2.9 Million XRP coins deposited on Binance as Charles Hoskinson responds to Peter Schiff’s attack on Ripple

- XRP price retraced 9% to $2.7 on Monday after rising 40% in reaction to Trump's crypto strategic reserve bucket.

- Peter Schiff led Bitcoin Maxis’ criticism of Ripple's inclusion, prompting a response from Cardano CEO Charles Hoskinson.

- XRP reserves on Binance crossed 2.9 million, signaling expectations of increased short-term volatility.

Ripple (XRP) price retraced 9% to $2.7 on Monday after United States (US) President Donald Trump’s crypto strategic reserve announcement triggered a 40% upswing over the weekend. On-chain transaction flows and intense community debates around Ripple’s inclusion signal the potential for more volatility in the coming sessions.

Ripple (XRP) hits roadblock at $3 as traders sell the news on Trump’scCrypto strategic reserve announcement

XRP's price action took a dramatic turn over the weekend, driven by a key announcement from US President Donald Trump that bolstered institutional appeal for the Ripple-backed coin.

On Sunday, Trump fulfilled a key campaign promise by issuing an executive order to establish the crypto strategic reserve.

According to the official announcement on Trump-owned Truth Social, the reserve includes XRP,

Solana (SOL), Cardano (ADA), Bitcoin (BTC) and Ethereum (ETH).

Within hours, all five assets recorded double-digit gains.

XRP price analysis | March 3

The chart above shows how XRP surged 40%, reaching the $3 mark from its opening price of $2.14 on Sunday.

However, XRP struggled to breach the $3 resistance as traders sold the news to lock in some of their 40% gains.

The sell-off intensified on Monday, pushing prices down 9% before XRP stabilized at $2.70 at press time.

Cardano CEO kicks against Peter Schiff criticism of Ripple inclusion in crypto strategic reserve

Trump’s decision to add XRP to the crypto strategic reserve came after Ripple CEO Brad Garlinghouse publicly urged a broader approach to US Treasury crypto holdings on February 28. He pushed for diversification beyond Bitcoin.

The move triggered a backlash from Bitcoin advocates, who argue that only BTC should be recognized due to perceived risks with altcoins. Economist Peter Schiff led the criticism, questioning the need for an XRP reserve.

Schiff, while acknowledging Bitcoin’s comparison to the US gold reserve, dismissed XRP’s inclusion.

“I get the rationale for a bitcoin reserve. I don’t agree with it, but I get it. We have a gold reserve. Bitcoin is digital gold, which is better than analog gold. So let’s create a bitcoin reserve too. But what’s the rationale for an XRP reserve? Why the hell would we need that?,” he posted on X.

- Peter Schiff, March 2, 2025

His comments sparked intense debates as key altcoin stakeholders swooped in to defend Trump’s decision to include Ripple as a step toward making the US a global crypto leader.

Cardano CEO Charles Hoskinson also weighed in, supporting XRP’s addition:

“Because XRP is great technology, a global standard, survived for a decade through many harsh cycles, and has one of the strongest communities. I think the president made the right decision.”

- Charles Hoskinson, March 2, 2025.

With capital now allocated across four altcoins, Bitcoin’s share of the strategic reserve could face pressure.

As US Treasury funds flow into XRP, ADA, SOL and ETH, Bitcoin’s dominance may decline, reinforcing crypto’s role in mainstream finance.

Traders deposited 200,000 XRP in 24 hours, anticipating further market cues

While XRP and the other four assets named in Trump’s strategic reserve announcement all posted considerable retracements on Monday, signaling a classic sell-the-news wave, a dramatic surge in XRP exchange deposits over the last 24 hours suggests that volatile price movements may not be over yet.

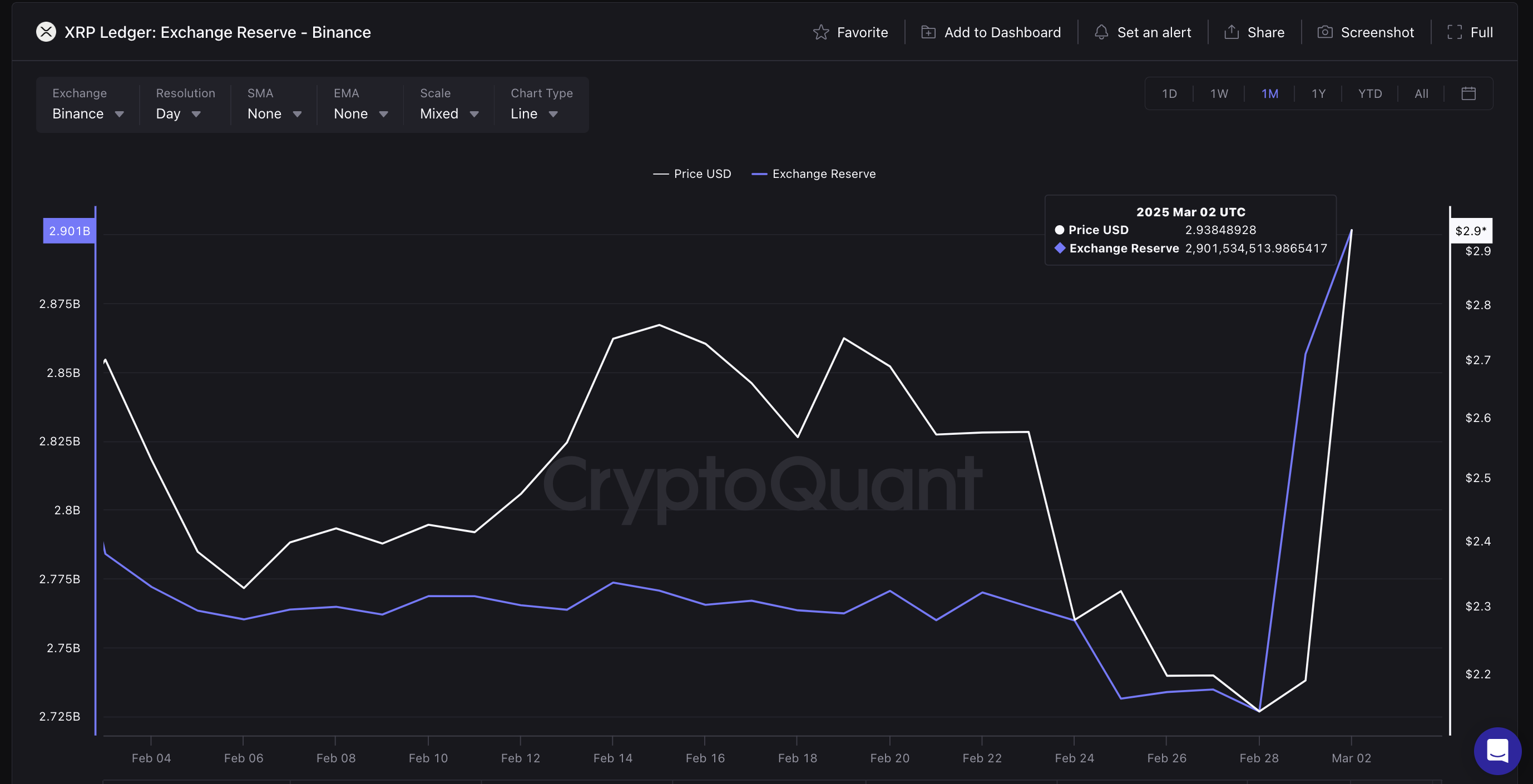

Supporting this outlook, CryptoQuant’s exchange reserves chart below tracks daily changes in total XRP coins deposited on Binance, providing clear insights into investors’ short-term expectations.

Ripple (XRP) Exchange Reserve, March 3, 2025 | Source: CryptoQuant

As seen above, XRP exchange reserves stood at 2.7 million coins at the close of February 28.

However, following Trump’s announcement, investors rapidly deposited over 200,000 XRP into Binance-hosted wallets, bringing total exchange reserves to a 60-day peak of 2.9 million coins as of Monday’s press time.

Valued at the current price of $2.70 per coin, investors have effectively increased XRP’s short-term supply available for trading on exchanges by approximately $600 million in the last 24 hours.

Short-term outlook: What’s next for XRP price?

XRP’s surge in exchange deposits introduces a layer of volatility by increasing the immediate supply of coins available for trading.

When investors move assets to exchanges in large volumes, it typically suggests a heightened readiness to sell or trade, amplifying short-term price fluctuations.

Currently, market sentiment hangs in the balance. XRP short-term profit takers and Bitcoiners criticizing Ripple imposed bearish pressure evidenced by the 9% dip on Monday.

However, bears will have to muster significant sell volumes comparable to those recorded on Sunday to force a deeper correction.

Conversely, strategic bull traders may hold out for more upside when the US Government officially begins purchasing XRP along with the newly announced reserve assets.

With the correction limited to 9%, XRP still maintains a large portion of the 40% gains recorded after the Trump announcement on Sunday.

Without any surprise bearish macro shocks, could tilt the momentum in favor of bulls anticipating a continuation of the rally above $3 in the coming sessions.

If demand remains strong, these inflows could serve as liquidity for the next leg up, potentially pushing XRP beyond the $3 resistance level in the coming sessions.

XRP Price Forecast: Bulls eye $3 rebound as market finds balance

Vital technical indicators on the XRPUSD daily chart confirm the bullish momentum remains intact for another $3 breakout attempt despite Monday’s pullback.

As depicted below, Bollinger Bands indicate that XRP remains above its mid-line support at $2.52, signaling resilience.

Parabolic SAR dots hover below the candles, reinforcing the uptrend.

The sharp volume surge on Sunday, when XRP rallied, contrasts with Monday’s declining sell-side pressure, implying bears lack the force to drive a full reversal toward $2.

XRPUSD Technical Analysis | March 3

For the rally to continue, XRP must reclaim resistance at $2.97, the upper Bollinger Band limit.

A break above this level could pave the way for $3.20.

However, if bears muster to sell volumes comparable to Sunday’s surge, XRP could test support at $2.52, with a further decline to $2.08 if selling pressure intensifies.

Without unexpected macro shocks, bull traders are poised to maintain dominance, as long as the XRP price holds above the $2.52 level, which also aligns with the midpoint price of the Sunday rally.