Why are altcoins down today?

- Altcoins began the week with major tokens like ETH, SOL, XRP, BNB and DOGE experiencing a correction.

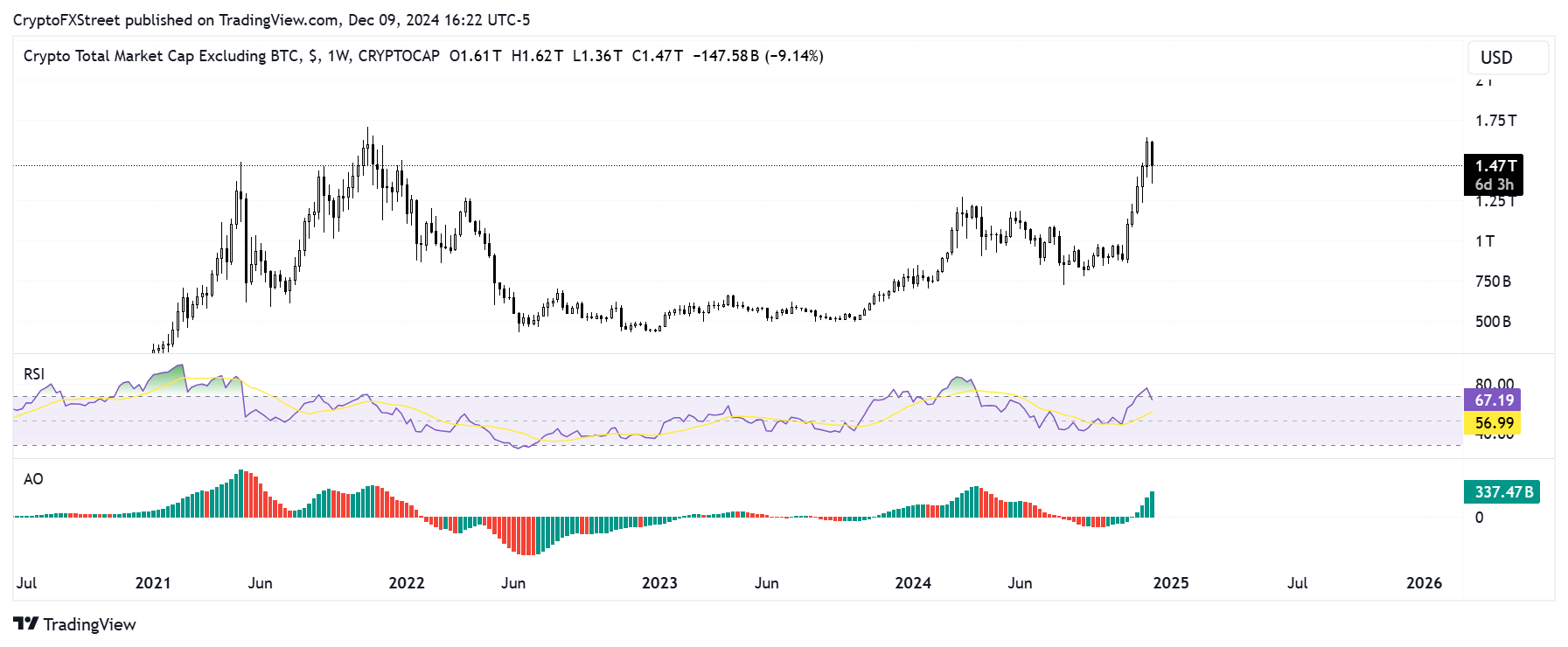

- The altcoin market cap performed a weekly close above $1.6 trillion last week following increased enthusiasm toward an alt season.

- Investor expectations for an alt season may have calmed after Bitcoin broke the $100K level.

Ethereum (ETH), Solana (SOL), XRP and the general altcoin market experienced a pullback on Monday, after their market cap crossed $1.6 trillion last week. The correction shows that Bitcoin dominance is still outweighing altcoins despite speculations of an alt season.

Altcoins decline amid growing expectations for massive alt season

Major altcoins, including ETH, SOL, XRP, BNB and DOGE, posted losses above 4% on Monday following signs of exhaustion among bulls. The pullback comes after the altcoin market performed a weekly close above $1.6 trillion for the first time since 2021.

Several crypto community members also suggest that this decline may be due to reduced expectations for an alt season after Bitcoin broke past the $100K level.

However, data from CryptoQuant CEO Ki Young Ju suggested that altcoins are not rallying at the expense of BTC in the current cycle considering the growth of stablecoin liquidity in the market. This suggests that new money flowed into the market to fuel the rally instead of capital rotation from BTC.

This has fueled high expectations among crypto enthusiasts, who suggested that the correction is a temporary pullback to spring the altcoin market cap to new highs.

A look at previous alt seasons also indicates that this pullback may be healthy for altcoins. In the 2021 market cycle, altcoins saw a major decline a few weeks after hitting new highs in May 2021 before recovering and setting new highs in November.

Total Crypto Market Capitalization excluding Bitcoin

As a result, traders may be positioning themselves to treat the decline as a buying opportunity. This is evident in tokens such as SOL and TON, trading slightly below their previous all-time highs.

CryptoQuant data suggests that these two assets are favorites to break past previous ATH prices following BNB and Bitcoin performances over the past week.

"Both projects are supported by strong fundamentals, including active development teams and active networks. Given these figures, it seems likely that these coins could follow Bitcoin's lead in the near future," said CryptoQuant analyst Maartun.

Additionally, the recent market decline comes from altcoins' rising correlation with Bitcoin after declining $100K over the weekend.