Will Dogecoin outshine XRP? Publicly traded Canadian firm buys 1 million DOGE

- Dogecoin and XRP struggle alongside Bitcoin as the largest cryptocurrency hovers under the $100,000 milestone on Wednesday.

- Canadian blockchain company Neptune Digital Assets bought 1 million DOGE tokens.

- Bitwise, Osprey Funds and Rex Shares are looking to launch a spot Dogecoin ETF in the US, which is likely to catalyze gains.

- XRP technical indicators show the likelihood of further decline, price outlook turns bearish.

Dogecoin (DOGE) and XRPLedger’s native token XRP observe a correction on Wednesday, extending their losses from the past seven days. DOGE is down 2.43% and XRP lost nearly 5% of its value on the day.

Between the two tokens, the largest meme coin is likely to lead the recovery and the anticipated altcoin season, during which 75% of the top 50 altcoins outperform Bitcoin over a period of 90 days.

Dogecoin added to the strategic reserve of a publicly traded Canadian firm

Neptune Digital Assets, a publicly traded Canadian blockchain company, acquired 1 million DOGE tokens, worth nearly $270,000, as part of a “strategic derivative purchase” on December 27, 2024. The details of the purchase were revealed in a disclosure published by the firm on Tuesday.

Between January 26 and February 3, the firm added 20 more Bitcoin tokens, worth $2 million. Thus, Neptune Digital Assets has a total BTC holding of 376 BTC (over $37 million). The firm shared plans to leverage xits enhanced purchasing power with a focus on BTC.

Neptune is the second publicly traded company to buy Dogecoin, the first is Spirit Blockchain, another digital asset firm. The move marks a rising institutional demand for and adoption of Dogecoin among firms.

Crypto traders await this catalyst for DOGE rally

The approval of United States (US) based Spot Bitcoin ETF catalyzed a bull run in BTC price in 2024. Traders expect the pattern to repeat with Dogecoin and await a Spot ETF approval in DOGE. Three firms, Bitwise, Osprey Funds and Rex Shares, are keen on launching a Spot Dogecoin ETF, an anticipated catalyst for the meme coin.

At the time of writing, Dogecoin trades at $0.25618, with a market capitalization of $38.63 billion.

Why DOGE and not XRP could kick off altcoin season

XRP, the native token of the XRPLedger, awaits a recovery in its token and the three key market movers influencing the altcoin are Bitcoin’s price trend, US Securities and Exchange Commission’s (SEC) lawsuit against Ripple and an anticipated approval of the XRP Spot ETF in the United States.

While XRP is further from its goal of a Spot XRP ETF launch, Dogecoin is a step closer with no lawsuit in tow and three firms awaiting approval to launch the product for institutional investors in the US.

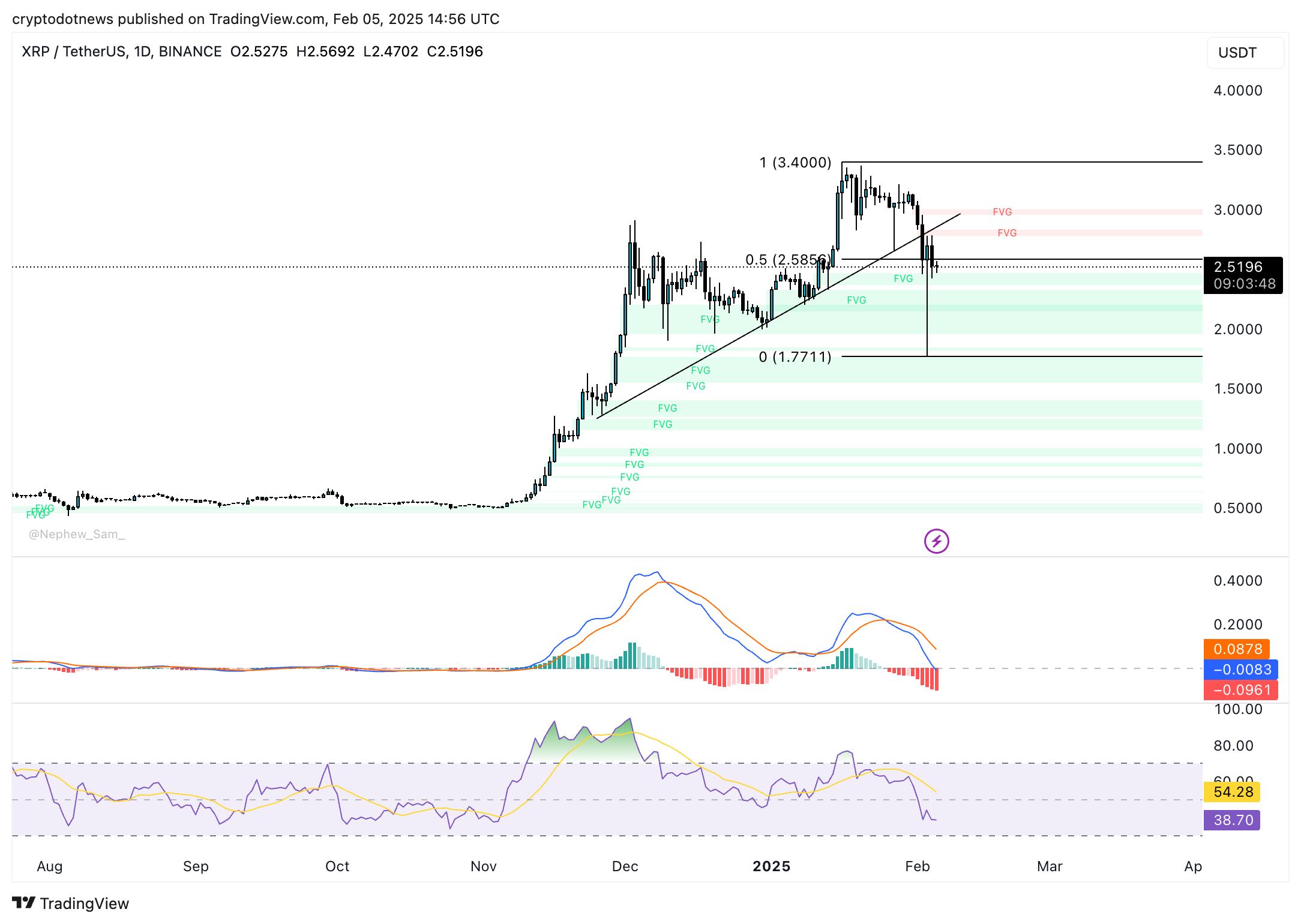

The XRP/USDT daily price chart shows signs of further deterioration in the altcoin. Relative Strength Index (RSI) reads 38 and is sloping downward and the Moving Average Convergence Divergence (MACD) indicator flashes red histogram bars under the neutral line, signaling a negative underlying momentum in the XRP price trend.

XRP could find support in the imbalance zone between $2.1491 and $2.3297, as seen on the daily price chart.

XRP/USDT daily price chart | Source: TradingView