Upbit crypto exchange faces suspension in South Korea over alleged KYC violations

- South Korea’s Financial Services Commission (FSC) has issued a suspension notice to Upbit, the country’s largest crypto exchange.

- Authorities propose a six-month suspension on new user registrations, citing over 500,000 breaches in its client identification process.

- Upbit has until Monday to contest the allegations before the FSC issues its final decision on Tuesday.

Upbit, South Korea’s largest cryptocurrency exchange, is facing potential regulatory sanctions for alleged Know Your Customer (KYC) violations. The Financial Intelligence Unit (FIU) of South Korea’s Financial Services Commission (FSC) has issued a suspension notice to the exchange, sparking concerns across Asian crypto communities.

Upbit allegedly breaches KYC rules amid license review

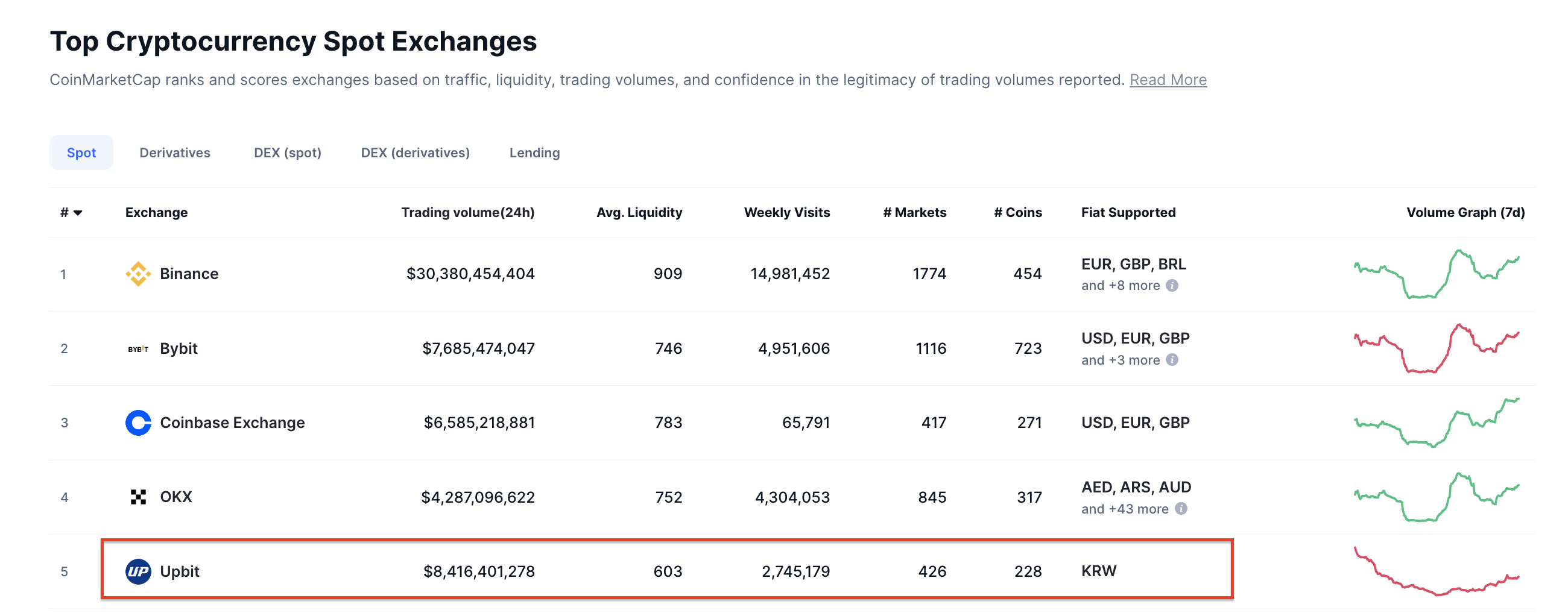

Founded in 2017, Upbit has grown to become the largest cryptocurrency exchange in South Korea and the fifth-largest globally, with daily trading volumes exceeding $8 billion.

However, in late 2024 South Korea’s FIU flagged the exchange for over 500,000 alleged KYC violations during a routine business license review, according to local sources.

Top 5 Cryptocurrency Exchanges Globally, January 2025 | Source: CoinMarketcap

Top 5 Cryptocurrency Exchanges Globally, January 2025 | Source: CoinMarketcap

The violations center around failures in client verification processes, critical under South Korea’s Special Financial Transactions Act.

This legislation mandates strict compliance to prevent money laundering and other financial crimes.

Upbit’s alleged breaches could result in penalties of up to 100 million Korean won ($68,600) per case, potentially totaling $34 billion.

The FIU has also accused Upbit of conducting transactions with unregistered cryptocurrency service providers, further compounding its compliance issues.

Potential impacts of Upbit exchange suspension on the South Korean crypto market

The FSC has proposed a six-month suspension on Upbit’s new user registrations as part of its regulatory measures.

Existing users would remain unaffected, ensuring continuity for the platform’s current customer base.

Upbit has until Monday to respond to the suspension notice. The FSC will review the exchange’s feedback before delivering its final decision on Tuesday.

As one of South Korea’s largest exchanges, Upbit plays a pivotal role in the nation’s crypto ecosystem.

A suspension could shift user activity to rival platforms, affecting liquidity and trading volumes in the region.

South Korea’s proactive approach to cryptocurrency regulation has set a high compliance standard.

The outcome of Upbit’s case could reinforce these standards, influencing future regulatory enforcement.

Crypto market participants in Asia are watching closely, as the decision could have broader implications for the global digital asset industry