Dogecoin Price Forecast: DOGE’s bearish trend persists despite Musk’s support

- Dogecoin price is extending its decline on Tuesday after falling nearly 17% the previous day.

- The recent correction in DOGE has liquidated over $20 million while its long-to-short ratio reads below one, hinting at a downtrend continuation.

- The technical outlook projects a correction toward the $0.14 level.

Dogecoin (DOGE) extends its decline, trading around $0.19 on Tuesday after falling nearly 17% the previous day. The recent correction in DOGE has triggered a wave of over $20 million in liquidations in the last 24 hours and more than $100 million last week. The technical outlook and long-to-short ratio suggest a further pullback targeting the $0.14 mark.

Dogecoin price dips, wiping over $20 million in the last 24 hours

Dogecoin price declined almost 17% on Monday and continues its downward trend on Tuesday by declining nearly 4% during the Asian trading session. This correction has triggered a wave of liquidations, resulting in over $20 million in liquidations in the last 24 hours and more than $100 million last week, according to data from CoinGlass.

Strong liquidations like this could spark Fear, Uncertainty, and Doubt (FUD) among DOGE investors, even with Musk’s support, raising selling pressure and leading to a further decline in Dogecoin price.

Dogecoin liquidation chart last 24 hours. Source: Coinglass

DOGE total liquidation chart. Source: Coinglass

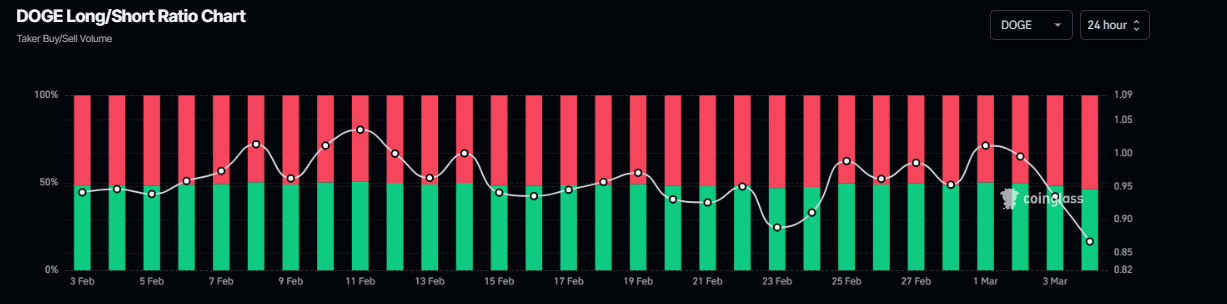

Another bearish sign is Coinglass’ DOGE long-to-short ratio, which reads 0.86 and continues to fall, reaching the lowest monthly level. This ratio below one reflects bearish sentiment in the markets as more traders are betting on the asset price to fall.

DOGE long-to-short ratio chart. Source: Coinglass

Dogecoin bears aiming for $0.14 mark

Dogecoin price faced rejection around its 50% price retracement level (drawn from an August 14 low of $0.05 to a December 2 high of $0.48) at $0.27 on February 15 and declined nearly 26% in two weeks. However, DOGE recovered 20% during the weekend but continued its decline on Monday. At the time of writing on Tuesday, it continues to trade down by 3.4%, around $0.19.

The Relative Strength Index (RSI) on the daily chart reads 33 after rejecting around its neutral level of 50 and approaching its oversold level of 30, indicating a strong bearish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bearish crossover, hinting at a further downtrend.

If DOGE continues its correction and closes below the $0.18 weekly support level, it could extend the decline to test its November 3 low of $0.14.

DOGE/USDT daily chart

However, if DOGE finds support around the $0.18 weekly level and recovers, it could extend the recovery to retest its 50% price retracement level at $0.27.