Crypto Today: Arkham discovers Bybit hackers wallet as BTC, ETH and top 20 altcoins lose $75B

- The global crypto market plunged 2% on Friday shedding over $75 billion as markets reacted to a 400,000 ETH hack involving Bybit Exchange.

- Binance exchange transferred 50,000 ETH to Bybit to buffer liquidity as restore market confidence

- Ethereum showed resillence holding the $2,600 support steady after a 3% dip within hours of the Bybit hack.

Bitcoin Market Updates:

Bitcoin (BTC) started the day on a positive note, rising as high as $99,495 before news of the Bybit hack triggered a 4% reversal to $96,200 at press time on Friday.

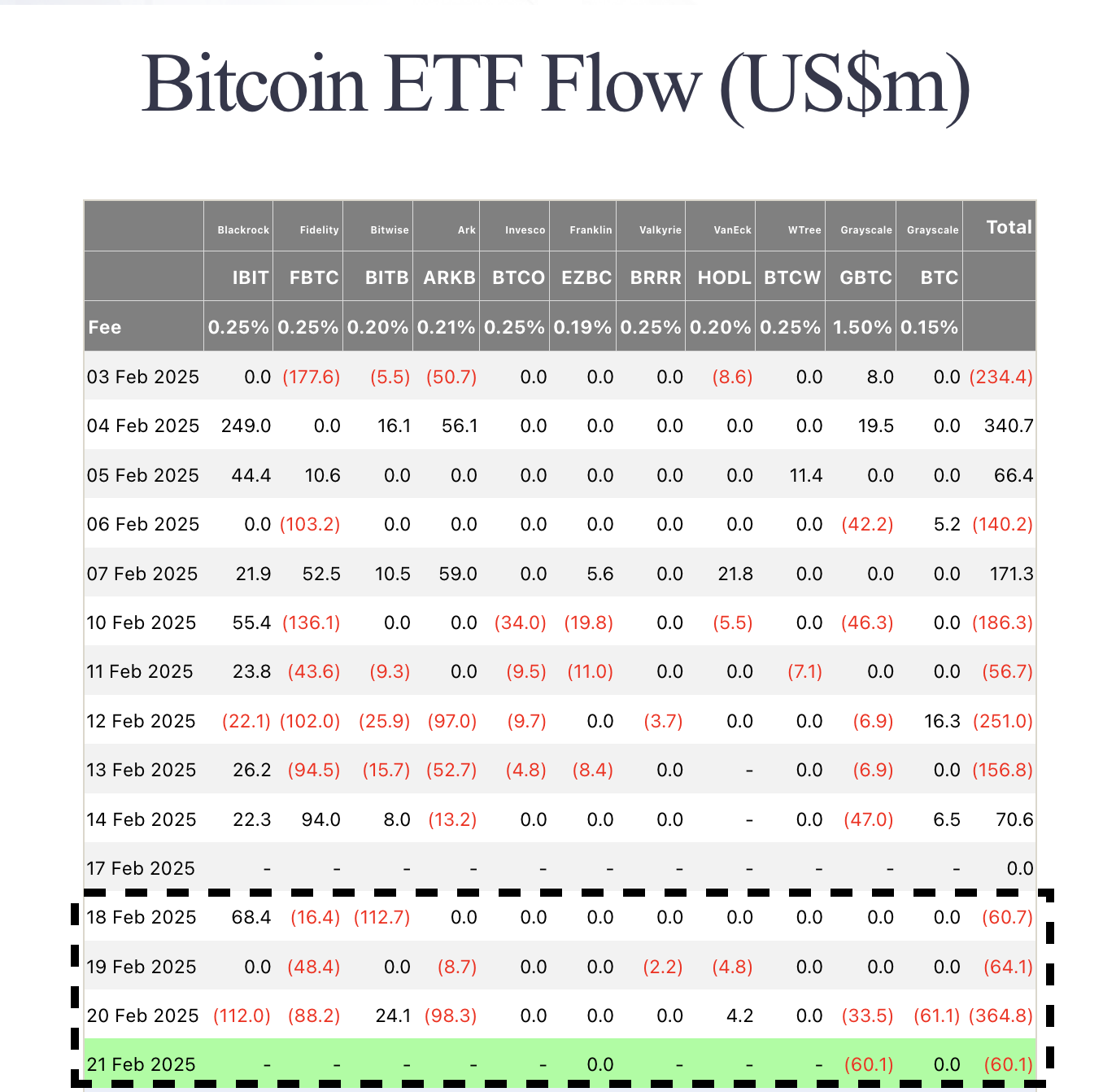

Bitcoin ETFs Flows (USD) | Source: Fairside

Bitcoin ETFs also contributed to the BTC price downtrend, recording an aggregate of $689.6 million outflows in 4 consecutive losing days from Monday.

Altcoin Market Updates: XRP, BCH, LINK lead losses as Bybit’s $1.4B hack

On Friday, Bybit exchange suffered a major hack that led to losses exceeding 400,000 ETH, worth approximately $1.4 billion at press time.

In response, Binance transferred 50,000 ETH to Bybit to help stabilize liquidity and restore user confidence.

Binance transfers 50,00 ETH to Bybit in Emergency Hack Response

However, the sheer scale of the breach sent shockwaves through the crypto market, triggering a significant sell-off across top altcoins.

Crypto market performance Feb 21, 2025 | Source: Coingecko

Among the hardest-hit assets, Dogecoin (DOGE), Cardano (ADA), and Chainlink (LINK) posted the steepest 24-hour losses.

DOGE plunged 6.4% as risk sentiment deteriorated, erasing its weekly gains. ADA followed closely with a 5.9% drop, struggling to hold the $0.75 level.

Meanwhile, LINK tumbled 5.4%, extending its multi-day downtrend.

While Bitcoin and Ethereum held their key support zones, the overall altcoin market continued to bleed, reflecting investor anxiety over centralized exchange security.

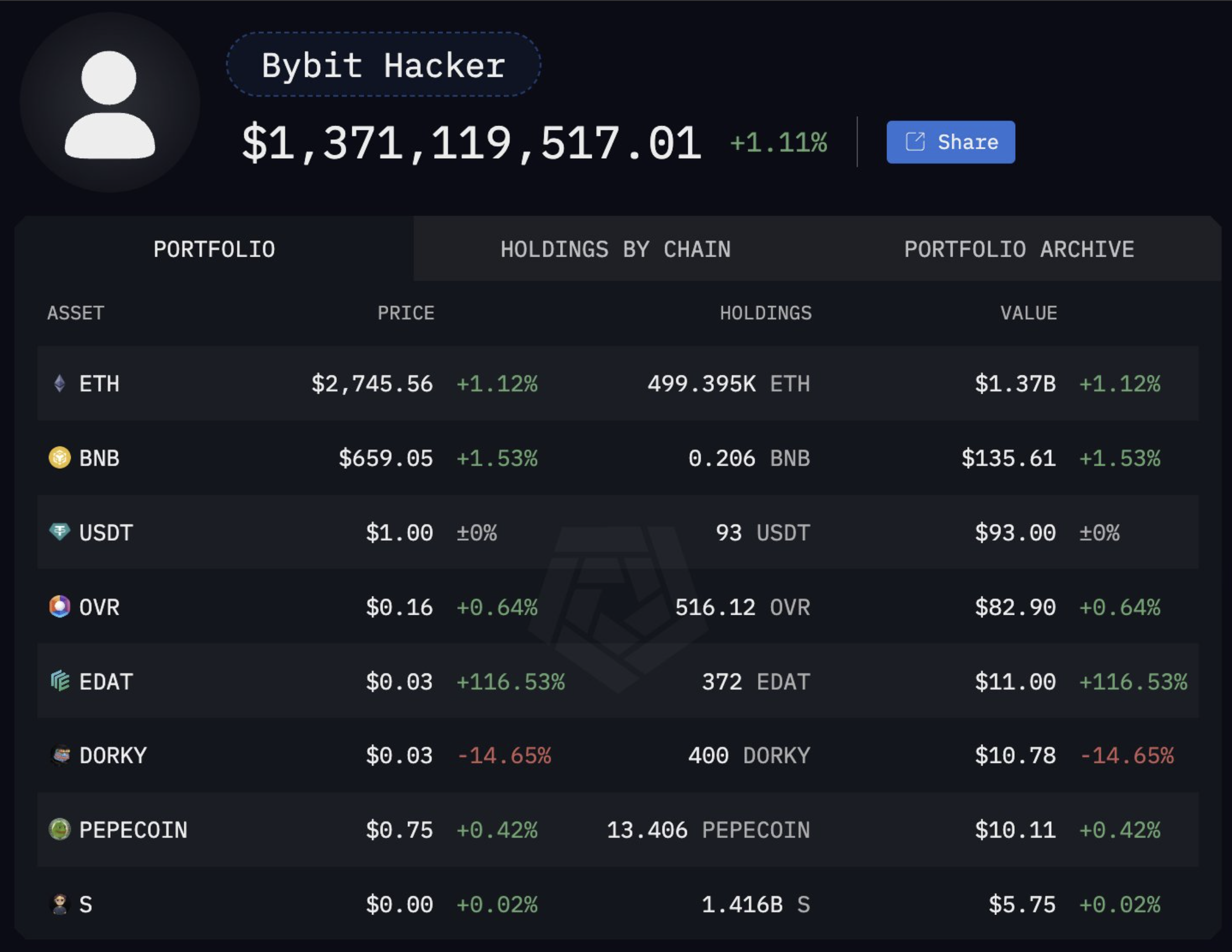

Chart of the day: Arkham Intelligence identifies ‘Lazarus’ kacker wallets as Binance funnels emergency $50K funds to Bybit

Blockchain analytics firm Arkham Intelligence has linked the Bybit hacker's wallets to the North Korean Lazarus Group, which has previously been implicated in several high-profile crypto heists.

Arkham’s report reveals that the hacker moved the stolen 400,000 ETH across 53 different wallets, with holdings totaling approximately $1.37 billion at press time.

The on-chain activity indicates potential laundering attempts through decentralized exchanges (DEXs) and cross-chain bridges.

Bybit CEO Ben Zhou confirmed that hackers compromised one of the exchange’s Ethereum cold wallets through a manipulated multisig transaction.

Despite the breach, Zhou assured users that Bybit remains solvent and is actively seeking bridge loans from partners to cover the losses.

In a bid to contain market panic, Binance transferred 50,000 ETH to Bybit, helping the exchange stabilize liquidity and prevent further disruptions.

However, investor sentiment remains fragile, with Ethereum slipping to $2,616 and Bitcoin struggling to reclaim the $97,000 level.

Arkham Intelligence Identifies ‘Lazarus’ Hacker Wallets | Feb 22, 2025 Source: Arkham.com

In a bid to contain market panic, Binance transferred 50,000 ETH to Bybit, helping the exchange stabilize liquidity and prevent further disruptions.

However, investor sentiment remains fragile, with Ethereum slipping to $2,616 and Bitcoin struggling to reclaim the $97,000 level.

It remains to be seen if the identification of these hacker-controlled wallets could assist law enforcement investigations or help retrieve users' funds.

Meanwhile a centralized exchange security, as traders weigh the risks of holding assets on CEX platforms.

Meanwhile, regulatory scrutiny is expected to intensify, with U.S. authorities closely monitoring the situation for potential sanctions violations.

As the market processes the aftermath of the Bybit breach, traders will be watching for further movements of the stolen funds, particularly if they begin flowing into mixers like Tornado Cash, which has historically been used by Lazarus-affiliated entities.

Crypto News Updates:

-

US SEC conclude Opensea probe with no ‘securities charges’ against NFTs

The U.S. Securities and Exchange Commission (SEC) has ended its investigation into OpenSea without classifying NFTs as securities or pursuing enforcement actions.

Bloomberg reported that the SEC informed OpenSea of the probe’s conclusion, marking a significant regulatory outcome for the NFT industry.

OpenSea’s CEO, Devin Finzer, welcomed the decision, emphasizing that an adverse ruling could have restricted innovation in the NFT space.

- “This is a win for everyone who is creating and building in our space. Trying to classify NFTs as securities would have been a step backward—one that misinterprets the law and slows innovation. Every creator, big or small, should be able to build freely without unnecessary barriers.” - Devin Finzer, OpenSea CEO, Feb 21, 2025

The marketplace had reportedly set aside a $5 million legal fund to support NFT artists and developers in case of litigation. With the SEC stepping back, NFT platforms may find more regulatory clarity moving forward.

-

Solana to integrate SEC-approved yield-generating stablecoin with 3.85% APR

Solana will integrate YLDS, the first SEC-approved yield-bearing stablecoin, offering a 3.85% annual percentage rate (APR) with no asset lockups.

Developed by Figure Markets, YLDS is registered as a public security and calculates its yield based on the Secured Overnight Financing Rate (SOFR) minus 0.50%.

The stablecoin accrues interest daily and pays out monthly in USD or YLDS tokens.

With Solana processing up to 65,000 transactions per second at minimal cost, YLDS aims to provide efficient, on-chain yield opportunities.

Users can trade YLDS for USD or other stablecoins on Figure Markets’ 24/7 platform, with fiat conversions available during U.S. banking hours.

The stablecoin’s yield currently surpasses 10-year and 30-year U.S. Treasury bond rates but remains below the average high-yield savings account return.

-

SEC agrees in principle to dismiss Coinbase lawsuit, pending final approval

The US SEC has agreed in principle to dismiss its enforcement case against Coinbase, awaiting final approval from the Commission.

The case, which accused Coinbase of operating as an unregistered securities exchange, broker, and clearing agency, will be officially closed once the Commissioners vote to accept the dismissal.

If approved, the decision will be "with prejudice," preventing the SEC from refiling the same charges.

This potential dismissal follows the SEC’s lawsuit against Coinbase in June 2023, which came shortly after similar action against Binance.

If the case is dropped, it could set a precedent for other enforcement actions against crypto exchanges. The final decision is expected within a week, depending on the Commission’s meeting schedule.