Bitcoin Price Forecast: BTC holds above $105,000 amid US macroeconomic data release

- Bitcoin price holds above $105,000 on Thursday despite the Fed’s decision to halt interest rate cuts in the US the previous day.

- Glassnode reports that BTC’s bull cycle mirrors 2015–2018, with room for further euphoria-driven growth.

- The upcoming US macroeconomic data release on Thursday could bring volatility to Bitcoin.

Bitcoin (BTC) holds above $105,000 at the time of writing on Thursday despite the Federal Reserve’s (Fed) decision to halt interest rate cuts in the United States (US) the previous day. Traders should watch the upcoming United States (US) Gross Domestic Product (GDP) for the fourth quarter of 2024 data release on Thursday, which could bring volatility to Bitcoin. Glassnode reports that BTC’s bull cycle mirrors 2015–2018, with room for further euphoria-driven growth.

Bitcoin holds above $105,000 despite Fed’s halts interest rate cuts in US

Bitcoin’s price continues to rise, trading above $105,000 on Thursday after rising slightly following Wednesday’s Federal Open Market Committee (FOMC) meeting. As widely expected, the US Federal Reserve (Fed) decided to keep the fed funds rate unchanged at the 4.25%—4.50% range while shifting slightly hawkish after acknowledging no improvement in inflation.

The Federal Reserve’s monetary policy statement highlighted a resilient labor market while maintaining that risks to its dual mandate goals “are roughly in balance.” The committee also hinted at an uncertainty of future rate cuts due to ongoing policy changes in the US.

Following the announcement, US Treasury yields rose, with the 10-year note gaining 4.5 basis points to 4.581%. At the same time, the US Dollar Index (DXY) climbed 0.17% to a session high of 108.10 despite Bitcoin’s 2.37% surge on Wednesday; the Fed’s decision to pause interest rate cuts could signal a bearish long-term outlook for the crypto market.

Moreover, investors should closely monitor the US Bureau of Economic Analysis (BEA), which will release its preliminary estimate of the US Gross Domestic Product for the October-December quarter on Thursday.

“The current release is a bit tricky, as the Fed announced its monetary policy decision to keep interest rates on hold ahead of GDP and PCE updates, and financial markets are still digesting the latest on that front,” says the FXStreet team in a post.

A better-than-anticipated GDP headline could support the Fed’s hawkish stance and the US Dollar (USD) while weighing on risky assets like Bitcoin. However, discouraging figures could have the opposite effect on the US Dollar and cryptocurrencies.

Bitcoin’s current bull market mirrors the 2015–2018 cycle

Glassnode’s “Thinking Ahead” report on Wednesday highlights that the current bull market shows several structural similarities to the 2015–2018 cycle.

The report explains that Bitcoin’s rally reflects a maturing market with reduced overall cyclical growth, measured bull market drawdowns, and moderated Realized Cap expansion.

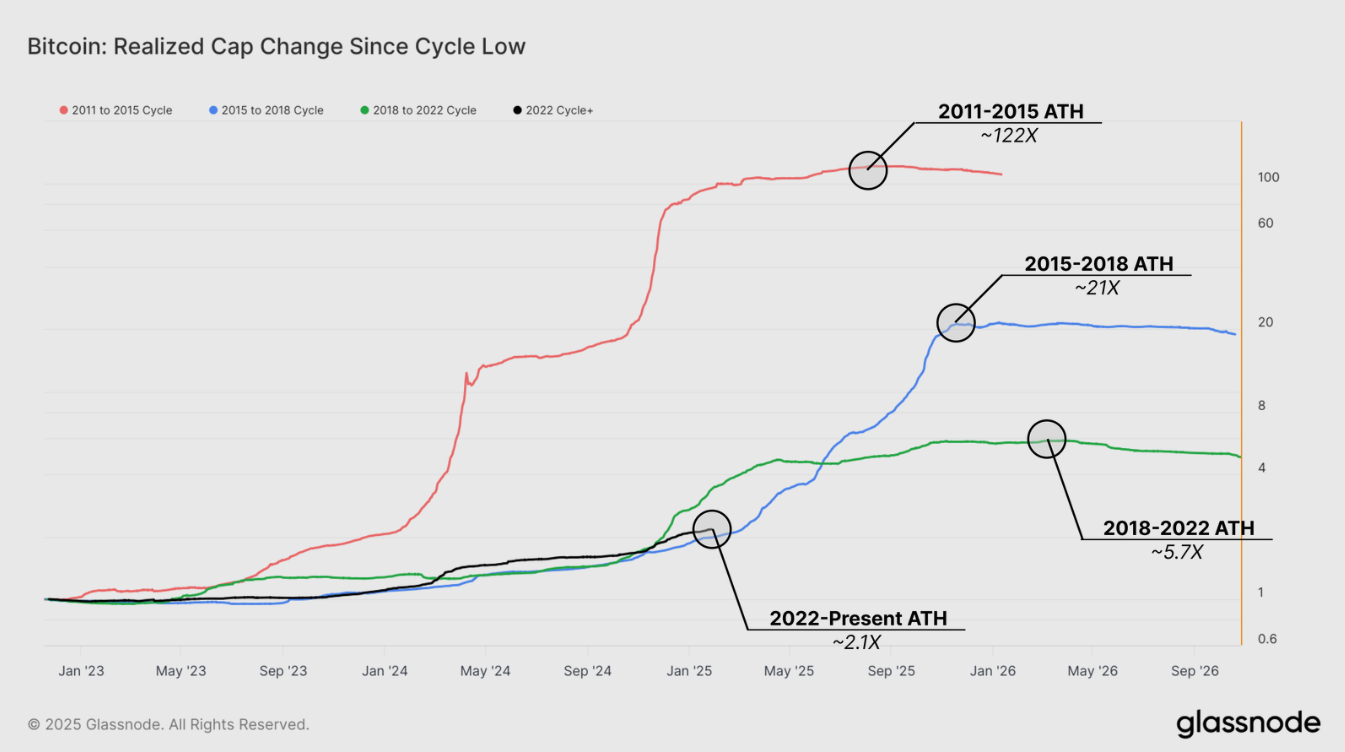

Although lower than prior peaks, as shown in the graph below, the current cycle’s 2.1 times Realized Cap growth is below the 5.7 times peak of the last cycle. It aligns with the 2015–2018 cycle at this stage, leaving room for potential euphoria-driven expansion in the longer term.

Bitcoin Realize Cap change since cycle low chart. Source: Glassnode

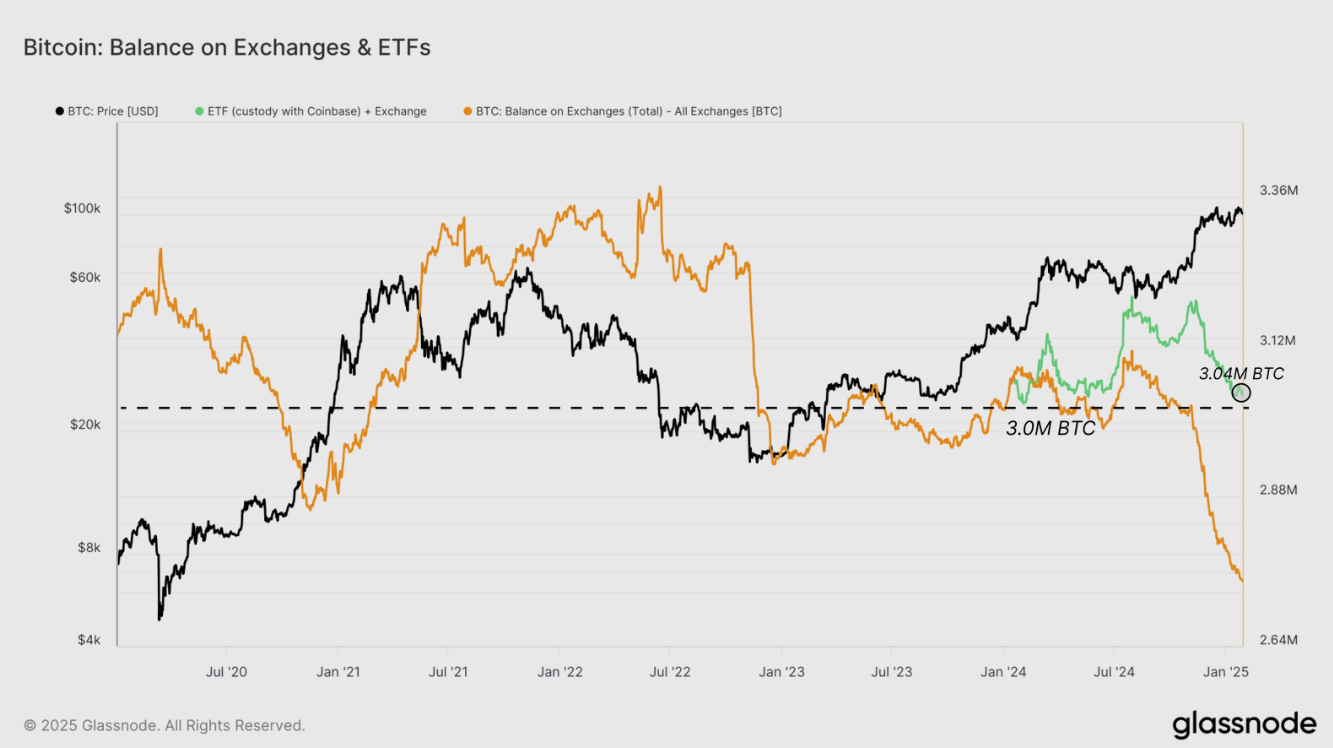

The report states, “The widely discussed drop in exchange balances does not signal a drastic depletion when accounting for the supply migration to ETF wallets. Therefore, the notion of an imminent supply shock due to declining exchange balances is inaccurate.”

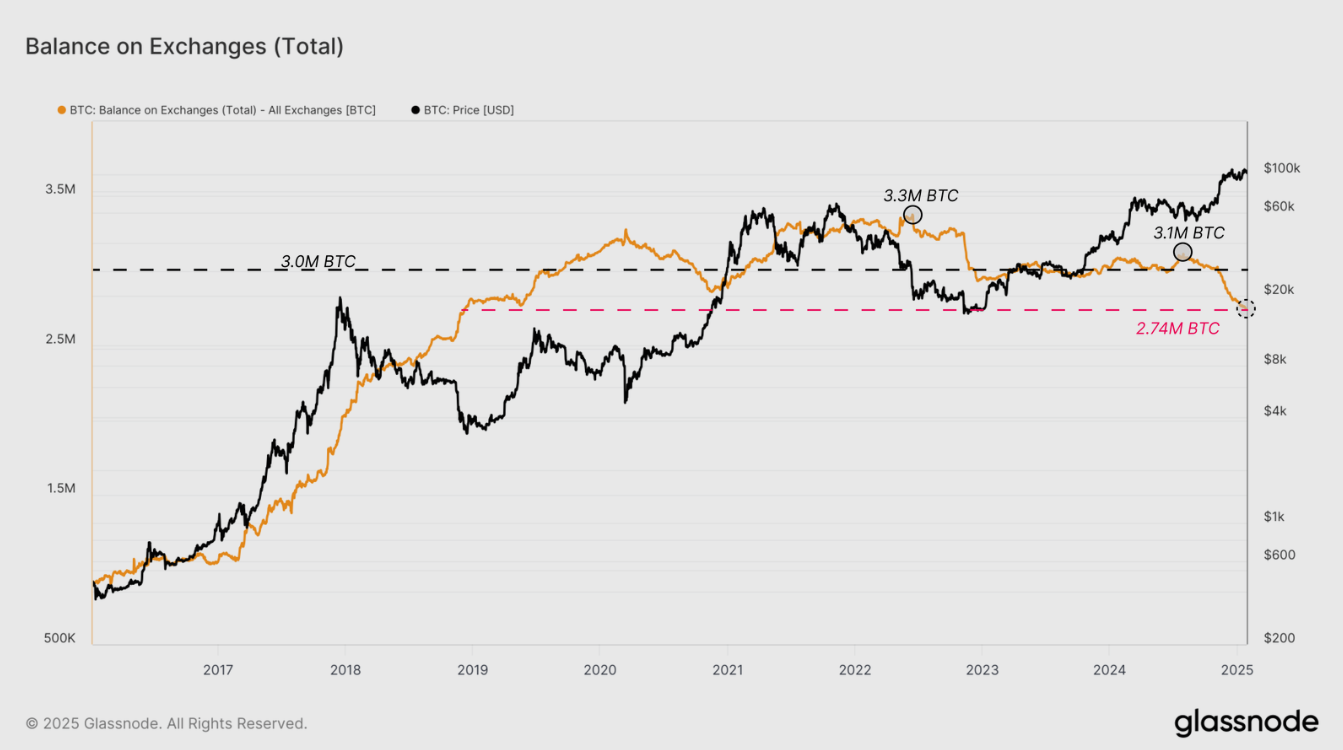

The graph below shows that Bitcoin balances on centralized exchanges have fallen to 2.7 million BTC, down from 3.1 million BTC in July 2024. While many interpret this as a form of supply shock caused by a mass withdrawal of coins by individual investors — potentially creating upward price pressure — the report explains that most of this decline stems from coins reshuffling into Exchange Traded Fund (ETF) wallets managed by custodians like Coinbase.

Balance on Exchanges (Total) chart. Source: Glassnode

Instead, capital rotation from long-term holders to new investors remains the primary driver of market cycles. Following two distribution waves, the current cycle’s wealth rotation size and rate mirror the late 2017 and early 2021 bull markets. This suggests a demand exhaustion phase may follow in the short term, potentially leading to a predominant HODLing sentiment in the market.

Bitcoin: Balance on Exchanges & ETFs chart. Source: Glassnode

Bitcoin Price Forecast: BTC aims for higher highs

Bitcoin price found support around its 50-day Exponential Moving Average (EMA) at $98,633 on Monday and rose 2.37% on Wednesday, closing above $103,700 on that day. At the time of writing on Thursday, it continues to trade higher around $105,400.

If BTC continues recovering, it could retest its January 20 all-time high of $109,588.

The Relative Strength Index (RSI) indicator on the daily chart reads 60, rebounding above its neutral level of 50 on Tuesday and signaling a rise in bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator is converging. If the MACD flips to a bullish crossover on a daily basis, it would give a buy signal and suggest an uptrend.

BTC/USDT daily chart

However, if BTC breaks below $100,000 and closes below the 50-day EMA on a daily basis, it could extend the decline and test its next key support around $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.