Bitcoin Price Forecast: BTC corrects after sharp recovery during the weekend

- Bitcoin price trades slightly down on Monday after rallying nearly 10% the previous day.

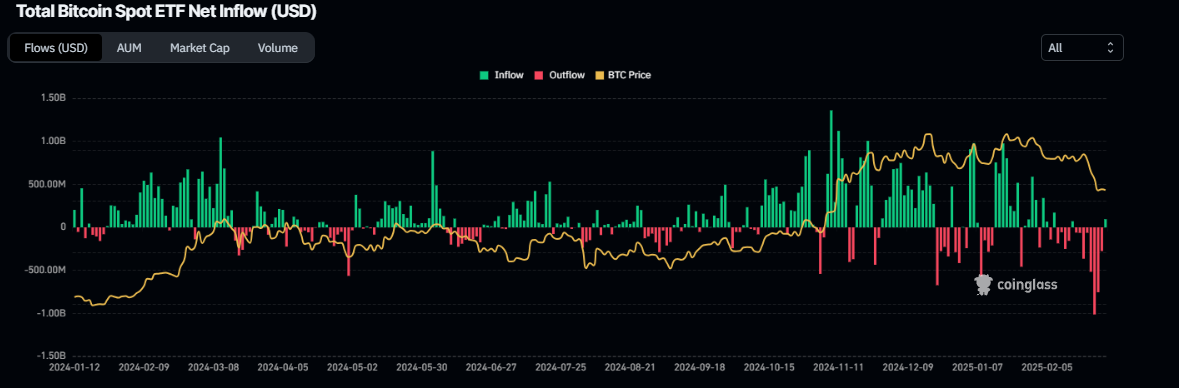

- US Bitcoin spot ETF data recorded a net outflow of $2.39 billion last week.

- QCP Capital’s report highlights that despite encouraging recovery in risk assets on Sunday, BTC is not quite in the game yet.

Bitcoin (BTC) price corrects and trades slightly down near $92,000 at the time of writing on Monday after rallying nearly 10% the previous day. Despite the recovery during the weekend, investor sentiment remains weak as US spot Exchange Traded Funds (ETFs) recorded a $2.39 net outflow last week, signaling institutional demand weakness. QCP Capital’s report on Monday highlights that despite the encouraging recovery in risk assets on Sunday, BTC is not quite in the game yet.

Bitcoin spikes as Trump announces ‘Crypto Strategic Reserve’

Bitcoin price trades slightly down around $92,000 when writing on Monday after recovering 9.53% on Sunday. This recovery was mostly due to US President Donald Trump’s announcement on his Truth Social platform of a US ‘Crypto Strategic Reserve,’ including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), aiming to boost America’s crypto leadership.

In an exclusive interview with FXStreet, Tracy Jin, COO of MEXC, said, “President Trump's announcement of establishing a US strategic crypto reserve comes at a crucial moment for the industry amid a downward trend in market sentiment over the past few days.”

Jin continued that historically, strategic reserves have significantly driven demand for commodities like Crude Oil and Gold. Institutional and central bank interest in Gold led to a 26% price increase in 2024, and a similar effect could be seen for crypto assets with strong technological foundations and real-world applications.

“If formed, the reserve could improve market resilience, increase institutional acceptance, and push for clearer regulation. The inclusion of ADA, SOL, and XRP is particularly notable, suggesting an attempt to support not just Bitcoin and Ethereum but other projects with real technological value,” Jin told FXStreet.

The QCP Capital’s report on Monday highlights that despite the encouraging recovery in risk assets on Sunday, BTC is not quite in the game yet.

The report further explains that BTC is still trading near the bottom of its multi-month range, and frontend crypto volatility (vols) is still relatively elevated, with both majors still reflecting a Put Skew till the end of March.

“The VIX is also elevated, signaling broader market unease in risk assets overall, particularly after the recent tariff escalations from the US administration,” says QCP’s analyst.

The report concluded that with the upcoming marcoenomonic data releases this week, “we expect frontend vols to remain firm. Additionally, the White House Crypto Summit on Friday will be a crucial event, with key details of the US Crypto Reserve and regulatory frameworks expected to surface.”

Bitcoin institutional demand weakens

Diving down into Bitcoin’s institutional demand, it shows signs of weakness. According to Coinglass, Bitcoin spot ETF data recorded net outflows of $2.39 billion last week, extending the previous week’s $540 million withdrawal trend and signaling continued weakness in demand. If the magnitude of the outflow continues and intensifies, the Bitcoin price could see further corrections.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

Bitcoin Price Forecast: BTC in recovery mode or continuing its downward trend

Bitcoin price declined from Monday’s high of $96,500 to Friday’s low of $78,258 last week. However, it recovered 11.50% during the weekend, closing above $94,270 on Sunday. At the time of writing on Monday, it trades down at around $92,000.

If BTC continues its recovery, it could extend the rally to retest its next resistance level at $100,000.

The Relative Strength Index (RSI) on the daily chart reads 47 after bouncing off oversold levels last week and is currently rejecting its neutral level of 50. For the bullish momentum to be sustained, the RSI must trade above the neutral level of 50.

BTC/USDT daily chart

On the contrary, if BTC declines and closes below the $90,000 support level, it could extend its decline to retest its $85,000 daily support.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.