Bitcoin drops under $90,000, are institutions truly long BTC?

- Bitcoin rallied close to $95,000 on Monday, before correcting under the $90,000 support.

- Institutional arbitrage-driven flows add complexity to the narrative of who is truly long on Bitcoin.

- BlackRock’s announcement to integrate Bitcoin ETF into its portfolio allocations and the US strategic crypto reserve catalyzed BTC gains earlier on Monday.

Bitcoin (BTC) climbed to a high of $94,416 early on Monday before erasing newfound gains and dropping under $90,000 support. Market movers and recent bullish developments, such as the United States (US) strategic reserve announcement, the upcoming crypto summit at the White House and BlackRock’s announcement regarding portfolio allocations, failed to catalyze a sustainable rally in Bitcoin.

Why Bitcoin is back under $90,000

Crypto traders observed heightened volatility in the Bitcoin price on Monday as market participants digested the news of Trump’s US crypto strategic reserve announcement and anticipated positive developments at the upcoming crypto summit on Friday.

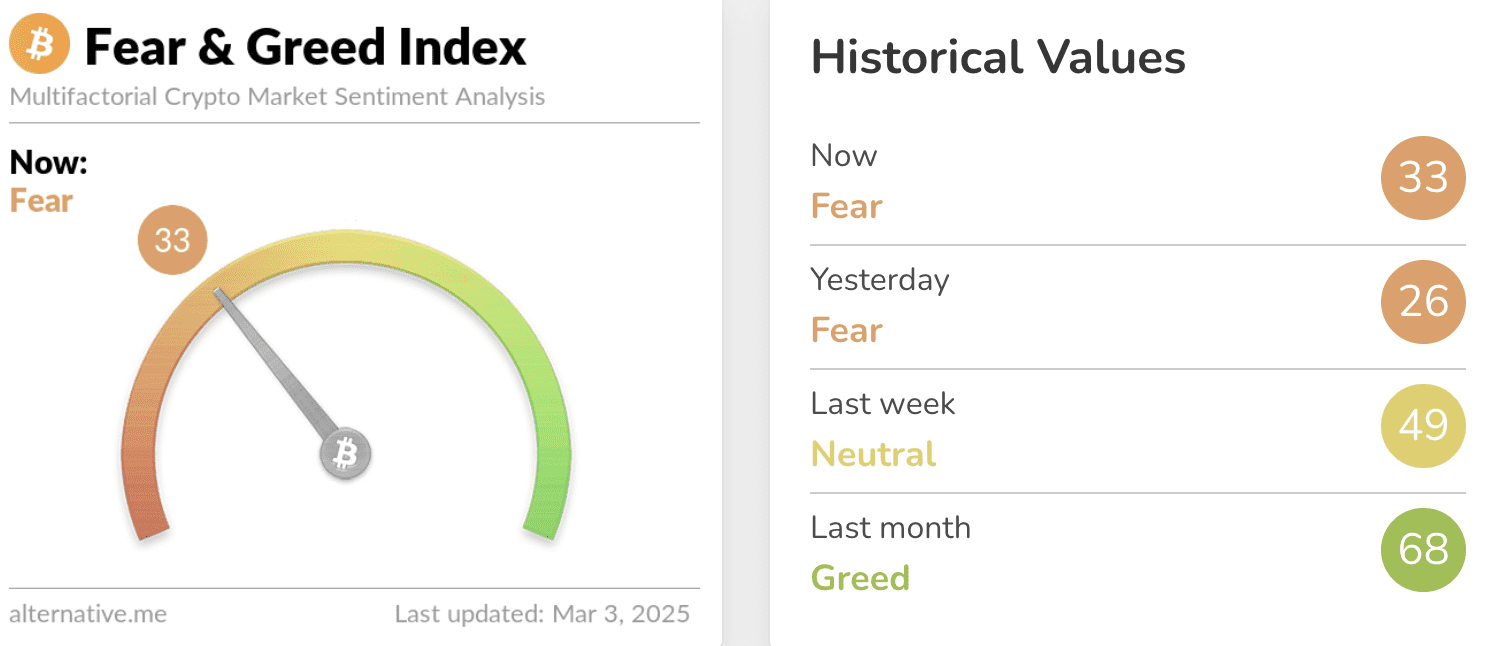

The enthusiasm was short-lived and the Crypto Fear & Greed Index, a gauge of the sentiment among traders, shows that despite the slew of positive announcements, traders continue to remain “fearful”.

Crypto Fear & Greed Index | Source: Alternative.me

The Bitbo Bitcoin volatility index tracks the volatility of the BTC price in US Dollars. The index shows a spike in volatility between February 23 and March 2. Volatility has climbed from 1.53% to 2.06%.

Typically, positive developments in the market tend to push Bitcoin prices higher.However, during periods of heightened volatility, BTC could swing either way. Therefore, BTC is likely to correct once the “hype” or “speculation” narrative fades, among other market movers.

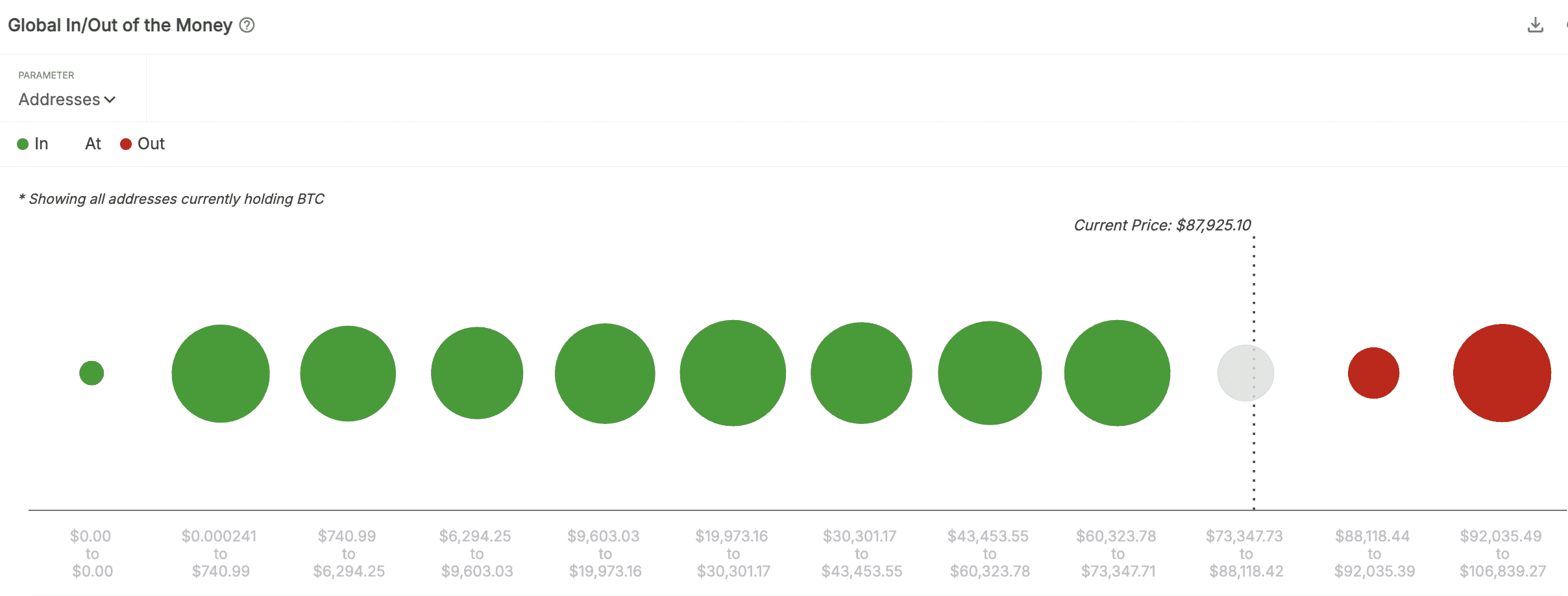

Close to the $90,000 support, specifically between the $88,118 and $92,035 levels, traders hold over $34.83 billion worth of Bitcoin. If the price drops unexpectedly, these wallet addresses are likely to be pushed underwater, meaning they could face unrealized losses on their BTC holdings, according to IntoTheBlock data.

The $90,000 level is, therefore, a key support for Bitcoin as the crypto attempts to recover and rally towards the $100,000 milestone.

Global In/Out of the Money | Source: IntoTheBlock

Are institutions truly long on Bitcoin: Expert commentary

Alvin Kan, COO of Bitget Wallet, spoke to FXStreet and shared insights on institutional capital flows to US-based spot Bitcoin ETFs and whether arbitrage-driven flows affect BTC price and the narrative.

“Despite $38.6 billion flowing into US spot Bitcoin ETFs, research shows that 56% of these net positive flows ($21.1 billion) are tied to arbitrage and hedging strategies, rather than outright long positions. This suggests that institutions are engaging in short-term tactical positioning rather than pure accumulation.

However, the remaining 44% ($17.5 billion) does indicate genuine institutional interest, supported by Bitcoin’s 67% price increase this year and sustained ETF demand. While arbitrage-driven flows add complexity to the narrative, they have not triggered significant downside volatility during outflows. Institutions are participating in Bitcoin exposure, but with a structured approach that balances long-term interest with active risk management,” Kan said.

Kan maintains an optimistic outlook on institutional demand for Bitcoin and believes that ETF flows are not the sole drivers of correction in BTC in the ongoing market cycle.

The Block’s Data and Insights newsletter, published on Monday, affirms Kan’s outlook by highlighting that institutional engagement seems “bullish for crypto.”

BlackRock’s recent announcement to incorporate its Bitcoin ETF into portfolio allocations and allow for 1-2% exposure in alternative asset portfolios marks “a significant step for mainstream adoption,” per the newsletter. Further, the White House’s crypto summit scheduled for next Friday could affirm positive regulatory developments and clarity on digital assets in the US.