Ethereum Price Forecast: Investors stay bullish with rising open interest and over 300K ETH withdrawals

Ethereum price today: $3,230

- Ethereum ETF's recent high outflows suggest investors may be de-risking or re-allocating capital to conservative strategies.

- However, sustained open interest growth and declining exchange reserves indicate otherwise, with a long-term bullish bias.

- Ethereum has to overcome the $3,550 resistance and key SMAs hurdle to resume a bullish trend.

Ethereum (ETH) is up 5% on Tuesday despite the increased outflows witnessed across its exchange-traded funds (ETFs). Meanwhile, the top altcoin could maintain a long-term bullish outlook as investors across the derivatives and spot market are leaning toward the buy side.

Ethereum ETFs disappoint, but derivatives and spot traders show optimism

Ethereum ETFs recorded a fourth consecutive day of net outflows on Monday, with investors shedding $39.40 million worth of ETH, per Coinglass data. In the past four days, over $354 million has flowed out of the funds following the crypto market decline.

"This pivot toward net selling could be tied to [...] large institutions and retail investors alike [...] de-risking amid uncertain market signals, potentially taking profits from previous gains or re-allocating capital to more conservative strategies," noted crypto analytics platform Amberdata. "Watching whether capital rotates into different crypto products — or sits on the sidelines — will be key to gauging how investors are positioning for the coming months."

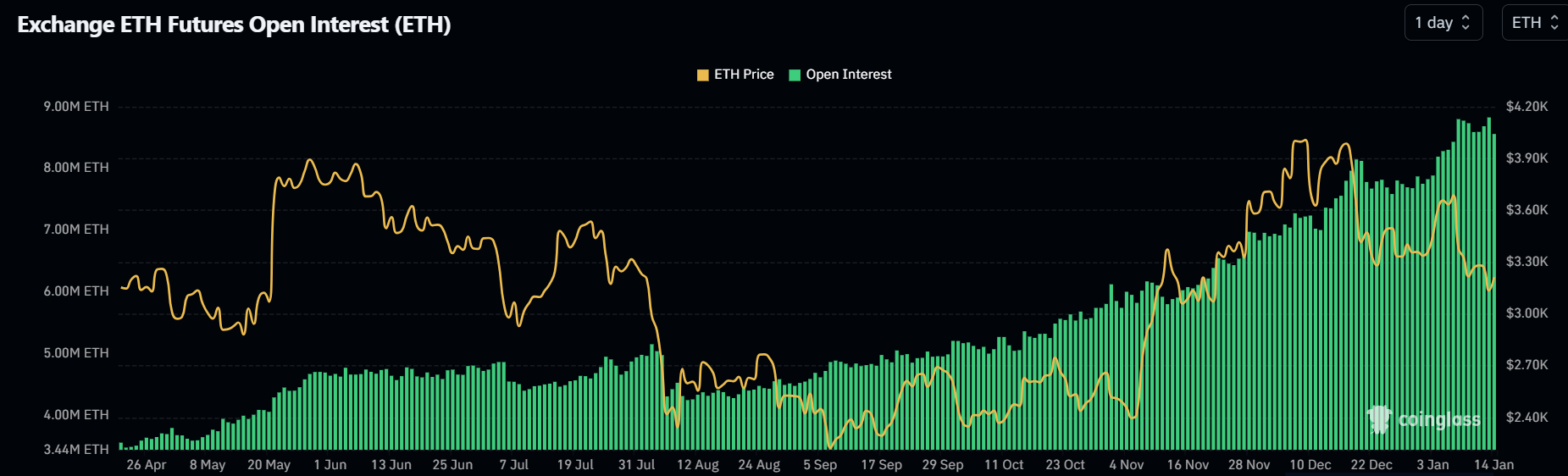

Despite the significant ETF outflows, Ethereum's open interest (OI) has remained at elevated levels, over 40% higher than when the market began rallying in November. The increased OI shows that derivatives traders are positioning for a potential ETH upside.

Open interest is the total amount of unsettled contracts in a derivatives market.

ETH Open Interest. Source: Coinglass

A similar trend is evident across the spot market, where Ethereum's exchange reserve has been trending downward. In the past week, investors have withdrawn over 300K ETH from exchanges to private wallets for potential long-term holding.

-638724870563980644.png)

Ethereum Exchange Reserve. Source CryptoQuant

The accumulation indicates that despite the dominant short-term bearish sentiment across the market, most investors are still bullish on the long-term prospects of ETH in the current market cycle.

Ethereum Price Forecast: ETH has to overcome $3,550 resistance to resume bullish trend

Ethereum has sustained $65.17 million in futures liquidations in the past 24 hours, with liquidated long and short positions accounting for $11.55 million and $53.61 million, respectively, per Coinglass data.

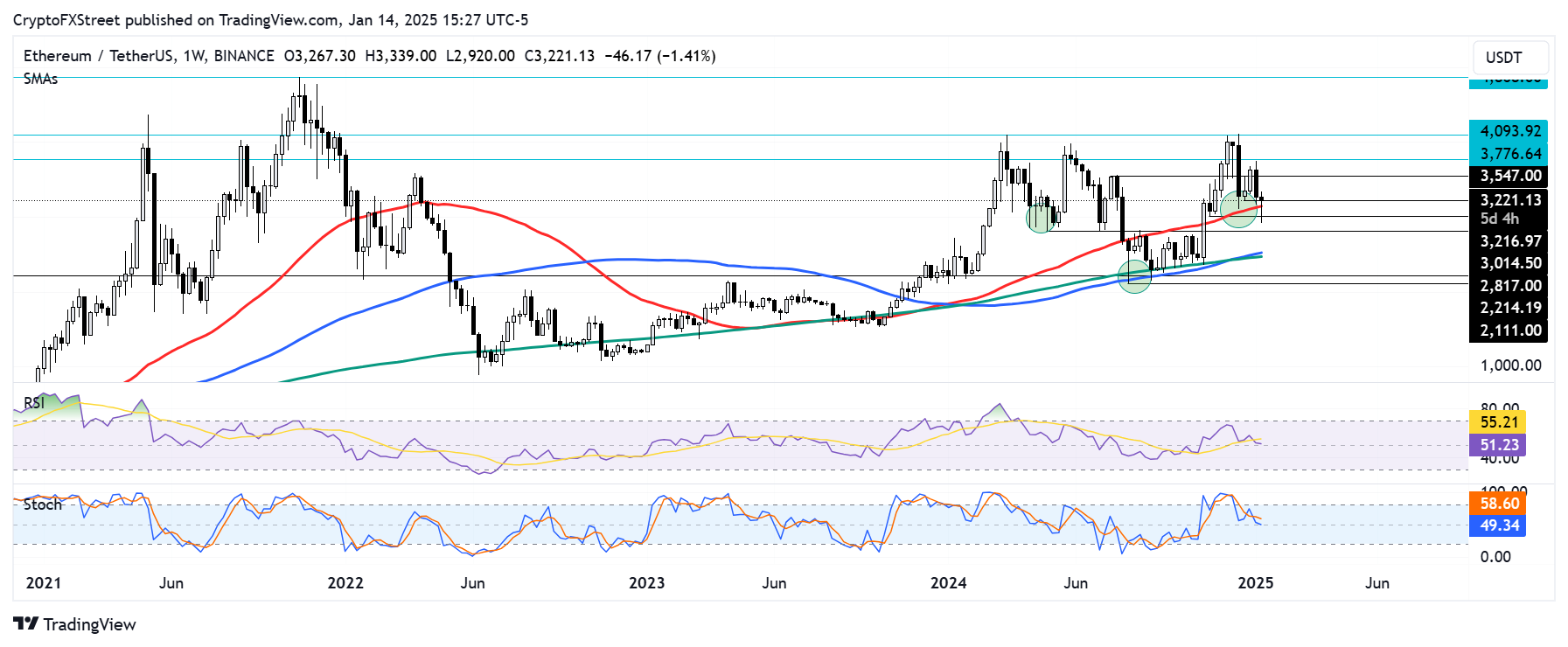

After finding support near the $3,000 psychological level, Ethereum is struggling to reclaim the $3,216 level. An exended move above this level will see ETH face a key resistance near $3,550. This resistance is strengthened by the 50-day, 100-day and 200-day Simple Moving Averages (SMAs), which are just below it.

ETH/USDT 8-hour chart

If ETH fails to see a rejection near these key hurdles, it could smash the $3,776 resistance and retest the major resistance level of $4,093 — its highest price in 2024. However, a failure to establish a firm move above $3,216 could send ETH back to the $3,000 psychological level.

Meanwhile, ETH still maintains a slightly bullish outlook on the weekly chart, with the $3,000 support holding firm. The recent decline could help establish the right shoulder of an inverse Head-and-Shoulders (H&S) pattern. However, a breach of the $2,817 key support level will invalidate the pattern.

ETH/USDT weekly chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are testing their neutral level lines. Crosses below their neutral levels could strengthen the bearish momentum.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.