. Nvidia Omniverse has implemented AI-assisted creation tools that allow designers to generate and modify 3D assets through natural language prompts rather than traditional modeling techniques.

Q: In your view, is the current phase more about consolidation and building, or does it signal a shift away from the metaverse narrative?

The current phase represents a healthy recalibration rather than abandoning the metaverse vision. We’re witnessing the “trough of disillusionment” following the initial hype cycle, which is the most productive period for serious builders. The narrative is shifting from abstract concepts to concrete applications and infrastructure development. The term “metaverse” may be used less frequently in marketing materials, but the fundamental goal of creating more immersive, interconnected digital environments continues to advance steadily.

Q: How do you see the long-term vision for metaverse adoption, and what needs to happen for mainstream engagement to grow?

Long-term metaverse adoption will be driven by three key factors: accessibility, utility, and interoperability. The technical barriers to entry must be substantially lowered. When building in virtual spaces becomes as intuitive as having a conversation, we’ll see exponential growth in creator participation.

Felix Xu, co-founder and CEO of ARPA Network and Bella Protocol

Q: How do you interpret the current market sentiment around metaverse projects compared to the peak hype period?

The current market sentiment around metaverse projects has evolved since the peak hype period around 2021–2022. Back then, excitement was sky-high, driven mostly by speculation, eye-catching virtual land deals, and massive promises — sometimes without clear delivery paths. Now, the market is much more discerning and sophisticated. Investors and builders are laser-focused on identifying projects with solid fundamentals: real user growth, genuine digital ownership experiences, strong retention metrics, and tangible, engaging use cases rather than just buzz and speculation.

Today, we’re seeing greater scrutiny around what a metaverse platform offers users beyond surface-level experiences — things like seamless interoperability, integration with broader Web3 ecosystems, practical benefits to digital ownership, and sustainable economic models.

Q: In your view, is the current phase more about consolidation and building, or does it signal a shift away from the metaverse narrative?

After the initial wave of hype and speculative enthusiasm, we’re now seeing a healthy recalibration — markets naturally filtering out weaker projects and highlighting those with genuine user value and strong fundamentals. Lasting relevance in the Metaverse requires delivering tangible experiences, practical utility, and sustainable ecosystems.

In essence, rather than abandoning the metaverse concept, the industry is refining it, laying solid foundations for meaningful growth. Additionally, a subtle but powerful shift is occurring beneath the surface: the gradual normalization of digital ownership and identity. People are quietly becoming comfortable with owning digital assets. This quieter period, therefore, is precisely what’s needed to set the stage for a more compelling, creative, and genuinely fun next chapter.

Mike Cahill, CEO at Douro Labs

Q: Do you think the slowdown in price action reflects a waning interest in the Metaverse, or is it more about broader market conditions?

The slowdown in price action is less about waning interest in the Metaverse than the industry's evolution as a whole. The market is maturing. Investors are looking past hype and into fundamentals. We’re moving from imagination to implementation, which means DeFi rails, real-world assets, and TradFi integrations are taking center stage.

Irina Karagyaur, co-Founder and CEO of BQ9

Q: How do you see the long-term vision for metaverse adoption, and what needs to happen for mainstream engagement to grow?

The Metaverse’s long-term survival depends on who builds it. If it remains controlled by a handful of centralized corporations, it will fade into irrelevance. If communities take ownership—ensuring digital rights, open standards, and decentralized governance—then it has the potential to be something far greater.

Mainstream engagement won’t happen because of a single breakthrough. It will happen gradually as AI improves digital environments, hardware becomes more accessible, and the Metaverse finds its place as an integrated rather than isolated part of our digital lives. The next phase isn’t about escaping reality—it’s about improving it. That’s where the real opportunity lies.