Ripple Price Annual Forecast: Can XRP ride the bullish wave to new highs in 2025?

- XRP gained over 250% so far in 2024 following Donald Trump's election victory and SEC Chair Gary Gensler's resignation.

- The SEC's appeal in its case against Ripple and the potential XRP ETF launch are key factors that could determine XRP's performance in 2025.

- Technically, XRP could hit a new all-time high near $4.75 if the crypto market's bullish sentiment extends into 2025.

Ripple (XRP) extended its consolidation pattern – which dates back to a sharp decline it witnessed in May 2021 – within the first 10 months of 2024. Despite Judge Analisa Torres's final ruling in August, which gave XRP a major victory in its case with the United States Securities and Exchange Commission (SEC), prices remained mum until November.

However, with tailwinds from crypto-friendly candidate Donald Trump's presidential election victory and SEC Chair Gensler's resignation, XRP broke out of its more than three-year consolidation.

Between November and December, XRP surged over 450% to reach a high of $2.90 on December 3, benefiting from the bullish sentiment more than any other top crypto asset. The rise pushed XRP's market cap above $150 billion, making it the third-largest cryptocurrency, ahead of USDT, Solana, BNB and Dogecoin.

XRP/USDT weekly chart

As we approach 2025, XRP looks set to ride the wave of its recent tailwinds toward reaching new highs and gaining an XRP Exchange-Traded Fund (ETF) approval. This move could spark massive institutional capital inflows into the remittance-based token.

SEC vs. Ripple four-year battle nears end

The regulatory battle between Ripple and the United States Securities & Exchange Commission has come a long way since the initial filing in 2020, when the regulator accused Ripple Labs of raising $1.3 billion from unregistered sales of its XRP token in 2013.

The case continued until 2023, when Judge Analisa Torres ruled that XRP sales to the public via exchanges do not constitute securities. This was considered a major win for the token and the crypto industry, which had been under serious scrutiny from the SEC.

In May 2024, the final submission deadline for the Remedies Phase arrived, marking a significant step toward resolution. Both parties submitted briefs opposing motions to seal documents.

The SEC sought nearly $2 billion in penalties for Ripple's institutional XRP sales, while Ripple argued for a mere $10 million fine, claiming their actions were compliant with regulations.

In August, the court ruled that Ripple would face a civil penalty of $125 million instead of the SEC's requested $2 billion. This ruling was seen as a momentary victory for Ripple, even as the crypto community anticipated an appeal from the regulator.

The ruling affirmed that XRP is not a security in most transactions but acknowledged some institutional sales as unregistered securities.

In October, the SEC filed an appeal against the August ruling. While the appeal does not contest the court's classification of XRP as a non-security in retail transactions, it focuses on institutional sales and personal transactions by Ripple executives Brad Garlinghouse and Chris Larsen.

Ripple responded swiftly with a cross-appeal that centred on four key issues, including whether an investment contract must be legally binding, contesting the classification of institutional XRP sales as securities based on the Howey Test, whether the SEC's vague guidance denied fair notice and challenging the validity of the injunction.

The SEC lost on all key points—that’s why they appealed. Today, Ripple filed a cross-appeal to ensure nothing’s left on the table, including the argument that there can’t be an "investment contract" without there being essential rights and obligations found in a contract.

— Stuart Alderoty (@s_alderoty) October 10, 2024

The appeal could extend the legal proceedings into 2025 and restrict the SEC from approving XRP ETF filings from asset managers.

XRP ETF could be the next crypto product to debut on Wall Street

Following the success of the spot Bitcoin ETFs after seeing approval in January, asset managers continued to look into launching ETFs for other top cryptocurrencies. As a result, Ethereum ETF joined Bitcoin in the crypto ETF league on July 23.

ETH ETFs' approval boosted asset managers' confidence as Bitwise filed for an XRP ETF on October 2. Just days after, asset manager Canary Capital followed with an S-1 filing on October 9, becoming the second firm to do so. By November 1, 21Shares joined the waiting list, filing an S-1 for its Core XRP Trust. Then came WisdomTree, which was among the first issuers of the spot Bitcoin ETF, filing for a WisdomTree XRP Fund on December 2.

Crypto community members initially viewed an XRP ETF approval as uncertain due to the SEC's efforts to appeal Judge Torres's final ruling.

However, the outcome of the 2024 US presidential election proved to be a game-changer in the country's crypto regulatory landscape.

Trump's return to the White House and Gensler's resignation fueled an XRP rally

The build-up to the 2024 presidential election was pivotal for the crypto industry, as the result would determine the regulatory outlook for digital assets over the next four years.

Donald Trump came out victorious with the backing of nearly all key players in the crypto industry after maintaining a pro-crypto stance throughout his campaign. Trump promised to provide a clear regulatory framework for crypto and fire Gary Gensler from his role as SEC Chair on his first day in office.

Following the election result, the entire crypto market began a massive rally. XRP also experienced quick price surges after it closed above the $1.00 psychological level for the first time since November 2021.

The gains could also be attributed to the relisting of XRP on major exchanges after the US presidential election, including Robinhood.

With the bullish momentum rising, the crypto industry took another win after SEC Chair Gensler announced on November 21 that he would resign from the agency by January 20.

This Thanksgiving, I'm thankful for... https://t.co/FHDPaRnRkU

— Brad Garlinghouse (@bgarlinghouse) November 21, 2024

The announcement pushed the price of XRP further higher, holding strong above $2 with an all-time high market cap of $154 billion on December 2.

XRP Market Cap. Source: CoinGecko

Donald Trump eventually nominated former SEC Commissioner Paul Atkins as Gensler's replacement.

Trump's presidential victory is considered the crypto industry's biggest win in 2024, particularly for Ripple, which suffered heavily from the Gensler-led SEC crackdown on digital asset firms.

What's new for Ripple? The RLUSD stablecoin

Ripple began developing its RLUSD dollar-denominated stablecoin in 2024 while battling with regulators.

Ripple first hinted at RLUSD in April 2024, positioning it as a competitor to established stablecoins like Tether's USDT and Circle's USDC.

RLUSD is designed to maintain a 1:1 price peg with the US Dollar and will be backed by US Dollar deposits, short-term Treasury bonds and other cash equivalents.

Ripple collaborated with several exchanges, including Uphold and Bitstamp, to ensure liquidity and support for the stablecoin's launch.

On December 10, Ripple secured approval from the New York Department of Financial Services (NYDFS) for its stablecoin launch.

RLUSD eventually went live on December 17, making Ripple a major player in the stablecoin market alongside Tether and Circle.

Ripple USD (RLUSD) is now live on global exchanges.

— Ripple (@Ripple) December 17, 2024

An enterprise-grade stablecoin built for everyone, $RLUSD combines fiat stability with blockchain efficiency:

➡️ Instant global payments, 24/7

➡️ Seamless on/off ramps

➡️ Access value in real-world assets.… pic.twitter.com/lJ43GdoDGR

Experts predictions for XRP in 2025

Eneko Knörr, cofounder and CEO of Stabolut, noted that XRP's large market cap and growing institutional interest will enable XRP ETFs to receive approval in 2025. He also expressed confidence that Ripple will be one of the biggest beneficiaries of the upcoming pro-crypto Trump administration, adding that RLUSD has a high chance of success. "Speculation is rife that Ripple, headquartered in the US, could be among the primary beneficiaries of this potential pro-crypto stance," Knörr told FXStreet in an exclusive interview.

Darren Franceschini, cofounder of Fideum, also made similar bullish remarks, stating that XRP ETFs could be launched by mid-2025 after the SEC's appeal in its case with Ripple is settled. "An ETF approval would likely attract a wave of institutional investors and could drive XRP's price to new heights," noted Franceschini. "Some experts are even speculating we might see it rally as high as $35 in the next year."

Ryan Lee, Bitget Research's Chief Analyst, expressed that RLUSD adoption could cement XRP's role in the broader financial ecosystem. "A stablecoin on the XRP Ledger could further strengthen XRP's utility and liquidity," Lee wrote to FXStreet. Despite the bullish sentiment surrounding prices, Lee cautioned that broader crypto market trends, especially Bitcoin's performance, are key factors that would affect XRP's price trajectory going into 2025.

James Davies, CEO of CVEX took a contrary approach, stating that Ripple isn’t totally transparent with its RLUSD reserve. “They need to declare what they hold, like Circle does, so we can understand how much utility the offering has,” said Davies.

XRP Fundamental Outlook 2025: Key on-chain metrics to monitor

XRP Total Amount of Holders

XRP added over 720,000 holders in 2024, growing to 5.71 million from 4.98 million in 2023. Notably, over 50% of these new holders came in the last quarter of the year, particularly after XRP's price spike in November. If XRP continues adding new holders in 2025 at the same pace, the buying pressure from these new investors could cause further price growth.

[16.30.53, 18 Dec, 2024]-638703290528556303.png)

Total Amount of XRP Holders. Source: Santiment

XRP MVRV Ratio and XRP 365-day MVRV Ratio

The Market Value to Realized Value (MVRV) Ratio measures the average profit or loss of all XRP investors.

XRP's MVRV Ratio shows that all investors are up on an average of 358% on their original investment. However, this is still below the peak of 430% seen in the 2021 bull market.

The 365-day MVRV Ratio shows that all investors who purchased XRP in the last 365 days have recorded average gains of 112%. XRP often sees a correction when this ratio hovers around 100%.

[16.49.38, 18 Dec, 2024]-638703291596375811.png)

XRP MVRV Ratio and XRP 365-day MVRV Ratio. Source: Santiment

However, the MVRV Long/Short Difference, which peaks at the top of bull cycles, is at 65% — still below levels seen in previous bull markets.

A cautious approach could prove beneficial as we enter into 2025 due to the significant gains investors are holding onto. While XRP looks set to benefit from the potential conclusion of its battle with the SEC and positive factors like its RLUSD stablecoin and a pro-crypto Trump administration, investors could panic if Fear, uncertainty, and doubt (FUD) impacts the crypto market. This could lead to heavy profit-taking, potentially causing a sharp drop in XRP's price.

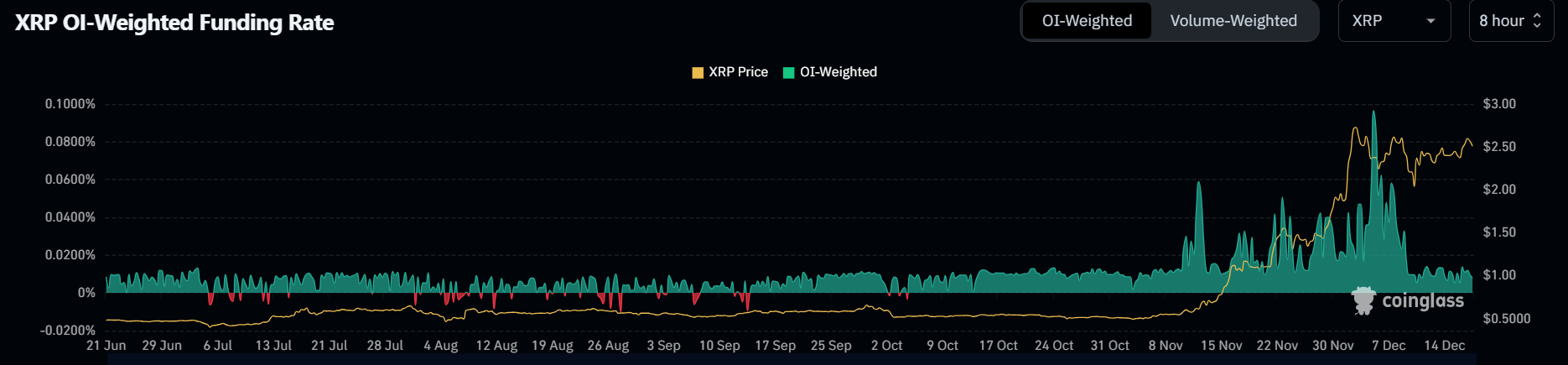

XRP Open Interest and Funding Rates

Open interest (OI) is the total number of outstanding contracts in a derivatives market. On the other hand, funding rates are periodic payments between long and short traders to keep the price of perpetual futures close to their spot market price.

XRP's OI reached an all-time high of $4.29 billion on December 3 before seeing a decline to $3.72 billion as of December 17 — a 400% increase from its $720 million OI in 2023. This shows that XRP is also seeing significant interest in the derivatives market.

XRP Open Interest. Source: Coinglass

Meanwhile, XRP saw a funding rate reset after surging to significant highs, dropping from 0.096% on December 3 to 0.011% on December 17. With prices maintaining an uptrend and funding rates at normal levels, XRP's derivatives market isn't overheated, leaving room for the remittance-based token to surge to new highs as we approach 2025. A similar funding rate pattern is evident in the general crypto market, meaning fewer headwinds in the derivatives market for now.

XRP Funding Rates. Source: Coinglass

XRP 2025 Technical Analysis: Bullish bias persists, yet continued overbought conditions pose risks

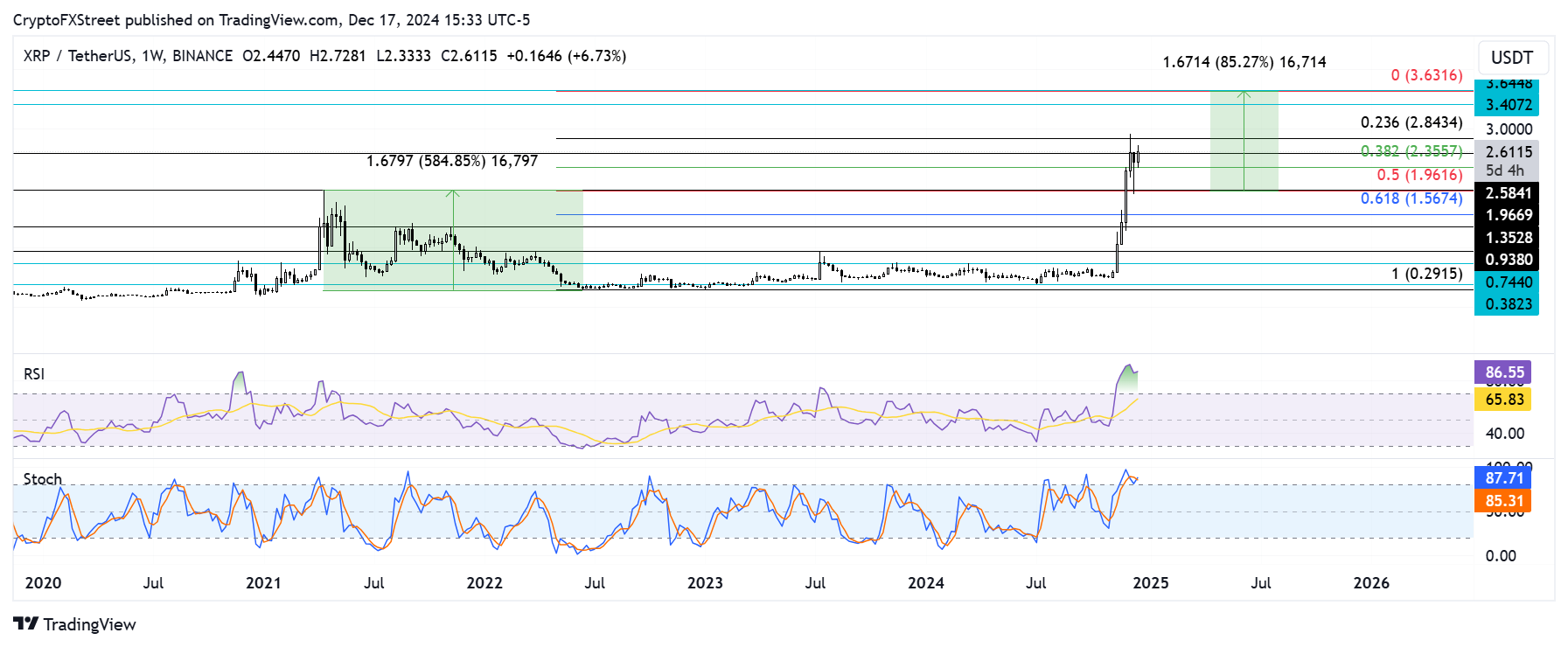

XRP broke out of a multi-year consolidation pattern after it surged above the $1.96 resistance in November. The measured height from the pattern’s lowest point to the breakout level indicates that XRP could rally to a new all-time high near the $3.64 level in the coming weeks. However, it could face selling pressure near its all-time high resistance at $3.55.

XRP/USDT weekly chart

Going into 2025, if XRP fails to overcome this resistance, investors could book profits and rotate into other altcoins. As a result, the Fibonacci retracement levels indicate that $2.84, $2.35 and $1.96 could serve as key support levels in such a scenario.

However, a potential XRP ETF approval could stretch the bull run across 2025.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) momentum indicators have been in the overbought region for over a month — at the highest levels since 2017. This signals that prices may be due for a major correction.

If the RSI and Stoch indicators cross below the overbought region and their neutral levels, XRP could witness heavy corrections and begin an extended downtrend.

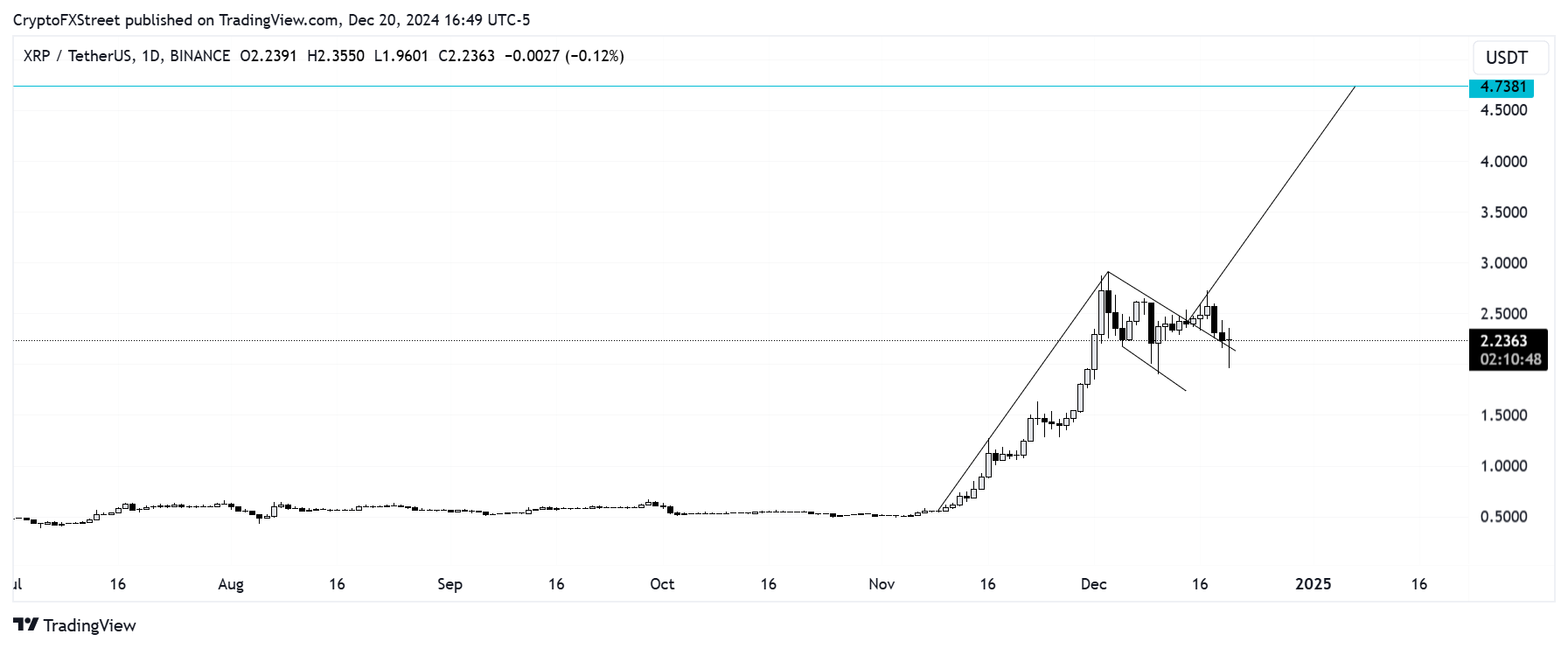

The daily chart presents an even more bullish view after XRP validated a bullish flag pattern by breaking above its upper boundary channel resistance.

XRP/USDT daily chart

If XRP holds this upper boundary channel line as a support, it could rally to target the $4.75 level – the measured height of the flagpole from its breakout point.

A weekly candlestick close below $1.96 will invalidate the bullish thesis.

Summary

Alongside Bitcoin, XRP surged 400% from the shadows to become the star of the show among top cryptocurrencies in the last two months of the year. The remittance-based token is poised for a promising 2025 as market participants anticipate the resolution of the SEC’s case against Ripple, adoption of the RLUSD stablecoin, and the potential launch of an XRP ETF.

An all-time high above $3.55 in the first quarter of 2025 seems likely, with bullish investors continually assessing key resistance levels. However, XRP could turn bearish if the overall bullish sentiment in the cryptocurrency market weakens.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.