Bitcoin Cash price rallies 7% as BTC, ETH, XRP struggle: What follows?

- Bitcoin Cash price pushed past the $300 level on Friday as CME Group’s move to list SOL ETFs sparked bullish sentiment across select altcoins.

- BCH’s latest price surge on Friday comes amid major declines in BTC, ETH and XRP prices.

- Amid bearish macroeconomic trends, Bitcoin Cash miners have sold 170,000 BCH in the final week of February.

Bitcoin Cash (BCH) was one of the top-performing crypto assets on Friday, defying the bearish market sentiment to score 7% gains. On-chain data suggests the rally could be short-lived with miners actively offloading their reserves.

BCH gains 7% as CME Group signals institutional interest in altcoins

On Friday, Bitcoin Cash price action decoupled from the broader cryptocurrency market by posting a 7% gain. Rebounding toward $320, BCH defied the prevailing bearish trend.

Bitcoin Cash (BCH) Price Action

Bitcoin Cash (BCH) Price Action

BCH's performance stood out, as major cryptocurrencies like Bitcoin, Ethereum and Cardano experienced considerable declines this week.

The catalyst for this upward movement was CME Group's announcement during the US trading session of its plans to list Solana Futures ETFs on March 17.

This development, coupled with the US Securities & Exchange Commission's (SEC) recent dismissal of charges against industry players, such as Uniswap, Coinbase and Robinhood, bolstered confidence in the altcoin sector.

Consequently, Bitcoin Cash's price climbed to an intraday high of $312.

Other altcoins, including Solana (SOL), XRP and Hedera (HBAR), also experienced gains during the US session, reversing earlier losses.

Miners' $52M selling spree could dampen market momentum

Despite the positive price action, underlying market sentiment remains cautious.

The impending implementation of tariffs on Canadian and Mexican imports by the Trump administration on March 1 is anticipated to exert inflationary pressure, potentially prompting investors to withdraw capital from the cryptocurrency market in the near term.

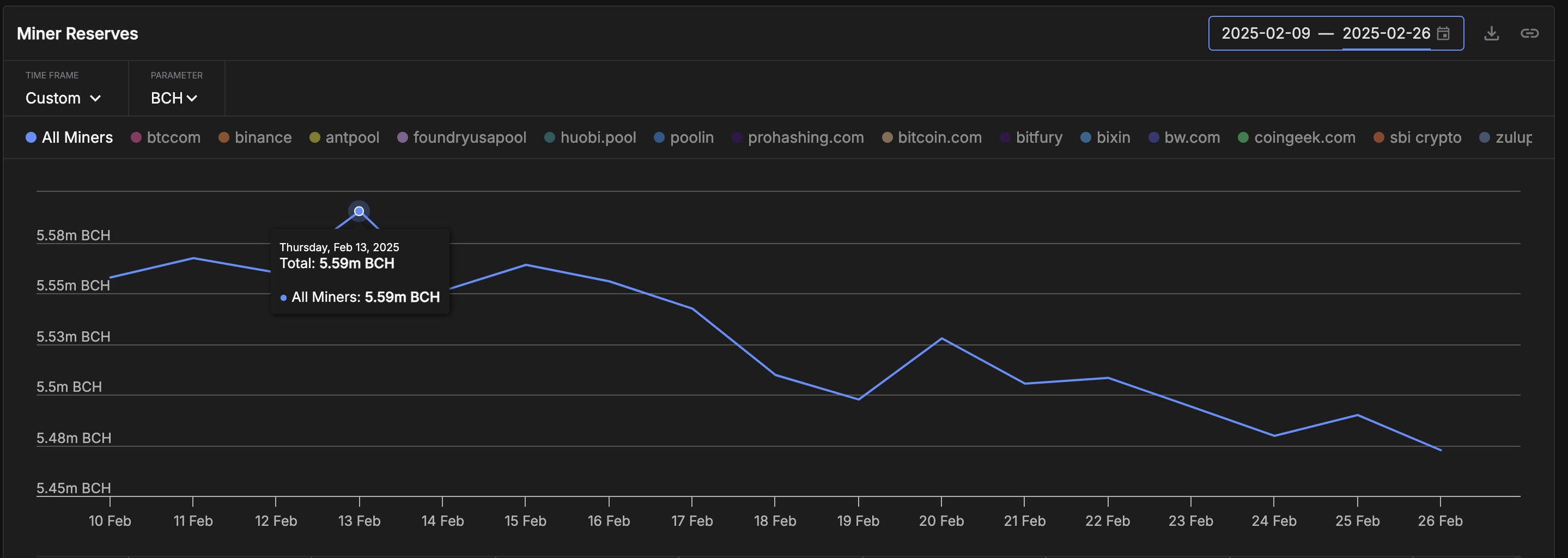

Supporting this cautious outlook, on-chain data reveals that Bitcoin Cash miners have been actively reducing their holdings.

Bitcoin Cash Miners Reserves vs. BCH Price

Bitcoin Cash Miners Reserves vs. BCH Price

As of February 13, miners collectively held 5.59 million BCH. By February 27, this figure had decreased to 5.36 million, indicating a sell-off of approximately 170,000 BCH, valued at around $55 million based on the recent price of approximately $320 per coin.

Given miners' significant influence within major Proof of Work (PoW) cryptocurrency ecosystems, the persistent sell-off could suppress upward price momentum.

First it could dampen confidence among current holders and dissuade prospective new entrants from committing to large volume buy-orders.

Beyond that, persistent inflows of newly-mined coins into exchanges could effectively flood market supply, nullifying the impact of the demand surge fuelled by CME Group moving to launch altcoin ETFs.

BCH Price Prediction: Failure to hold $300 could reaffirm bearish dominance

Bitcoin Cash’s forecast leans cautiously bearish despite its recent 7% rally as key technical indicators reveal mixed signals. BCH surged to $318, breaking past short-term resistance with rising trading volumes indicating renewed interest.

The increase in trading activity is typically a bullish sign, suggesting strong participation from market buyers. However, a closer look at the trend suggests caution.

Bitcoin Cash Price Prediction | BCH

BCH price remains below the 20-day EMA at $323, reinforcing the presence of near-term selling pressure.

A breakout above this level could validate further upside toward the 50-day EMA at $363, but failure to reclaim it may see BCH struggling to maintain bullish momentum.

Additionally, the MACD line, while slightly tilting upward, remains in negative territory, suggesting the broader bearish trend remains intact.

On the downside, if Bitcoin Cash fails to hold above the $300 mark, sellers could regain control, triggering a fresh decline. Notably, if the miners' recent sell-off persists, it could further weaken demand. A break below this psychological support could send BCH toward $280, confirming bearish dominance.