Ripple's XRP flashes red as President Trump to begin Mexico, Canada tariffs in March

- XRP dipped on Monday as President Donald Trump reiterated plans to begin tariffs for Mexico and Canada.

- The remittance-based token's funding rates flashed negative in the past five days, signaling rising bearish pressure.

- XRP could face massive downward pressure if it declines below a descending triangle's support at $1.96.

Ripple's XRP joined the wider crypto market decline, plunging nearly 10% on Monday following President Donald Trump reiterating that the US will kick off tariffs on Mexico and Canada.

Despite initially pausing the tariffs, both countries have failed to work out an agreement with the US government.

Crypto investors reacted negatively to the news, shedding nearly $230 billion in market capitalization — similar to the market decline when Trump first announced the tariff in early February.

XRP funding rates and open interest show reduced demand

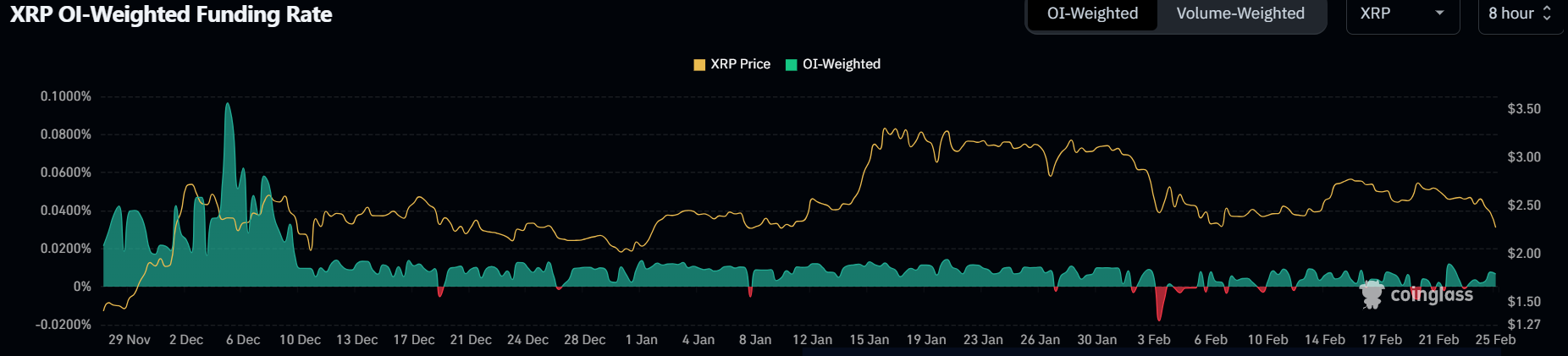

The current market downtrend has seen XRP funding rates flip negative on several occasions over the past five days, indicating rising bearish pressure.

XRP Funding Rates. Source: Coinglass

Funding rates are fees exchanged between traders in perpetual futures contracts to keep the contract price close to the underlying asset's spot price.

When funding rates are positive, traders holding long positions pay a fee to traders holding short positions. When the rate is negative, short traders pay long traders.

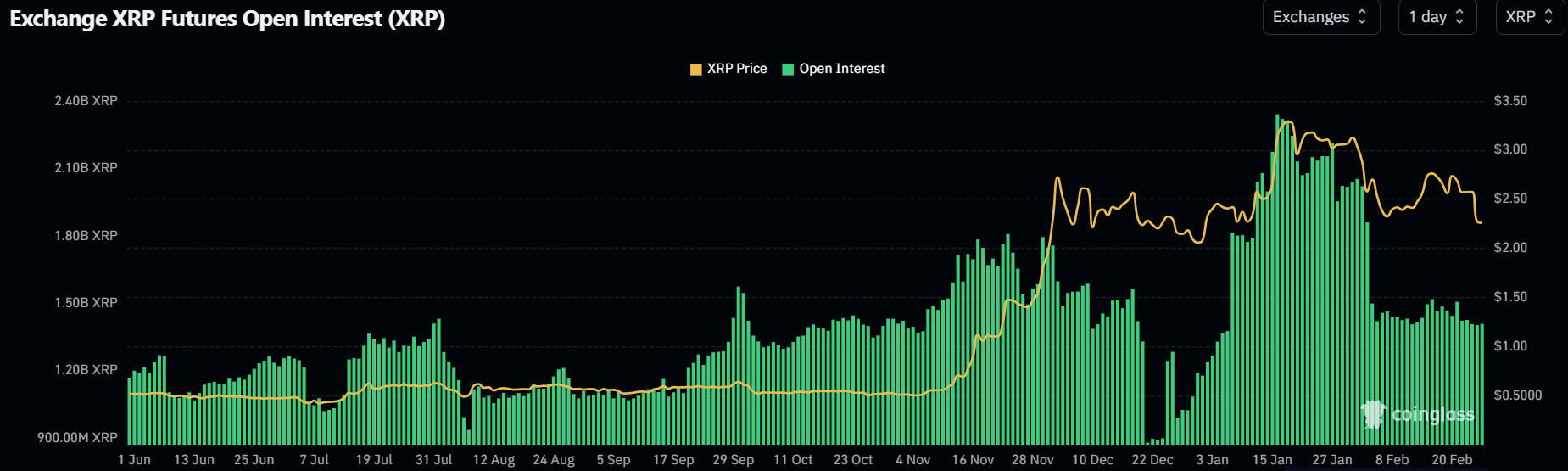

Meanwhile, XRP open interest has failed to recover since the market crash on February 3, hovering around 1.40 billion XRP from 2.02 billion XRP, per Coinglass data.

XRP Open Interest. Source: Coinglass

Open interest is the total number of unsettled futures contracts in a derivatives market. It shows how many active positions exist in the market at a specific time.

However, investors appear to be buying the dip as XRP's exchange net outflows across Binance, Kraken and Coinbase have accelerated over the past 24 hours.

A potential reason for this buy-the-dip activity is the recent actions of the Securities and Exchange Commission (SEC), which has started dropping cases against crypto companies.

Notably, the agency dismissed cases against Coinbase and Robinhood Crypto, a positive sign for the broader crypto industry.

Investors anticipate the SEC may reach a similar conclusion with Ripple, ending its four-year-long battle against the company.

XRP plunges below $2.55, eyes triangle's support at $1.96

XRP saw $43.62 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $40.54 million and $3.08 million.

XRP has declined below the $2.55 support that bulls defended throughout last week. The downward move follows its rejection near the resistance of a descending triangle and the 50-day Simple Moving Average (SMA).

XRP/USDT daily chart

The remittance-based token could find support near the $1.96 level if bulls fail to hold the 100-day Exponential Moving Average and the support level near $2.20.

A decline below $1.96 will accelerate the downward pressure and send XRP toward $1.35.

On the upside, XRP must overcome the descending triangle's resistance to begin an uptrend.

Meanwhile, the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) on the weekly chart are trending downward, with the latter attempting to cross below its neutral level.

The Moving Average Convergence Divergence (MACD) line is testing its moving average line while its histograms have moved below their neutral levels.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.