Solana Price Forecast: Investors unstake $500M SOL as Bitcoin breaks $100K

- Solana price settled above the $240 support level on Thursday, down 9% from its all-time high of $264 recorded last week.

- On-chain data shows Solana investors unstaked 2.2 million SOL over the last seven days, signaling an ongoing profit-taking trend.

- Despite Bitcoin flipping $100,000, Solana’s Bull Bear Power (BBP) indicator shows weakened buying momentum.

Solana price halted at $245 mark on Thursday, down 9% from the all-time high of $264 recorded last week. On-chain data trends show key SOL stakeholders are actively taking profits as Bitcoin price crossed the $100,000 milestone.

Solana price hits $245 roadblock amid BTC breakout

On Wednesday, Bitcoin price crossed the $100,000 milestone for the first time, buoyed by news of United States president-elect Donald Trump announcing crypto-friendly Paul Atkins to replace Gary Gensler as Securities and Exchange Commission (SEC) chair.

The Bitcoin milestone instantly sparked bullish sentiment across altcoin markets, driving the likes of Ripple (XRP), Ethereum and Solana to new weekly peaks.

Solana price action

Solana price action

The chart above shows that Solana’s price had traded as low as $224 on Tuesday,. but after Trump announced Atkin’s nomination, SOL price advanced 4.2% before pulling back from the $245 resistance on Thursday.

However, Solana’s 4.2% daily timeframe rally has been relatively subdued when compared to Bitcoin (BTC), which climbed 8% over the last 24 hours.

This raises concerns about an underlying bearish catalyst.

Investors unstaked $500M SOL after all-time high

Last week, Solana drew global media attention as it raced to a new all-time high price of $264 on November 23, clearing the previous peak of $259 recorded four years ago.

However, recent on-chain data trends suggest key stakeholders within the Solana ecosystem began taking profits, capitalizing on the market euphoria.

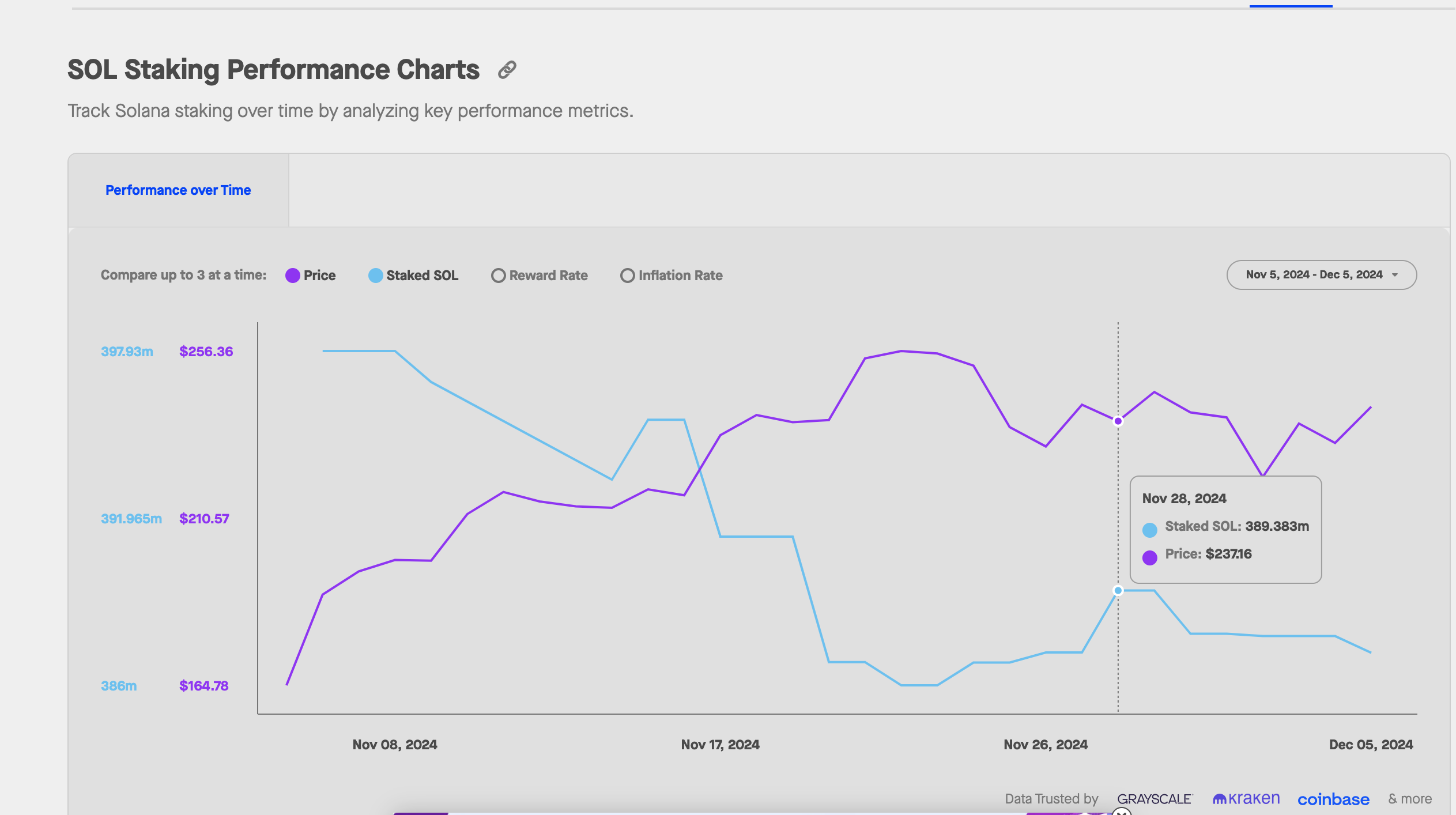

Validating this narrative, the chart below tracks the total value of SOL coins deposited in active staking smart contracts.

This typically serves as a proxy for monitoring the activity of large stakeholders and core network validators around critical market events.

Solana total staked value, December 2024 | Stakingrewards.com

Solana’s network staking deposits have been in decline over the past week. The chart above shows the total staked value dropped from 389.4 million SOL on November 28, to hit 387.2 million SOLon Thursday.

This reflects that, in the last seven days, Solana’s core network validators withdrew over 2.2 million SOL worth approximately $528 million when valued at the current prices.

When stakers withdraw such a large amount during a rally, it dampens the bullish momentum for two vital reasons.

First, by withdrawing 2.2 million SOL from staking contracts, the short-term market supply is effectively diluted.

This partially nullifies the impacts of the bullish sentiment from Bitcoin's $100,000 milestone on the Solana markets.

More so, stakers are highly influential within any Proof-of-Stake network, as they are viewed as sophisticated investors in charge of securing the network.

When they start making large withdrawals, it dissuades other market participants from intensifying their buying pressure.

If the current staking outflow trend persists, Solana's price could struggle to advance towards new all-time highs above $265 in the near term.

Solana price forecast: $250 resistance looms large amid profit-taking

Solana faces mounting bearish pressure as profit-taking and rapid decline in staking deposits weigh on the short-term price action.

The Chande Kroll Stop indicator highlights immediate resistance at $250, suggesting that SOL may struggle to break above this level in the short term.

Historically, this resistance zone has triggered selling pressure and without a significant surge in buying volume, SOL could face further pullbacks.

Solana price forecast | SOLUSDT

The BullBear Power (BBP) indicator remains in negative territory, reflecting diminished buying momentum despite recent attempts to rally.

This signals that bearish sentiment is currently overpowering bullish sentiment, making a sustained move beyond $250 increasingly unlikely.

If SOL fails to close within the $245-$250 range, it risks descending toward the next key support level at $230.

A breakdown below this level could accelerate selling, pushing SOL to retest the $224 support zone, where it last found temporary relief on Tuesday.

On the upside, a close above the $250 mark could trigger a decisive breakout to new all-time highs above the $270 area.

However, with large stakers withdrawing over 2.2 million SOL in the past week, Solana’s short-term price outlook could remain largely neutral.