Ethereum Price Forecast: ETH could rally 35% as investors anticipate a historically positive February

Ethereum price today: $3,120

- Ethereum has posted more positive returns in February than in any other month.

- Daily active addresses on Ethereum surged to a yearly high above 588,000.

- Ethereum could pull off a 35% rally if it breaks the upper boundary resistance of a falling wedge pattern.

Ethereum (ETH) is trading around $3,100 on Wednesday, with indications that investors might be positioning for a potential rally in February. From a technical perspective, ETH could rise by 35% if it achieves a high-volume move above the resistance level of a falling wedge pattern.

Ethereum could resume its uptrend in February

Ethereum is on track to end January for the second consecutive year with negative returns due to heightened negative sentiments surrounding the Ethereum Foundation and a wider choppy crypto market.

However, February could bring attention back to ETH as it has recorded more positive returns for the top altcoin than any other month.

ETH's only negative return in February dates back to the crypto market crash of 2018 that began in the month. Since then, ETH has consistently seen positive returns in the month, experiencing a 46.28% gain in February 2024.

On average, ETH has returned 17.13% in February, historically making it its second-best performing month.

Ethereum Monthly Returns. Source: Coinglass

If history repeats, ETH could begin an uptrend in the next few days or weeks.

On-chain data indicates investors may be positioning for the February move with United States (US) President Donald Trump's decentralized finance (DeFi) platform increasing its Ethereum holdings to $250 million worth of ETH and staked ETH in the past days, per Arkham data. The platform is also expanding its holdings in the Ethereum DeFi landscape with AAVE, LINK and ENA purchases.

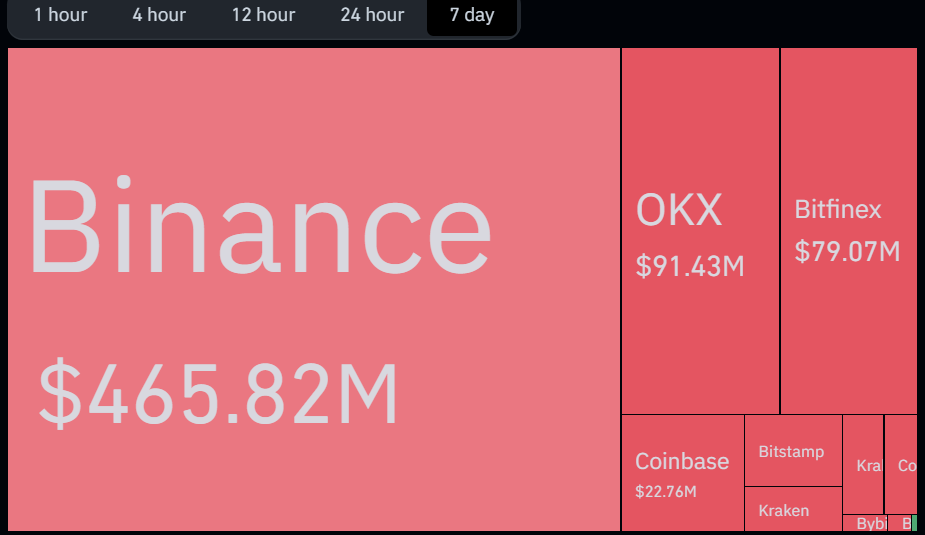

Ethereum exchange net flows also suggest that investors show a buy-side bias with increasing net ETH withdrawals across most top exchanges in the past week. This indicates that more investors are buying than selling ETH through crypto exchanges.

ETH Exchange Net Flows. Source: Coinglass

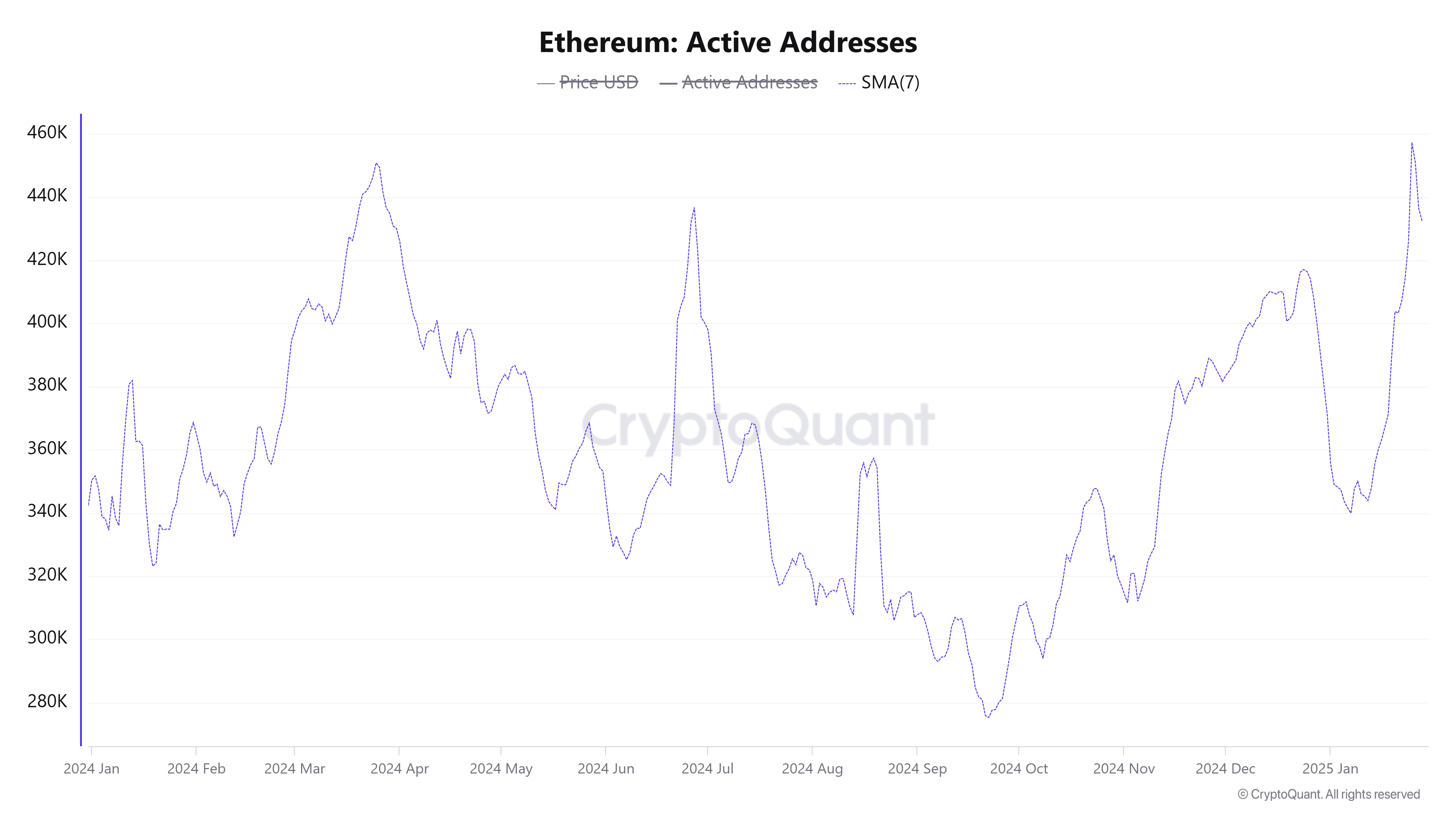

Furthermore, Ethereum's daily active addresses (DAA) suggest a bullish outlook, rising to a one-year high of 588,782 on Saturday. The seven-day moving average of the DAA also reached a new yearly high, signaling rising user interest.

Ethereum Daily Active Addresses (7DMA). Source: CryptoQuant

Meanwhile, Ethereum exchange-traded funds (ETFs) recorded a net outflow of $136.20 million on Tuesday, according to Coinglass data.

Ethereum Price Forecast: Can ETH pull off a 35% rally?

Ethereum experienced $67 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $32.48 million and $34.52 million, respectively.

ETH is currently trading within a falling wedge pattern. This pattern is characterized by an upper boundary descending trend line that connects lower highs and a lower boundary line that connects lower lows. The falling wedge pattern is considered bullish as it indicates that a downtrend is losing momentum.

ETH/USDT daily chart

If ETH breaks above the wedge's upper boundary resistance and establishes it as support, it could rally 35% above its three-year high resistance at $4,100. It's important to note that the $4,100 resistance could be difficult to overcome as it was a key sell zone in 2024, indicating strong selling pressure at this level. ETH also faces key resistances near $3,550 and $3,770.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are currently below their neutral levels, indicating dominant bearish momentum in the market.

On the other hand, the Stochastic Oscillator (Stoch) has retreated from the oversold region, signaling a potential reversal in the bearish trend. These indicators provide valuable insights into the current market sentiment and potential price movements.

On the downside, if ETH breaches the support zone between $2,800 and $3,000, it could invalidate the thesis and spark a 25% decline.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.