Crypto Today: Traders bet on Fed cut as Bitcoin, XRP, Solana pull in $130B

- The cryptocurrency sector valuation grew by $12.5 billion as it advanced to a new all-time high of $3.73 trillion on Tuesday.

- While Bitcoin price hit a new all-time high of $108,135, Ethereum and Solana also scored considerable gains.

- Privacy-focused coins Monero and Litecoin also recorded major gains after the US authorities shut down a North Korean crypto laundering network.

Altcoin market updates: Solana, XRP, Litecoin emerge as top performers ahead of Fed decision

As the US Federal Open Market Committee (FOMC) kicked off its last meeting of the year on Tuesday, bullish traders placed last minute bets in anticipation of a third consecutive rate cut decision.

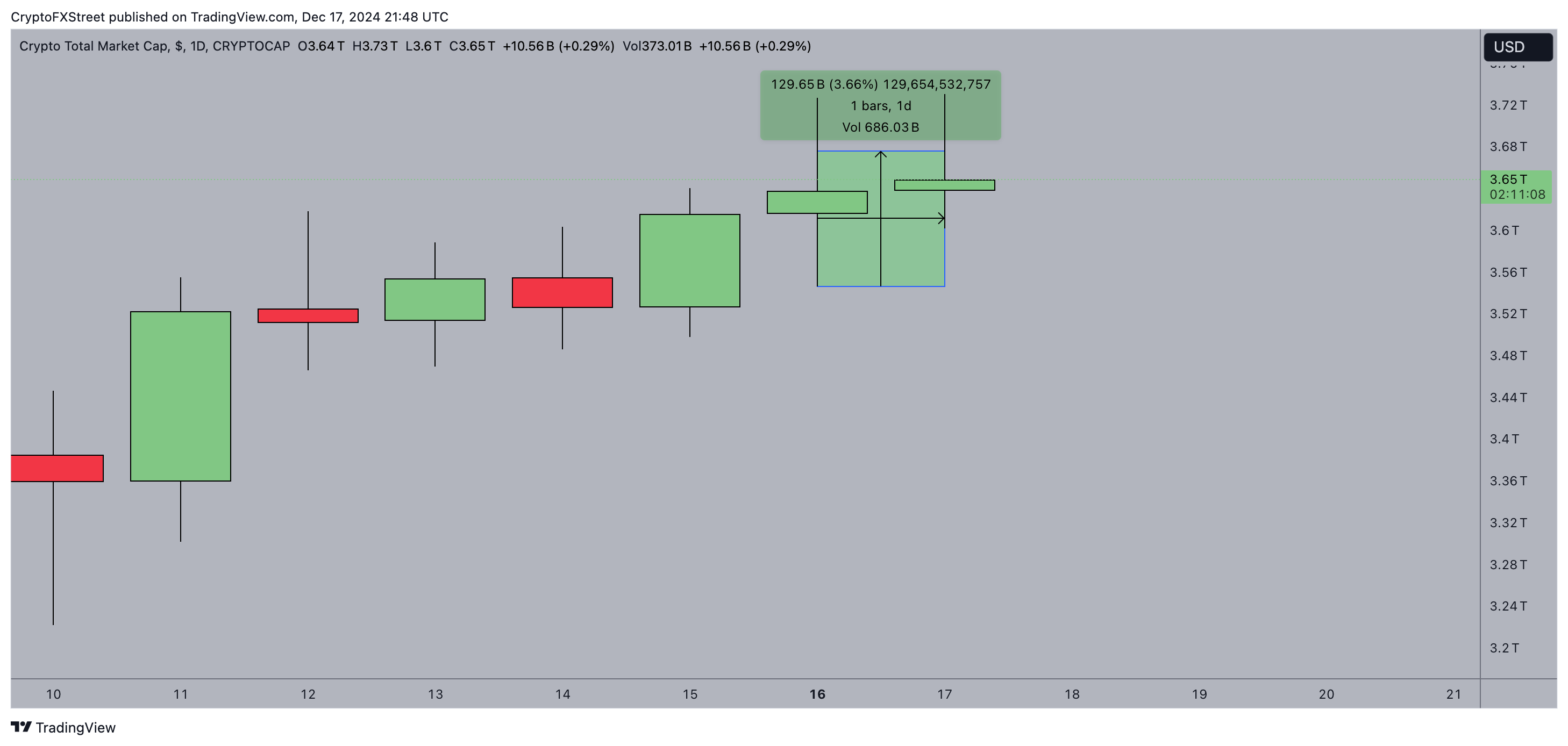

Crypto Market Capitalization, December 17

Crypto Market Capitalization, December 17

Amid the rapid capital inflows, the crypto sector grew 3.7%, adding nearly $130 billion to its global market capitalization on Tuesday.

- While Bitcoin (BTC) hit a new all-time high of $108,135, mega cap altcoins like Litecoin (LTC) and Solana (SOL) and Ripple (XRP) also scored considerable gains.

- Solana price surged 4% on Tuesday, propelled by the growing popularity of its latest memecoin fad, Fartcoin (FART), which crossed the $1 billion market cap on Tuesday.

- On Monday, the US Department of the Treasury's Office of Foreign Assets Control (OFAC) sanctioned seven corporate entities linked to providing financial and military support to the Democratic People's Republic of Korea (DPRK).

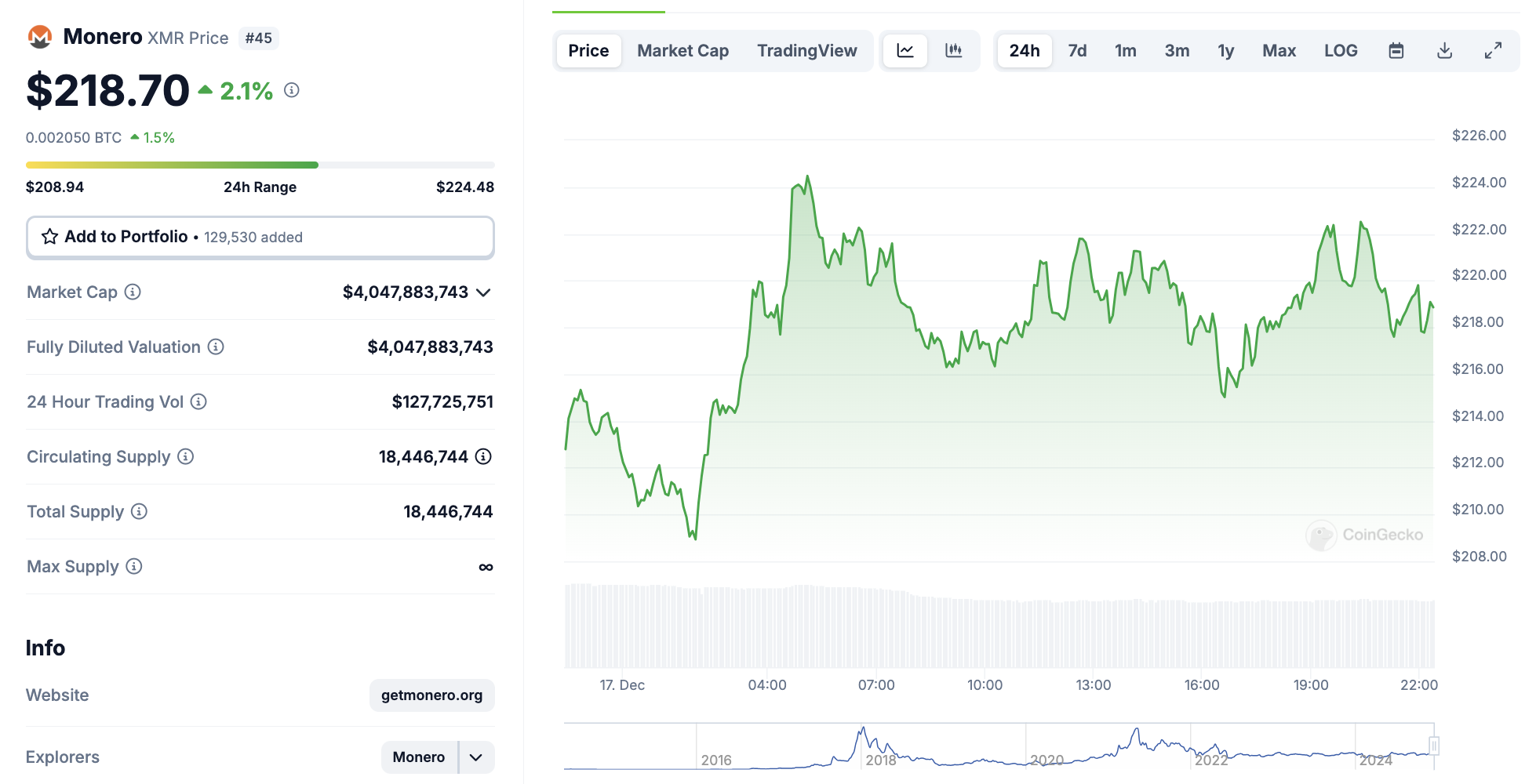

Monero (XMR) Price action | Source: Coingecko

The US authorities' sanctions on the North Korean hackers drove up demand for privacy-focused altcoins.

While Litecoin price rose 7% to breach the $130 resistance, Monero also rose to 2% to hit the $218 mark.

Chart of the day Traders sell altcoins, buy Bitcoin on risk-averse sentiment

In the first week of December, global markets faced turbulence amid escalating geopolitical tensions in South Korea and Syria.

While the crypto market rebounded following the release of a dovish US CPI report on December 10, critical indicators suggest that investors remain cautious, with a lingering low-risk appetite stemming from the recent market crash.

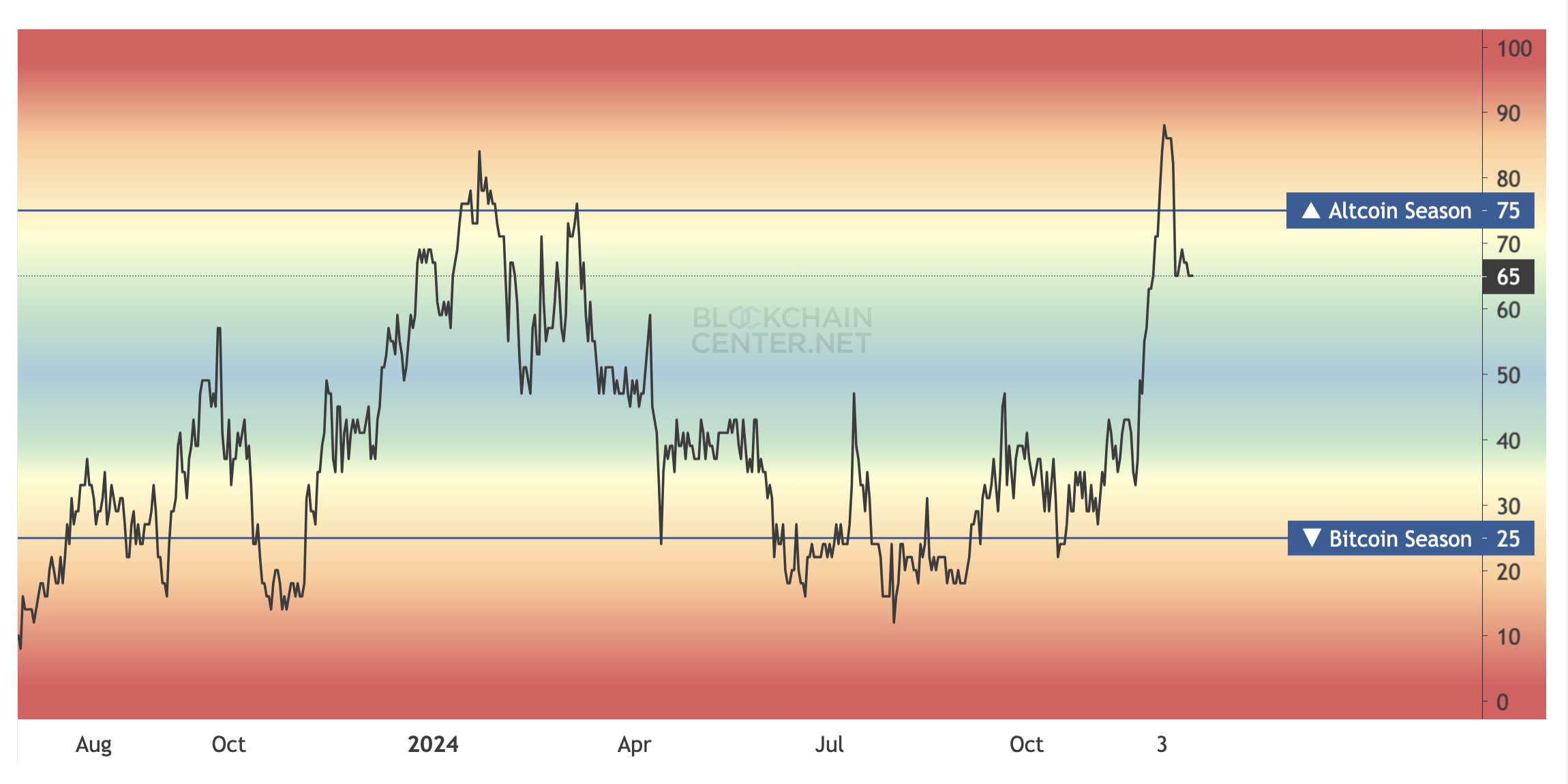

The BlockchainCentre's Altcoin Season Index highlights this sentiment by tracking the ratio of altcoin market demand relative to daily capital flows into Bitcoin, the largest and most established cryptocurrency.

Historically, when investors adopt a risk-averse stance amid economic uncertainty, capital tends to favor Bitcoin over the more volatile altcoins.

Altcoin Season Index, December 17, 2024 | BlockchainCenter

As shown in the chart below, the Altcoin Season Index declined from 75 on December 4 to 65 as of press time on Tuesday, marking a 13% drop in altcoin demand relative to Bitcoin since the market bottomed out on December 9.

This sharp decline underscores the cautious positioning of traders amid the current backdrop.

Looking ahead, all eyes are on the Federal Reserve's (Fed) interest rate decision on Wednesday.

If the Fed delivers a rate cut in line with analysts’ expectations, it could rekindle investor demand for risk assets and reignite capital flows toward altcoins.

- Bybit to Cease Crypto Services in France by January 2025 Amid Regulatory Pressures

Bybit, a major global crypto exchange, will halt withdrawal and custody services for French users starting January 8, 2025, following heightened regulatory scrutiny from French authorities. Affected users are urged to withdraw their assets before the deadline to avoid disruptions.

Accounts with balances exceeding 10 USDC will have their holdings transferred to Coinhouse, a licensed crypto custodian in France, upon verification.

For accounts below this threshold, Bybit will deduct a 10 USDC termination fee.

The move underscores broader legislative efforts to tighten oversight of crypto services within the region.

- Eliza Labs Partners with Stanford to Research AI Integration in Crypto

Eliza Labs, creators of the ai16z AI agent platform, has partnered with Stanford University’s Future of Digital Currency Initiative to explore AI and digital currency interactions.

The research will prioritize developing trust mechanisms and governance models for AI agents in the crypto ecosystem.

The collaboration, funded by Eliza Labs, combines leadership from Stanford professors with insights from top-tier crypto industry stakeholders.

The initiative aims to advance AI agent reliability and strengthen their role in decentralized systems.