Ethereum Price Forecast: ETH likely to stage 30% rally following heightened weekend buying pressure

Ethereum price today: $3,450

- Ethereum on-chain indicators signal rising buying pressure over the weekend.

- Investors are potentially rotating from Bitcoin to Ethereum following a decline in its market dominance.

- ETH could rally 30% after overcoming the $3,400 neckline resistance level of a Head-and-Shoulders pattern.

Ethereum (ETH) is up over 4% on Monday following increased weekend buying pressure and investors potentially rotating away from Bitcoin. The top altcoin could stage a 30% rally if it maintains bullish pressure above the $3,400 key level.

Ethereum investors flip bullish with weekend buying pressure

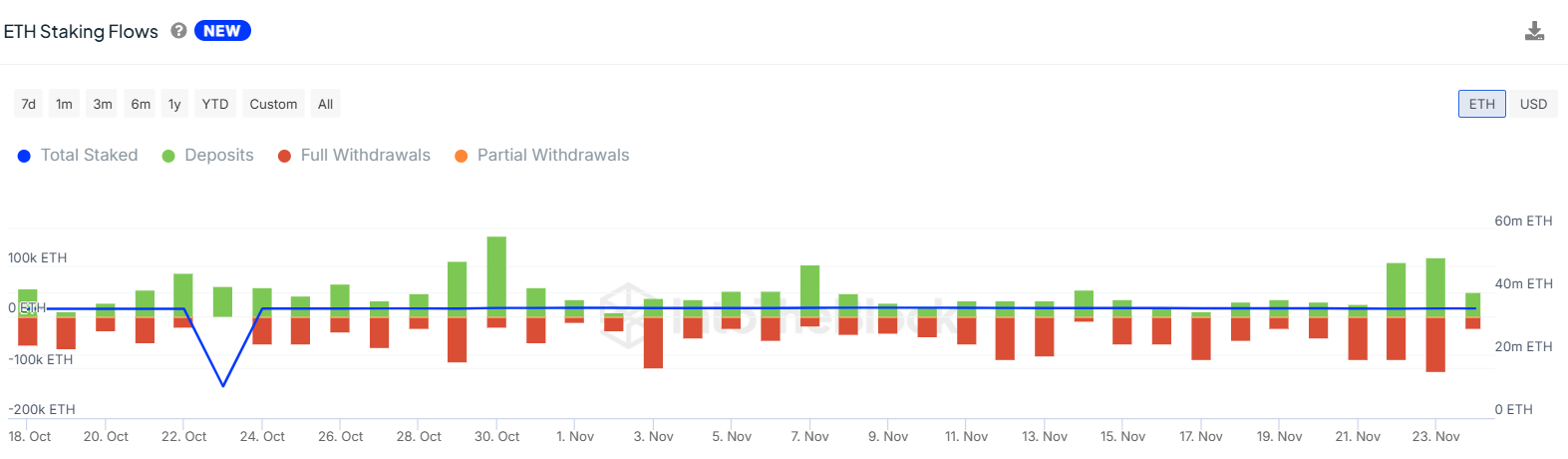

Ethereum staking flows switched to inflows for the first time in seven days on Friday and stayed positive over the weekend with net inflows of 59K ETH. If the trend continues, it could lead to rising ETH scarcity and a subsequent price increase.

ETH Staking Flows | IntotheBlock

The switch to buy-side is also evident in Ethereum exchange-traded funds (ETF) recording net inflows of $91.3 million on Friday after six days of consecutive net outflows, per Coinglass data.

Investors also staged similar buying pressure across spot exchanges, pushing ETH exchange flows during the weekend to net outflows of ~130K ETH worth about $435 million.

- All Exchanges-638681525647123356.png)

ETH Exchange Netflows | CryptoQuant

According to a Monday note by QCP analysts, investors could be rotating from Bitcoin to ETH and other altcoins, considering BTC dominance fell from 62% to 59% in the past week. The analysts noted that the trend will continue if BTC continues rejecting the $100K key level.

Meanwhile, Michael Nadeau of the DeFi Report said in a recent issue that ETH may be following its last bull cycle price pattern.

"In the last cycle, Bitcoin broke its all-time high in Q4-20. It wasn't until Q1-21 that ETH broke its all-time high [and] went on to do a 5.4x in the first 4 months of the year," Nadeau wrote.

Ethereum Price Forecast: ETH set for 30% rally after overcoming $3,400 resistance

Ethereum is up over 4% following $62.88 million in ETH futures liquidations in the past 24 hours, per Coinglass data. Liquidated long and short liquidations accounted for $28.17 million and $34.71 million, respectively.

ETH retested the $3,400 neckline resistance of a Head-and-Shoulders pattern over the weekend and finally broke above it on Monday.

ETH/USDT daily chart

If ETH sustains an extended move above the $3,400 resistance, it could surge above its yearly high resistance of $4,093 with a 30% rally to $4,522. To complete such a move, ETH has to overcome the $3,732 key resistance level.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) momentum indicators are trending upwards above their neutral levels, indicating rising bullish pressure.

A daily candlestick close below the $3,000 psychological level will invalidate the bullish thesis and send ETH to find support at the $2,817 level.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.