Bitcoin Price Forecast: BTC edges below $100K as China hits back after US tariffs take effect

- Bitcoin price edges below $100,000 on Tuesday after recovering from a low of $91,231 the previous day.

- The US and China trade war can bring more volatility to risky assets like Bitcoin.

- Bybit’s CEO Ben Zhou suggests that the total liquidation on Monday may have been $8–$10 billion, far exceeding the reported $2 billion.

Bitcoin’s (BTC) price edges down nearly 3%, trading below $100,000 during the early European session on Tuesday after recovering from a low of $91,231 the previous day. The US-China trade war can bring more volatility to risky assets like Bitcoin. Moreover, Bybit’s CEO Ben Zhou suggests that the total liquidation on Monday may have been $8–$10 billion, far exceeding the reported $2 billion.

US-China trade war escalation may fuel volatility in Bitcoin

Bitcoin price faced a pullback in the early Asian trading session, reaching a low of $91,231, but quickly recovered its fall to close above $101,300 on Monday. The recent correction was fueled by the implementation of US President Donald Trump’s announced tariffs on major trading partners, including China, Canada and Mexico, on Saturday. This exerted some selling pressure on the overall crypto market. However, Bitcoin recovered this fall as US President Trump ordered the creation of a first-ever US sovereign wealth fund to serve as a tool for economic development on Monday. The new sovereign wealth fund order has stirred optimism among crypto community members, who have been speculating about adding Bitcoin to the fund.

Bitcoin is edging down 3% during the early European session at the time of writing on Tuesday. The markets might turn cautious later in the day as traders await developments surrounding tariff negotiations between the US and China.

FXStreet’s analyst Lallalit Srijandorn states, “China’s finance ministry on Tuesday announced a package of tariffs on a range of US products, including crude oil, farm equipment, and some autos, in an immediate response to a 10% tariff on Chinese imports announced by US President Donald Trump that went into effect at 05:01 GMT on Tuesday.”

The development surrounding trade tariff policies will be closely monitored. Economists say Trump’s tariffs are widely expected to push up US inflation, supporting the USD by keeping US interest rates higher for longer. These events could bring volatility to risky assets like Bitcoin, and traders should remain cautious accordingly.

Monday’s liquidations may have hit $8-$10 billion, surpassing reported value of $2 billion — says Bybit CEO Ben Zhou

Ben Zhou, CEO of Bybit exchange, posted on X on Monday, “Real total liquidation is a lot more than $2 billion; by my estimation, it should be at least around $8-10 billion.”

He further explained that Bybit’s 24-hour liquidation alone was $2.1 billion, compared to only around $333 million recorded on Coinglass. However, this is not all liquidations, as the API limitation has brought the numbers down.

I am afraid that today real total liquidation is a lot more than $2B, by my estimation it should be at least around $8-10b. FYI, Bybit 24hr liquidation alone was $2.1B, As you can see in below screenshot, Bybit 24hr liquidations recorded on Coinglass was around $333m, however,… https://t.co/4WLkPxTYF4 pic.twitter.com/woTOHQvNkt

— Ben Zhou (@benbybit) February 3, 2025

Despite the recent downfall in Bitcoin Coinshares, the report on Monday highlights some optimistic signs for the largest cryptocurrency by market capitalization.

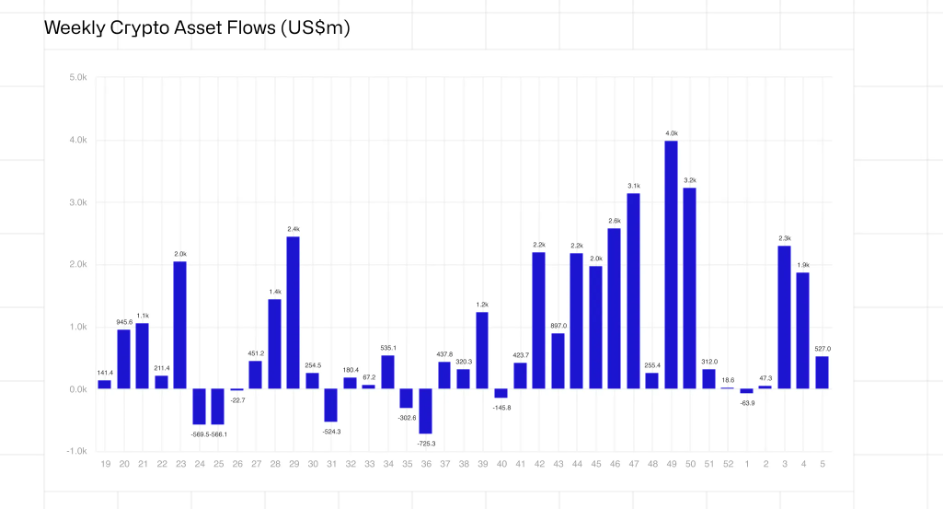

According to the report, digital asset investment products saw inflows totaling $527 million last week despite the trade tariffs and DeepSeek news influencing investors. Moreover, Bitcoin saw inflows totaling $486 million in the same period, while short-Bitcoin saw a second week of inflows totaling $3.7 million, as shown in the graph below.

Weekly crypto asset flow chart. Source: Coinshares

Bitcoin Price Forecast: BTC still has room for correction

Bitcoin’s price faced a pullback in the early Asian trading session, reaching a low of $91,231, but quickly recovered its fall to close above $101,300 on Monday. At the time of writing on Tuesday, it edges down by 3%, trading around $98,200.

If BTC continues its correction, it could extend the decline to test its psychologically important level of $90,000.

The Relative Strength Index (RSI) on the daily chart reads 44, after being rejected from below its neutral level of 50, and points downwards, indicating a strong bearish momentum. Moreover, the Moving Average Convergence Divergence (MACD) showed a bearish crossover on Friday, hinting at further correction ahead.

BTC/USDT daily chart

However, if BTC recovers and finds support around $100,000, it would extend the recovery to retest its Friday high of $106,012.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.