Bitcoin Price Forecast: BTC edges below $102K ahead of mid-tier US data and Trump’s tariff threats

- Bitcoin price continues to decline, trading below $102,000 on Thursday after falling 2.3% the previous day.

- BTC could expect volatility after the US weekly Initial Jobless Claims data release on Thursday.

- In a Bloomberg Live interview on Wednesday, BlackRock CEO Larry Fink said BTC could raise to $700,000.

Bitcoin’s (BTC) price continues to decline, trading below $102,000 at the time of writing on Thursday after falling 2.3% the previous day. Later in the day, BTC could expect volatility after the US weekly Initial Jobless Claims data release. In an interview with Bloomberg Live on Wednesday, BlackRock CEO Larry Fink said BTC could raise to $700,000.

Bitcoin investors await next fundamental catalyst – US weekly Initial Jobless Claims data

Bitcoin price edges slightly below $102,000 during Thursday’s early European trading session as investors await the next fundamental catalyst. The US economic calendar will feature weekly Initial Jobless Claims data for the week ending January 17, and the US Treasury will hold a 10-year Treasury Inflation-Protected Securities (TIPS) auction.

If the weekly Initial Jobless Claims data comes in lower than the forecasted value of 220K, it would signal that the US economy continues to perform well. This would allow the US Federal Reserve (Fed) to keep rates higher for longer, strengthening the US Dollar (USD) and weighing on risky assets such as stocks and Bitcoin. However, equities and risky assets like Bitcoin may rise if the data comes in higher than expected.

US President Donald Trump has threatened 25% tariff hikes on Canada and Mexico and 10% on China, which will come into effect on February 1. He also plans to impose tariffs on Europe after stating that the European Union would have to "pay a big price" for not buying enough American exports during his electoral campaign. Additionally, Trump threatened on Wednesday to impose “high levels” of sanctions on Russia and tariffs on imports from there if President Vladimir Putin did not reach a settlement to end its war against Ukraine, per CNBC.

Pablo Piovano, a Senior Analyst at FXStreet, posted on Thursday that “uncertainty around President Trump’s proposed trade tariffs adds another layer of complexity. Should these tariffs push US inflation higher, the Fed may need to maintain a hawkish stance, potentially strengthening the Greenback.”

A hawkish Fed often leads to higher interest rates, which makes US government bonds and other Dollar-denominated investments more attractive, thus making risky assets like Bitcoin less attractive.

BlackRock CEO Larry Fink says Bitcoin could go up to $700,000

According to a Bloomberg Live interview on Wednesday, BlackRock CEO Larry Fink stated that “if everyone adopted a 2% or 5% allocation, you could see Bitcoin Bitcoin to $500K… or even $700K.”

Fink believes it’s possible, especially if currency debasement or economic instability persists.

"This is one thing that will change Bloomberg even, I believe we are going to be in the cutting edge of tokenizing bonds and stocks," @BlackRock's Larry Fink discusses democratizing finance by tokenizing currencies. #BloombergHouse #WEF25

— Bloomberg Live (@BloombergLive) January 22, 2025

⏯️https://t.co/2Bkhd9oBzw pic.twitter.com/W1duDViagn

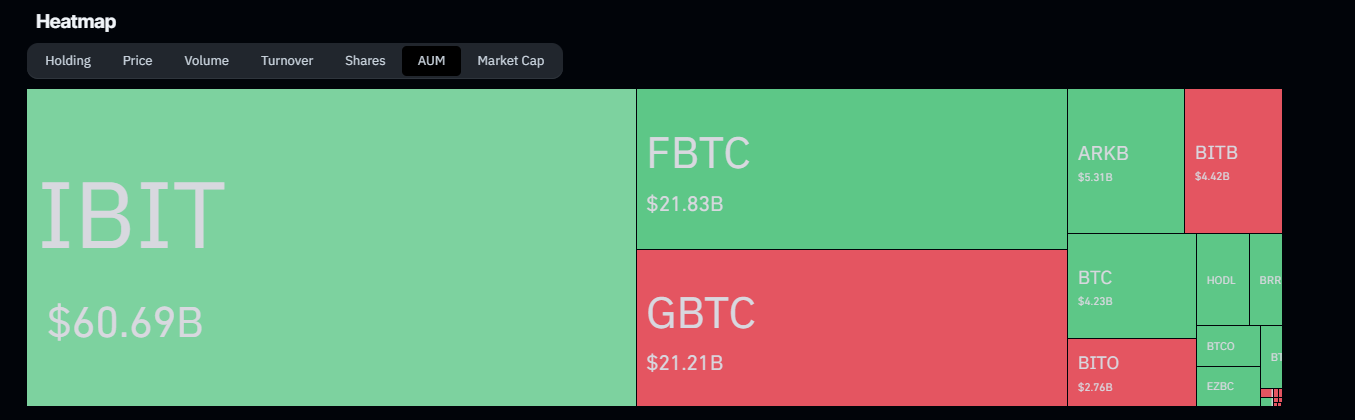

Coinglass Bitcoin spot Exchange Traded Funds (ETFs) data shows that out of the $125.09 billion of total Assets Under Management (AUM) in spot ETFs, BlackRock’s iShares Bitcoin Trust (IBIT) fund is the largest, holding $60.69 billion.

Bitcoin ETF heatmap. Source: Coinglass

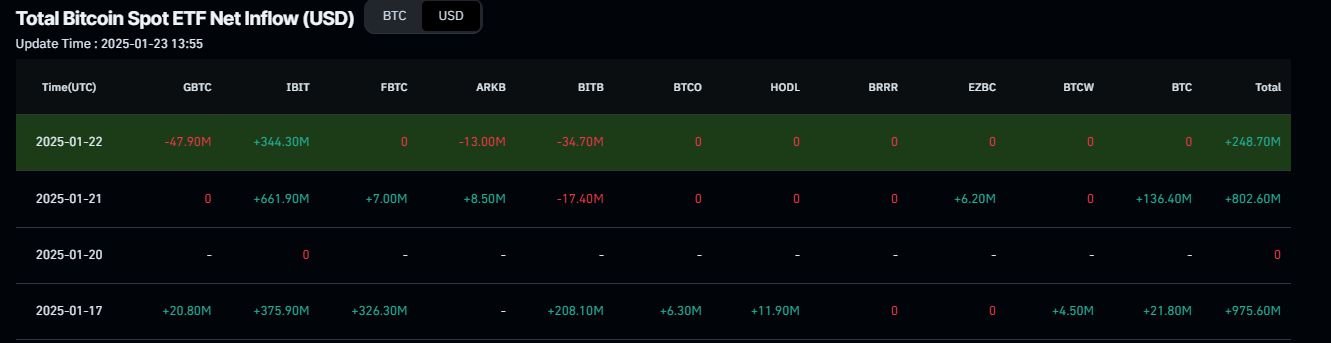

Additionally, Bitcoin spot ETF data recorded a $248.70 million inflow on Wednesday, marking two straight inflows this week. For Bitcoin’s price to continue its upward momentum, the magnitude of the ETF inflow must intensify.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

In an exclusive interview with Ruslan Lienkha, chief of markets at YouHodler, told FXStreet, “ETFs will exhibit a high correlation with the spot BTC market, as buying or selling a Bitcoin ETF

represents another mechanism for trading. Consequently, any inflows or outflows into or out of ETFs will directly mirror the broader dynamics of the spot market.”

Bitcoin Price Forecast: BTC exceed $109K or correct to $90K

Bitcoin’s price reached a new all-time high (ATH) of $109,588 on Monday but quickly slipped 6.68% and closed at $102,260. However, the next day, it found support around its key $100,000 level and rose 3.8%. On Wednesday, it could not sustain its rise and fell 2.3%, closing below $104,000. At the time of writing on Thursday, it continues to edge down around $101,480.

If the $100K support level holds and BTC breaks above its all-time-high, it could extend the rally above the $125K mark, calculated by the 141.40% Fibonacci extension level (drawn from the November 4 low of $66,835 to Monday’s ATH of $109,588) at $127,287.

The Relative Strength Index (RSI) indicator on the daily chart reads 55, above its neutral level of 50, indicating bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator flipped a bullish crossover on January 15, giving a buy signal and suggesting a continuation of an uptrend.

BTC/USDT daily chart

However, if BTC faces a pullback and closes below $100,000, it could extend the decline to retest its next support level at $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.