XRP update: Canada's Purpose Investments enters XRP ETF race, US firms yet to receive regulatory greenlight

- XRP ETF could debut in Canada as Purpose Investments submitted a prospectus with Canadian regulators, proposing to launch a spot XRP ETF.

- Purpose Investments aims to be the first firm to launch an XRP ETF while its US counterparts await acknowledgment from the SEC.

- XRP could find support near $2.62 if it breaks the lower boundary line of a descending channel.

XRP is down 3% on Saturday as asset manager Purpose Investments submitted a prospectus with Canada securities regulators to launch a Ripple (XRP) exchange-traded fund (ETF). The firm seeks to beat US companies — as the US Securities & Exchange Commission (SEC) is yet to respond to their filings — to launch the world's first spot XRP ETF.

XRP ETF receives traction as Canadian firm seeks to get ahead of US issuers

Canadian asset manager Purpose Investments has submitted a preliminary prospectus to Canada securities regulators for the proposed launch of a Purpose Ripple (XRP) ETF.

The firm stated that the Purpose Ripple ETF is designed to allocate the majority of its assets to long-term holdings of XRP to offer its holders the potential for sustained capital appreciation.

Purpose claims to be the first to introduce spot Bitcoin and Ethereum ETFs, which commenced trading on the Toronto Stock Exchange in February and April 2021, respectively.

The firm now seeks to build on its success by launching the world's first spot XRP ETF, according to a statement released on Thursday. Although XRP exchange-traded products (ETPs) already exist in other European countries.

"As XRP sees increasing adoption and institutional interest, we believe an ETF can offer investors a transparent and familiar way to access it within a regulated framework," said Som Seif, founder and CEO of Purpose Investments.

Purpose Investments' XRP ETF intentions follow that of US issuers, who await the Securities & Exchange Commission's (SEC) response on their XRP ETF filings.

Although US-based firms were the first to file, Canada's regulatory framework typically allows for faster ETF approvals than their US counterpart, especially that of cryptocurrency ETFs. Hence, the Purpose XRP ETF could debut before that of US issuers.

Five US asset managers, including Grayscale, Bitwise, Canary Capital, WisdomTree and 21Shares, have all filed for an XRP ETF with the SEC.

Additionally, Polymarket data revealed that the odds for an XRP ETF approval in the US increased to 82%, signaling heightened expectation for the SEC to begin acknowledging the filings.

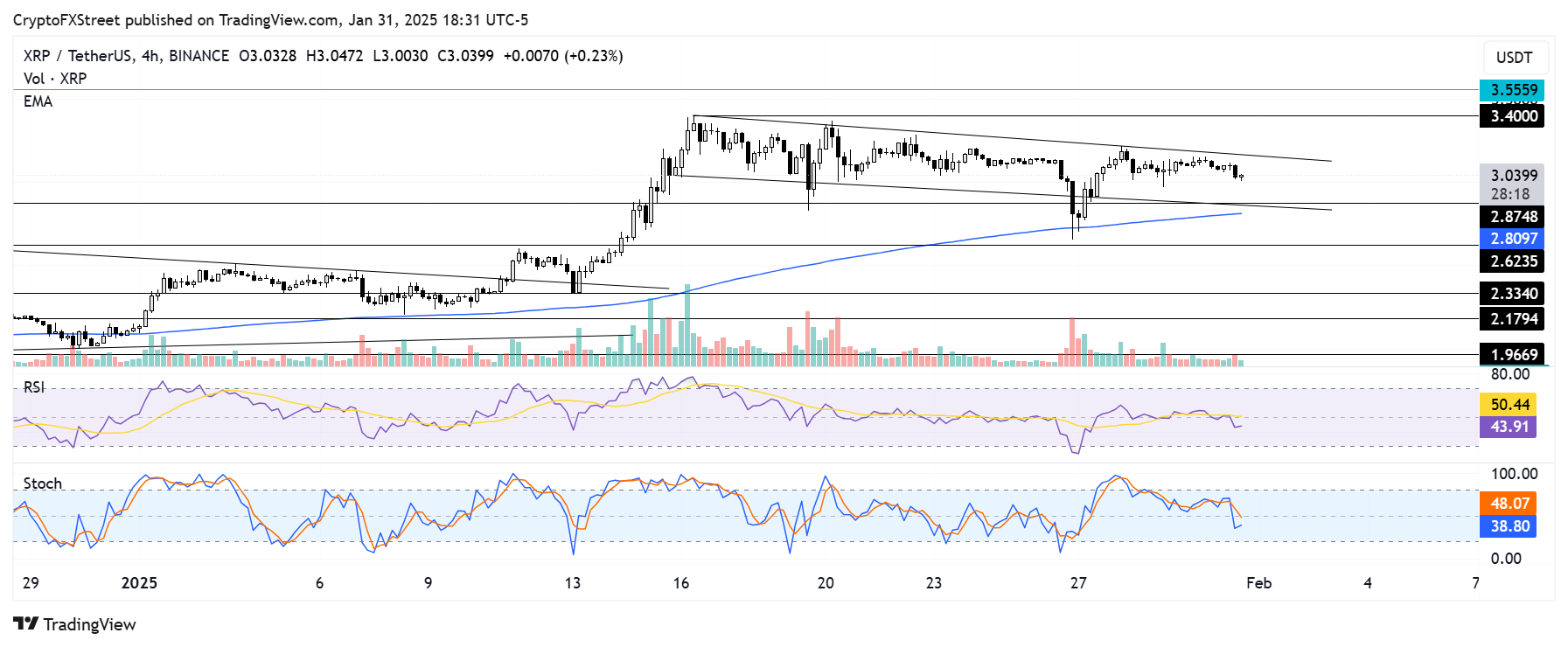

XRP could find support near $2.62 if it declines below descending channel

XRP continued consolidating on Friday, with its price slightly tilted toward the downside. The remittance-based token is following a developing descending channel extending from January 15.

XRP/USDT 4-hour chart

If XRP fails to hold the channel's lower boundary line, it could find support near $2.62. However, if XRP sustains a move above the channel's upper boundary line and holds it as a support, it could rally to test its all-time high resistance at $3.55.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating dominant bearish momentum.

A daily candlestick close below $2.33 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.