Crypto Today: Pi Coin rallies, BTC, XRP hold key levels, as Made-in-USA assets lose $63B on Trump tariff woes

- Cryptocurrencies market capitalization plunged below $2.7 trillion on Tuesday, shedding another 3.4% as sell-offs intensified.

- Nasdaq has filed documentation with the US SEC to list Hedera spot ETFs

- Bitcoin price stabilizes above $82,000 as buyers stepped in to mitigate cascading liquidations.

Bitcoin market updates:

Bitcoin price stabilizes above the $82,000 support level, down 13% from the local top of $95,000 recorded after Trump’s crypto strategic reserve announcement in the weekend.

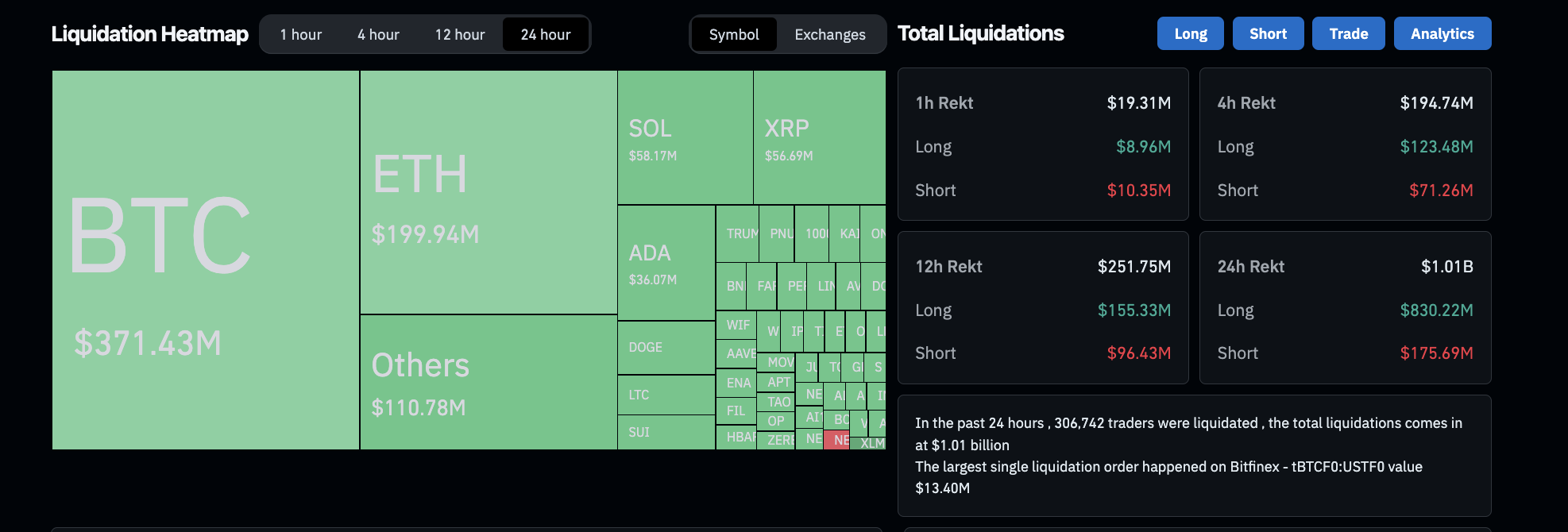

Crypto Market Liquidations, March 4 | Source: Coinglass

In the last 24 hours, over $390 million BTC long contract positions have been wiped out, accounting for nearly 40% of the $1 billion total market liquidations.

Altcoin market updates: Privacy coins on the rise as Coinmarketcap lists Pi coin

- Investors pulled out over $400 billion from altcoins within 24 hours of Trump announcing the commencement of import tariffs on Mexico and Canada.

- Top-ranked Solana Memecoins suffered losses exceeding 20% on the day as traders shifted capital away from low liquidity and highly speculative assets.

Made-in-USA projects performance, March 4 | Source: Coinmarketcap

- Made-in-USA coins declined by 14.75% on Tuesday, reflecting aggregate losses of $63 billion, according to Coinmarketcap data.

- Ripple (XRP) traders continue to defend the $2 support and bull traders eye long-term gains.

Chart of the day: PI Network post profits as Coinmarketcap listing nullifies bearish headwinds

Pi Network is a privacy-focused cryptocurrency that allows users to mine coins using mobile phones.

Due to AML and compliance concerns, Pi Network’s growth has been hampered in recent years, with trading limited to P2P platforms and OTC markets.

However, following improvements in the United States (US) regulatory stance under the Trump administration, Pi Coin has secured listings on top exchanges like Bitget.

Pi Network (PI) Listed on CoinmarketCap | March 4

With a Binance listing reportedly in the works, data aggregator CoinMarketCap listed Pi Coin on Tuesday.

This positive development has enhanced demand and awareness for Pi.

At press time, Pi Coin is trading above $1.74 with a market capitalization of $12.1 billion, posting a 2.3% gain—making it the only top 20-ranked cryptocurrency in profit amid the ongoing market dip fueled by Trump’s tariffs on Canada and Mexico.

Crypto news updates:

-

Flowdesk raises $102 million to expand crypto services amid market growth

Flowdesk, a France-based crypto trading firm, secured $102 million in funding through a mix of equity and debt, led by HV Capital.

The investment will support Flowdesk’s expansion into tokenization, OTC derivatives and the development of a crypto credit desk, aligning with increasing institutional demand.

The firm plans to scale its global operations by hiring more staff and opening a new office in the United Arab Emirates.

The funding comes as the crypto market sees renewed growth, positioning Flowdesk to capitalize on emerging opportunities in digital asset trading and infrastructure.

-

Nasdaq files 19b-4 form for Grayscale’s Hedera (HBAR) spot ETF listing

Nasdaq has submitted a 19b-4 filing to the US Securities and Exchange Commission (SEC) to list Grayscale’s Hedera (HBAR) spot ETF.

The filing, a key step in the regulatory approval process, will initiate the SEC’s review once published in the Federal Register.

This move follows similar ETF applications for other cryptocurrencies, signaling increased interest in altcoin-based ETFs.

If approved, the HBAR spot ETF would provide institutional investors with regulated exposure to Hedera, reflecting broader efforts to expand crypto investment products in US markets.

Aave expands lending markets to Sonic in strategic layer-1 integration

Aave has launched its lending markets on Sonic, marking its first Layer 1 expansion of the year after governance approval.

The move follows the successful rollout of Aave’s version 3 and aligns with Sonic’s rebranding from Fantom, which introduced new fee monetization mechanisms.

The deployment includes substantial liquidity commitments and aims to leverage Sonic’s infrastructure for enhanced capital efficiency.

This expansion coincides with Aave discontinuing its lending operations on the Polygon PoS chain, signaling a shift in its Layer 1 strategy.