Bitcoin Weekly Forecast: BTC shows weakness, bears aiming for $90,000 mark

-

Bitcoin price hovers around $97,000 on Friday after losing nearly 5% in the last three days.

- CryptoQuant weekly report shows that activity on the Bitcoin network has declined to its lowest level in a year.

- Traders should watch FTX's upcoming repayments to creditors starting on February 18.

Bitcoin (BTC) price hovers around $97,000 on Friday after losing nearly 5% in the last three days. CryptoQuant weekly report shows that activity on the Bitcoin network has declined to its lowest level in a year. Traders should watch FTX's upcoming repayments to creditors starting on February 18, which could bring in volatility for Bitcoin prices.

Bitcoin crashes as Trump implements tariffs on imports from Canada, Mexico, and China

Bitcoin price started this week with a sharp correction, reaching a low of $91,231. This correction was fueled by the implementation of US President Donald Trump's announced tariffs on major trading partners, including China, Canada, and Mexico, on Saturday, which exerted some selling pressure on the overall crypto market.

However, later in the day, Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau announced they had conversations with US President Trump and agreed to pause tariffs for 30 days to negotiate after compromising on cooperation in security and trade with the US. The market mood shifted positively after the news, allowing BTC to recover and close above $101,300 on Monday.

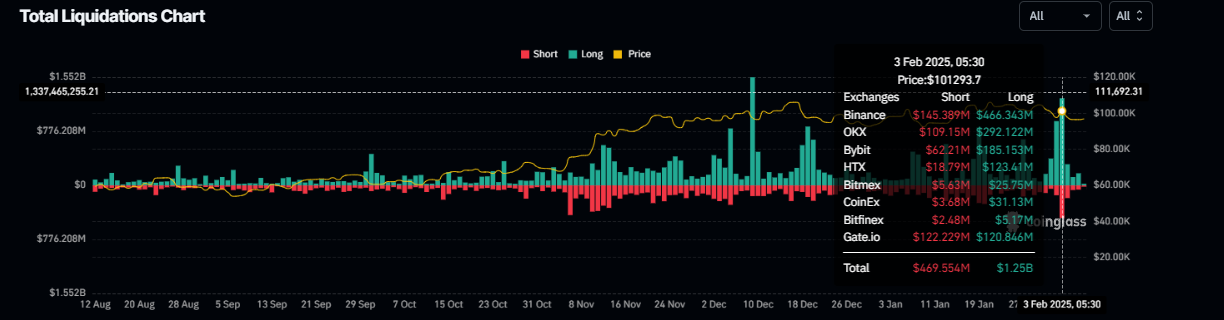

This price drop triggered a wave of liquidations across the crypto market, resulting in $1.72 billion in total liquidations that day, almost $373 million specifically in BTC, according to data from CoinGlass.

Total Liquidations chart. Source: Coinglass

Still, Ben Zhou, CEO of Bybit exchange, posted on X on Monday, "Real total liquidation is a lot more than $2 billion; by my estimation, it should be at least around $8-10 billion."

He further explained that Bybit's 24-hour liquidation alone was $2.1 billion, compared to only around $333 million recorded on Coinglass. However, this is not all liquidations at Bybit, as the API limitation brought the numbers down.

I am afraid that today real total liquidation is a lot more than $2B, by my estimation it should be at least around $8-10b. FYI, Bybit 24hr liquidation alone was $2.1B, As you can see in below screenshot, Bybit 24hr liquidations recorded on Coinglass was around $333m, however,… https://t.co/4WLkPxTYF4 pic.twitter.com/woTOHQvNkt

— Ben Zhou (@benbybit) February 3, 2025

Trump ordered the creation of the first-ever US sovereign wealth fund

Bitcoin quickly recovered from Monday's fall as US President Trump ordered the creation of the first-ever US sovereign wealth fund to serve as a tool for economic development. The new sovereign wealth fund order has stirred optimism among crypto community members, who had been speculating about adding Bitcoin to the fund.

However, the recovery came to an end on Tuesday when China's finance ministry announced a package of tariffs on a range of US products, including Crude Oil, farm equipment, and some autos. This was an immediate response to the 10% tariff on Chinese imports announced by US President Donald Trump, leading to a 3.5% fall in BTC on that day.

Bitcoin continues to decline despite Eric Trump's support and Scott Bessent's positive comments

Bitcoin price continued to decline on Wednesday, closing below $96,700 despite US Treasury Secretary Scott Bessent's positive macroeconomic outlook. Bessent said late Wednesday the "focus is on bringing down 10-year Treasury yields, rather than the Fed's benchmark short-term interest rate."

Bessent further stated, "US President Donald Trump wants lower interest rates."

Lowering 10-year Treasury yields and interest rates is generally seen as a bullish sign for risky assets like Bitcoin. However, prices decline on that day.

Moreover, on Thursday, positive comments on Bitcoin from Eric Trump, son of the US President, also failed to support its price, leading to a slight decline in BTC, closing at $96,552. In a post on his social media X, Eric Trump encouraged the addition of BTC to their family-backed crypto platform World Liberty Financial’s portfolio.

Feels like a great time to enter #BTC! @worldlibertyfi

— Eric Trump (@EricTrump) February 6, 2025

FTX repayments could bring volatility for BTC

Bitcoin could expect volatility due to FTX's upcoming repayments to creditors, starting on February 18. The bankrupt exchange is set to begin repayment to creditors with claims under $50,000, particularly those in the Bahamas, with 9% interest per annum from November 11, 2022.

The exchange first filed for bankruptcy in November 2022 with an estimated debt of $11.2 billion. Payouts are expected to total up to $16.5 billion, while the exchange raises additional funds by selling assets and investments in tech firms. This news is significant as it marks a crucial step in recovery for those affected by the FTX collapse in November 2022, generating considerable interest in the cryptocurrency community.

FTX Repayments: 18 Feb 2025

— Sunil (FTX Creditor Champion) (@sunil_trades) February 4, 2025

Funds available from 10am ET

FTX Claims < $50k

FTX Creditors in the Bahamas process have email confirmation that repayments will start on 18 Feb 2025

9% interest per annum from 11 Nov 2022 pic.twitter.com/FrmDN4qiK7

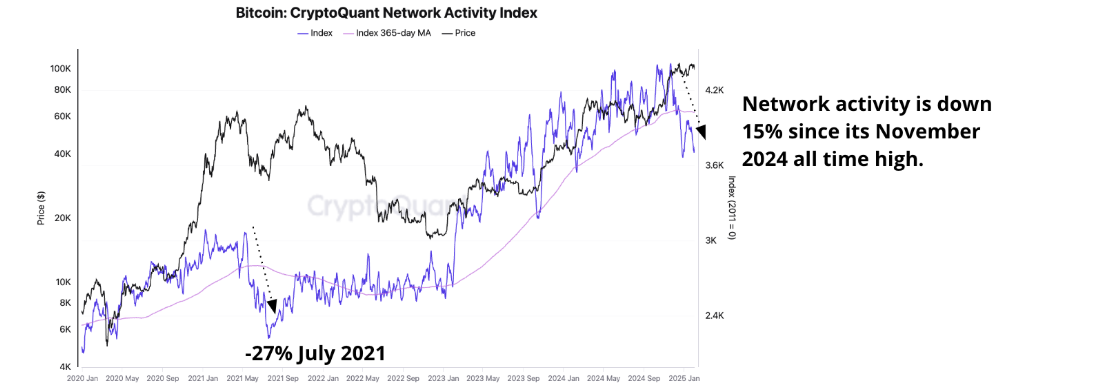

CryptoQuant weekly report highlights that the activity on the Bitcoin network has declined to its lowest level in a year. According to the report, the Bitcoin Network Activity Index indicates that activity has been down 15% since the November 2024 record high. The index is now at 3,760, the lowest level since February 2024. Moreover, the index has fallen significantly below its 365-day moving average, which had not occurred since July 2021, after China banned Bitcoin mining. The index measures the growth in key Bitcoin network metrics like active addresses, number of transactions, block size, etc.

Bitcoin Network Activity chart. Source: CryptoQuant

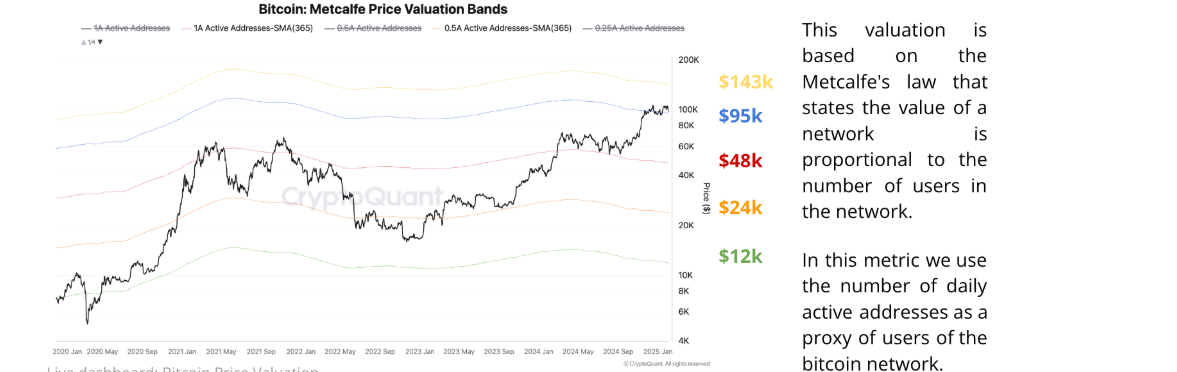

The report further explains that from a network activity perspective, Bitcoin's fair value lies between $48,000 and $95,000 (red and blue Metcalfe valuation bands). At a current price of $99,000, Bitcoin appears overvalued, considering that it has traded between the red and blue Metcalfe Valuation Bands since February 2024. Moreover, the valuation bands have been trending downward since March 2024, when network activity started to slow down.

Bitcoin Metcalfe Price Valuation Bands chart. Source: Cryptoquant

Is BTC out of the woods?

Bitcoin price faced a pullback, reaching a low of $91,231, but quickly recovered to close above $101,300 on Monday. However, it failed to maintain its recovery and declined nearly 5% in the next three days. At the time of writing on Friday, BTC trades at around $97,000.

If BTC continues its correction, it could extend the decline to test its psychologically important level of $90,000.

The Relative Strength Index (RSI) on the daily chart reads 44 and points downwards after being rejected from below its neutral level of 50 on Monday, indicating increasing bearish momentum. Moreover, the Moving Average Convergence Divergence (MACD) showed a bearish crossover last week, hinting at further correction ahead.

BTC/USDT daily chart

Conversely, if BTC recovers and finds support around $100,000, it would extend the recovery to retest its January 31 high of $106,012.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.