Is Altcoin Season here as Bitcoin reaches a new all-time high?

- Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit.

- Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

- On-chain data shows the Altcoin Season Index has more room for growth as capital flows more into BTC than altcoins.

Bitcoin (BTC) reaches a new high of $98,384 on Thursday, with altcoins also rallying in response to US President-elected Donald Trump's crypto-friendly stance. On-chain data suggests the Altcoin Season Index has further growth potential, as investors appear hesitant to fully rotate into altcoins while BTC edges closer to the $100,000 milestone.

Altcoin season is when cryptocurrencies other than Bitcoin see substantial price increases.

Recent rally is an early sign of Altseason

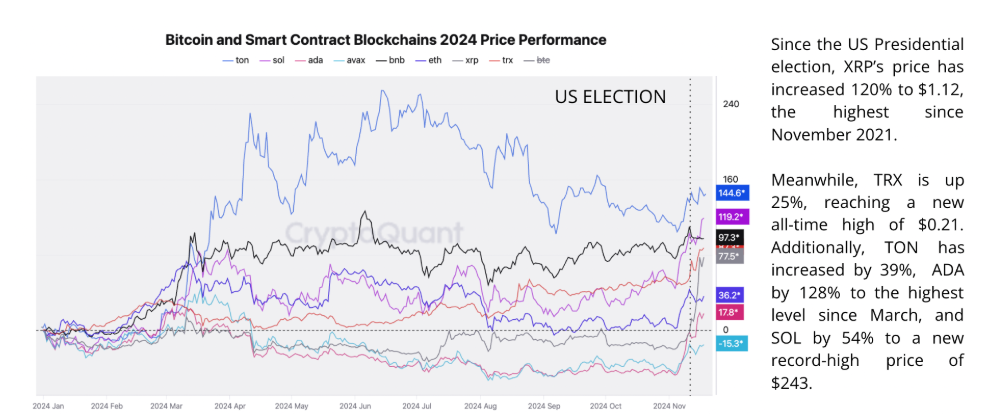

CryptoQuant’s weekly report on Wednesday shows that Layer-1 cryptocurrencies have seen a price surge after the US presidential election in early November. Cryptocurrencies like Ripple, Tron, Cardano, Toncoin, and Solana have seen their prices increase sharply based on expectations that the new US administration will be more pro-crypto.

As showed in the report, Ripple Labs CEO said in an interview, “The crypto industry has embraced Trump; Trump has embraced the crypto industry…”

Layer-1 cryptocurrencies price performance chart. Source: CryptoQuant

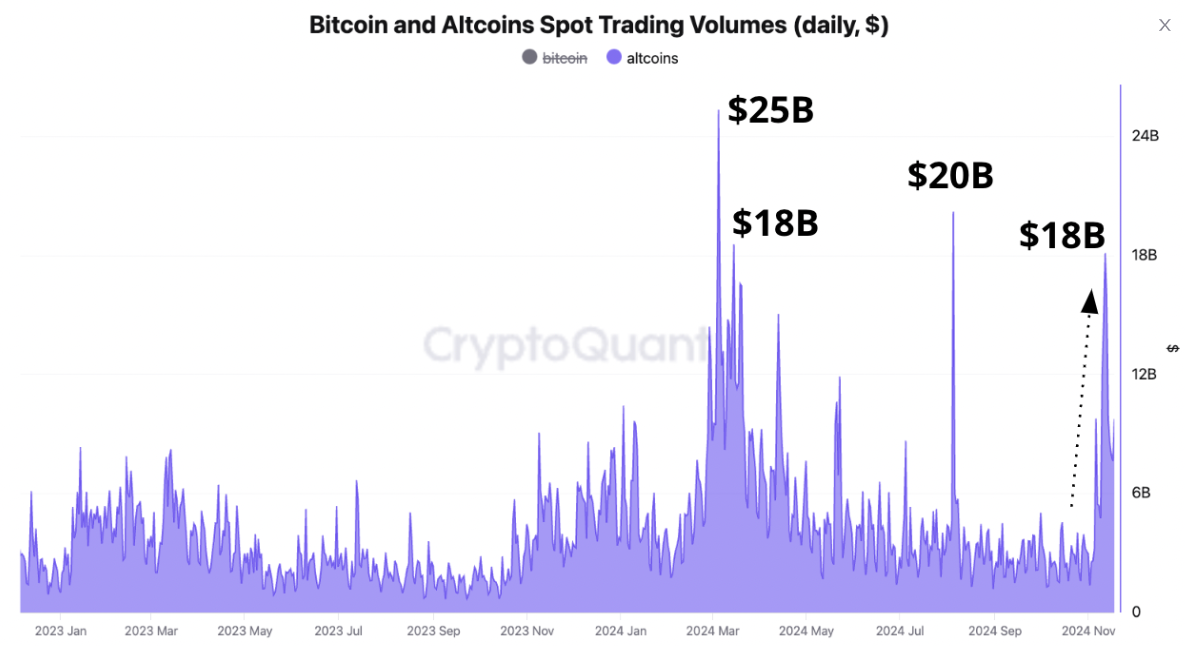

The report further explains that the altcoin price surge was accompanied by a spike in spot trading volume, reaching one of the highest daily levels so far in 2024. Daily spot trading volume for altcoins increased after the US presidential election and spiked as high as $18 billion on November 11, the highest since early August. Before this, altcoin spot trading volume had remained muted since May.

Altcoins Spot Trading Volume chart. Source: Santiment

Despite the recent rally, the Altcoin Season has yet to start. The QCP report highlights that investors might not be ready to fully invest in altcoins, as BTC seems to have more legs to go before the 100K milestone.

The report continued, “Historically, we’ve seen altcoins outperform whenever the majors consolidate after a significant rally as profits rotate into smaller-cap coins. BTC’s dominance is around 60% now, and it will probably need to be around <58% to signal the start of altcoin season.”

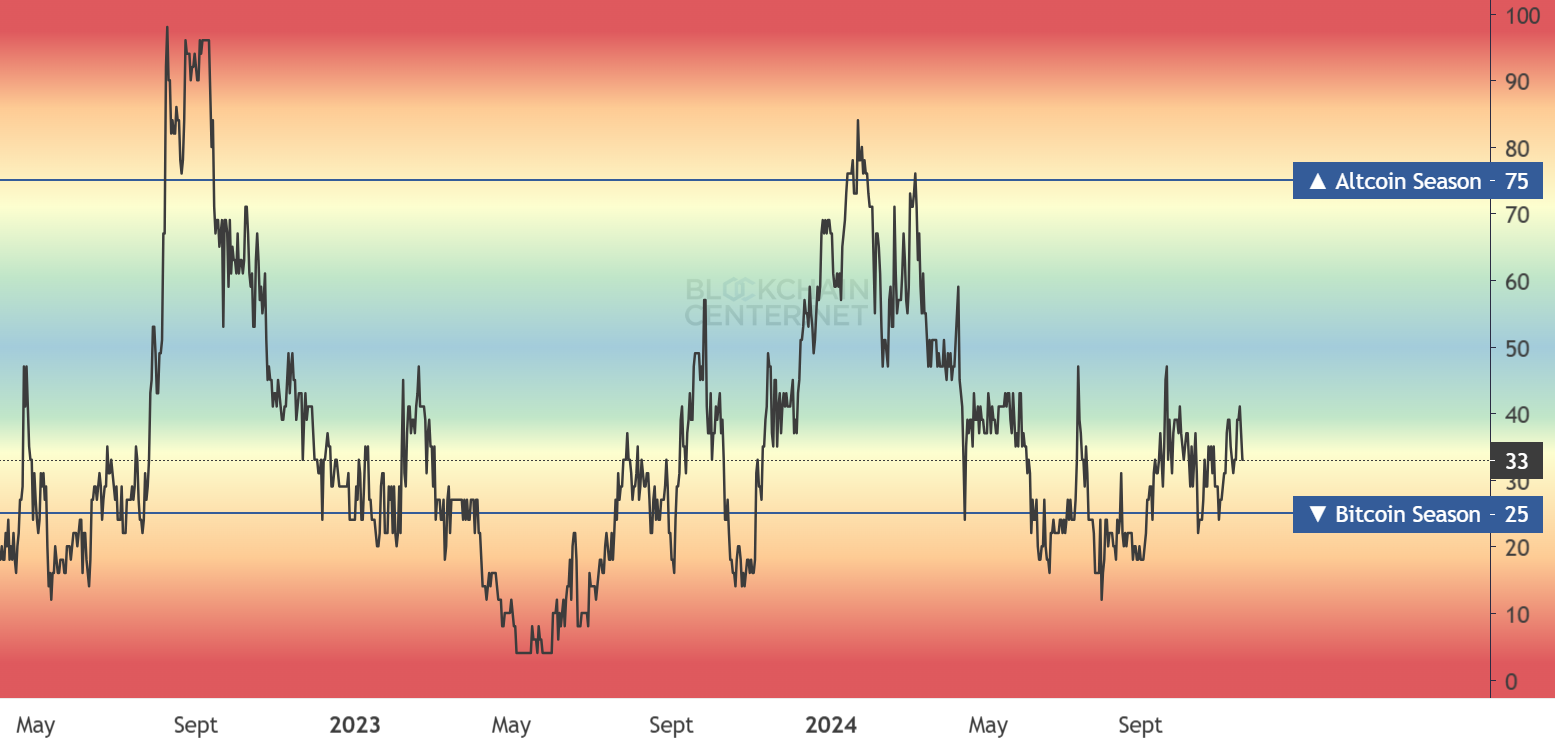

Blockchaincenter.net’s Altcoin Season index chart provides a clearer picture. This metric shows whether it is Altcoin or Bitcoin season. If the index is below 25, it suggests that Bitcoin performs well compared to altcoins (money flows into Bitcoin from altcoins). However, if the index is above 75, it suggests that altcoins perform better than Bitcoin (money flows into altcoins from Bitcoin).

The index stands at 33, indicating that altcoins have more room for growth. Investors still prefer to invest their money in Bitcoin or hold it rather than transferring it to altcoins.

Altcoin Season index chart. Source: Blockchaincenter.net

If 75% of the Top 50 coins performed better than Bitcoin over the last season (90 days), it also indicates Altcoin Season. These excluded from the Top 50 are Stablecoins (Tether, DAI…) and asset-backed tokens (WBTC, stETH, cLINK).

The graph below shows that altcoins like Mantra (OM), (Sui) SUI, (Dogecoin) DOGE, and other coins have performed better. However, most other top altcoins are still under the woods. This shows more room for growth and the altcoin season is yet to come.

-638677906726907642.png)

Top 50 Performance over the last 90 days season chart. Source: Blockchaincenter.net

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.