Bitcoin Price Forecast: 14,000 BTC moved after years of dormancy

- Bitcoin price recovers and trades around $97,800 on Monday after reaching a low of $91,231 last week.

- CryptoQuant data shows 14,000 long-dormant BTC moved on Monday, and BTC Exchange Netflow reached FTX collapse levels.

- Nick Forster, founder of Derive.xyz, stated that the chances of BTC reaching $200K by December 26, 2025, had risen slightly to 12%, up from 11% last week.

Bitcoin (BTC) price recovers slightly and trades around $97,800 on Monday after reaching a low of $91,231 last week. CryptoQuant data shows 14,000 long-dormant BTC moved on Monday, and BTC Exchange Netflow reached FTX collapse levels. Moreover, Nick Forster, founder of Derive.xyz, told FXStreet that the chances of BTC reaching $200K by December 26, 2025 had risen slightly to 12%, up from 11% last week.

Bitcoin dormant wallet moves 14,000 BTC

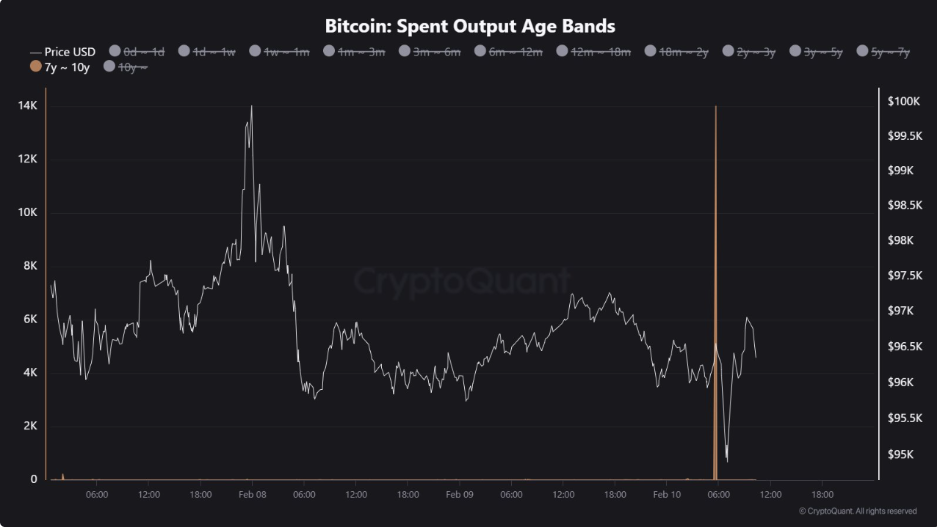

Bitcoin price recovers slightly, trading around $97,800 during the early European trading session on Monday, after correcting for two consecutive weeks. CryptoQuant data shows that on Monday, 14,000 BTC that had been inactive for 7 to 10 years were moved.

Despite the large volume, these coins have not yet been transferred to any exchanges, suggesting they are not intended for immediate sale. However, traders should remain cautious as the average acquisition price of these coins is low, which could influence the holders’ future decisions regarding potential sales.

Bitcoin Spend Output Age Bands chart. Source: CryptoQuant

The previous week, CryptoQuant data showed the largest BTC net outflow since 2022.

The graph below shows that Bitcoin Exchange Netflow has returned to levels last seen during the FTX collapse, accompanied by a 3% decline in BTC supply on exchanges.

Notably, the second-largest outflow in this period occurred last July, nearly matching this week’s magnitude. Despite the prevailing sentiment, major buyers — possibly institutional investors or funds — accumulate during price dips.

Bitcoin Exchange Netflow total chart. Source: CryptoQuant

QCP Capital’s report on Monday states, “Following DeepSeek’s move two weeks ago and last week’s tariff-driven volatility. This time, Trump’s announcement of a 25% levy on steel and aluminum briefly unsettled markets ahead of Powell’s testimony and CPI data.”

The report further explained that with Mexico and Canada among the top three US suppliers, the tariffs cast doubt on last week’s temporary delay and could reignite trade tensions. Adding to the uncertainty, Trump’s remarks on potential sanctions against Japan — a key US ally — follow the White House’s move to block Nippon Steel’s takeover of US Steel. Moreover, BTC volatility now skews in favor of puts until April, reflecting a lack of upside catalysts.

However, in an exclusive interview with FXStreet, Nick Forster, Founder of Derive.xyz, said “For BTC, the chances of it reaching $200K by December 26, 2025 have risen slightly to 12%, up from 11% last week.”

Forster continued that there’s a 15% chance of BTC exceeding $135K by the end of Q2, up from 14%.

Bitcoin Price Forecast: BTC bears aiming $90,000 mark

Bitcoin price faced rejection, closed below the $100,000 psychological level and declined nearly 2% in the previous week. At the time of writing on Monday, it recovers slightly and trades at around $97,800.

If BTC continues its correction, it could extend the decline to test its psychologically important level of $90,000.

The Relative Strength Index (RSI) on the daily chart reads 45 after being rejected from its neutral level of 50 last week, indicating slightly bearish momentum. Moreover, the Moving Average Convergence Divergence (MACD) showed a bearish crossover, hinting at further correction ahead.

BTC/USDT daily chart

However, if BTC recovers and finds support around $100,000, it would extend the recovery to retest its January 31 high of $106,012.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.