Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP momentum indicators hint at correction

- Bitcoin price is nearing its key support of $100,000; a firm close below would lead to a dip to the $90K mark.

- Ethereum price approaches its 200-day EMA at $3,136; a firm close below would lead to a correction.

- Ripple price is sliding toward its ascending trendline support; a close below would lead to a decline.

Bitcoin (BTC) and Ethereum (ETH) are approaching their crucial support levels on Monday; a firm close below would lead to a correction. Ripple (XRP) price follows BTC and ETH as it nears its ascending trendline; a close below would lead to a pullback ahead.

Bitcoin bulls show signs of exhaustion

Bitcoin price reached a new all-time high of $109,588 last week but failed to maintain its upward momentum. BTC started declining slightly since Saturday and fell 2.22% until Sunday. At the time of writing on Monday, it continues to trade down, approaching its key support level of around $100,000.

If BTC closes below the $100,000 level, it could extend the decline to test its next key support around $90,000.

The Relative Strength Index (RSI) indicator on the daily chart reads 51, slightly above its neutral level of 50; however, it points downwards, indicating a weakness in bullish momentum. The Moving Average Convergence Divergence (MACD) indicator is also converging. If the MACD flips to a bearish crossover on a daily basis, it would give sell signals and suggest a downtrend.

BTC/USDT daily chart

However, if the $100K support level holds, it would extend the recovery to retest its Monday’s ATH of $109,588.

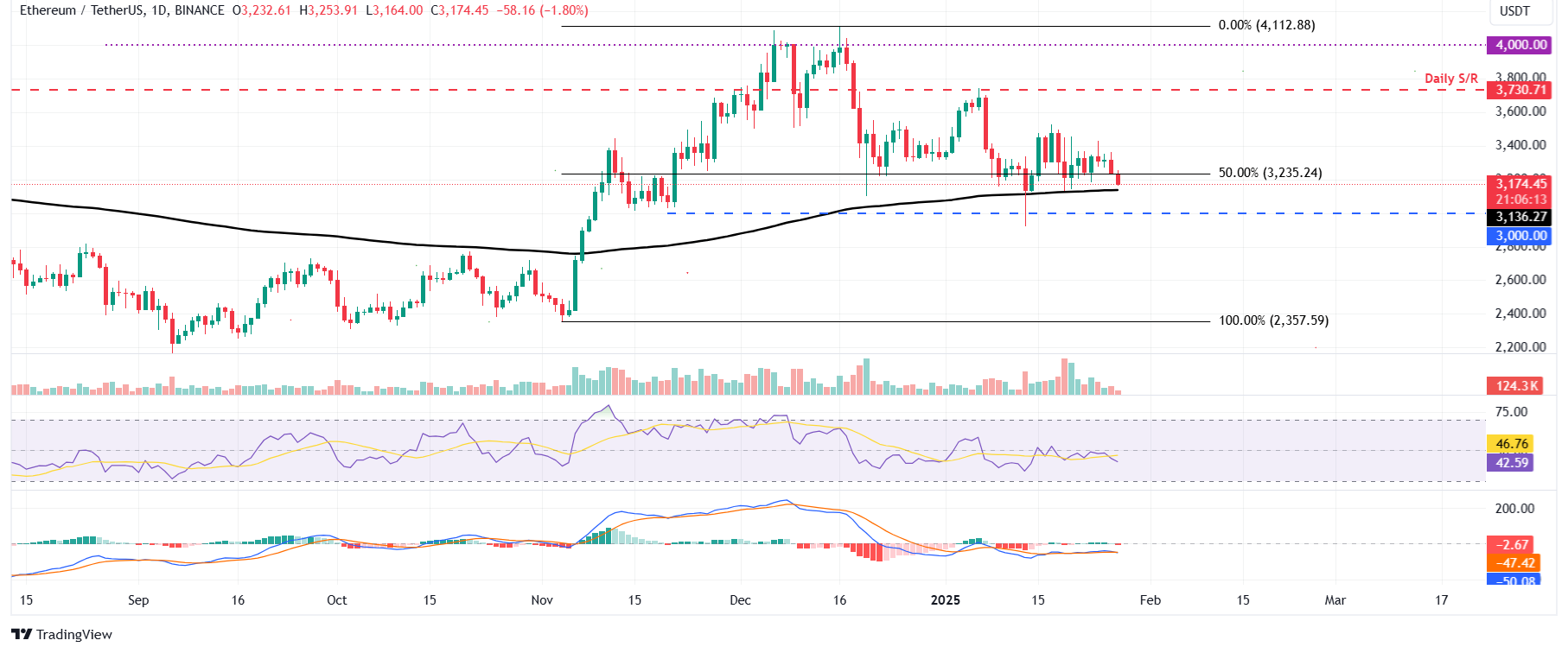

Ethereum is poised for a downleg if it closes below the 200-day EMA

Ethereum bulls were retested, and support was found around its 200-day Exponential Moving Average (EMA) at $3,136 the previous week. However, it declined by 2.6% on Sunday. It trades down at Monday’s start of this week, nearing its 200-day EMA at $3,136.

If ETH closes below the 200-day EMA at $3,136, it could extend the decline to test its psychological importance level of $3,000.

The RSI indicator on the daily chart reads 42, below its neutral level of 50, pointing downwards, indicating bearish momentum. The MACD indicator also shows a bearish crossover on Sunday, indicating a downward trend.

ETH/USDT daily chart

However, if the $3,136 EMA level is maintained, ETH could extend the recovery to test its daily resistance level at $3,730.

Ripple price is primed for a correction if it closes below its ascending trendline

Ripple price faced resistance around the $3.40 level last week. On Monday, it trades slightly down around $2.99, approaching its ascending trendline (drawn by connecting multiple low levels since early January).

If Ripple breaks and closes below $2.72, it could extend the decline to test its next daily support at $1.96.

The RSI indicator reads 57, above its neutral value of 50 and points downwards after rejection from its overbought level of 70 on January 18, indicating weakness in bullish momentum. Additionally, the MACD flipped a bearish crossover on Sunday, giving sell signals and suggesting a downtrend.

XRP/USDT daily chart

Conversely, if XRP continues its upward momentum, it could extend the rally to test its $3.40 resistance level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.