Bitcoin Price Forecast: Will BTC reach $100K this week?

Bitcoin price today: $91,600

- Bitcoin price consolidates between $87,000 and $93,000 after reaching a new all-time high of $93,265 last week.

- Founder and CEO of CryptoQuant Ki Young Ju says that Bitcoin euphoria is here.

- Reports highlight that investors may delay rotating into altcoins as BTC shows potential to reach the $100K milestone.

Bitcoin (BTC) edges higher and trades at around $91,600 at the time of writing on Tuesday while consolidating between $87,000 and $93,000 after reaching a new all-time high (ATH) of $93,265 last week. Ki Young Ju, founder and CEO of CryptoQuant, says Bitcoin euphoria is here and shorting now could be either catching the top — or shorting at the bottom of a parabolic bull run. Reports highlight that investors may delay rotating into altcoins as BTC shows potential to reach the $100K milestone.

Bitcoin euphoria is here, says CryptoQuant’s CEO

Bitcoin reached a new ATH of $93,265 last week, rallying over 35% since the US Presidential election on November 5. On Tuesday, Ki Young Ju, founder and CEO of a crypto analytics company, said, “Bitcoin euphoria is here.”

Young continued his statement, “99.3% of UTXOs are in profit now. Everyone’s happy. This euphoric phase typically lasts 3–12 months (except the Nov ’21 bull trap). This started 2 weeks ago. Shorting now could be either catching the top — or shorting at the bottom of a parabolic bull run.”

#Bitcoin euphoria is here.

— Ki Young Ju (@ki_young_ju) November 19, 2024

99.3% of UTXOs are in profit now. Everyone's happy. This euphoric phase typically lasts 3–12 months (except Nov '21 bull trap).

This started 2 weeks ago. Shorting now could be either catching the top—or shorting at the bottom of a parabolic bull run. pic.twitter.com/bjHKTuNKGf

QCP’s report also highlights that investors might not be ready to fully rotate into altcoins as BTC seems to have more legs to go before that 100K milestone.

The report continued, “Historically, we’ve seen altcoins outperform whenever the majors consolidate after a significant rally as profits rotate into smaller-cap coins. BTC’s dominance is around 60% now, and it will probably need to be around <58% to signal the start of altcoin season.”

Bitcoin’s Open Interest (OI) is also rising, further supporting the bullish thesis. Coinglass’s data shows that the futures’ OI in BTC at exchanges rose from $46.05 billion on November 10 to $56.75 billion on Tuesday, a new all-time high. An increasing OI represents new or additional money entering the market and new buying, which suggests a bullish trend.

Bitcoin Open Interest chart. Source: Coinglass

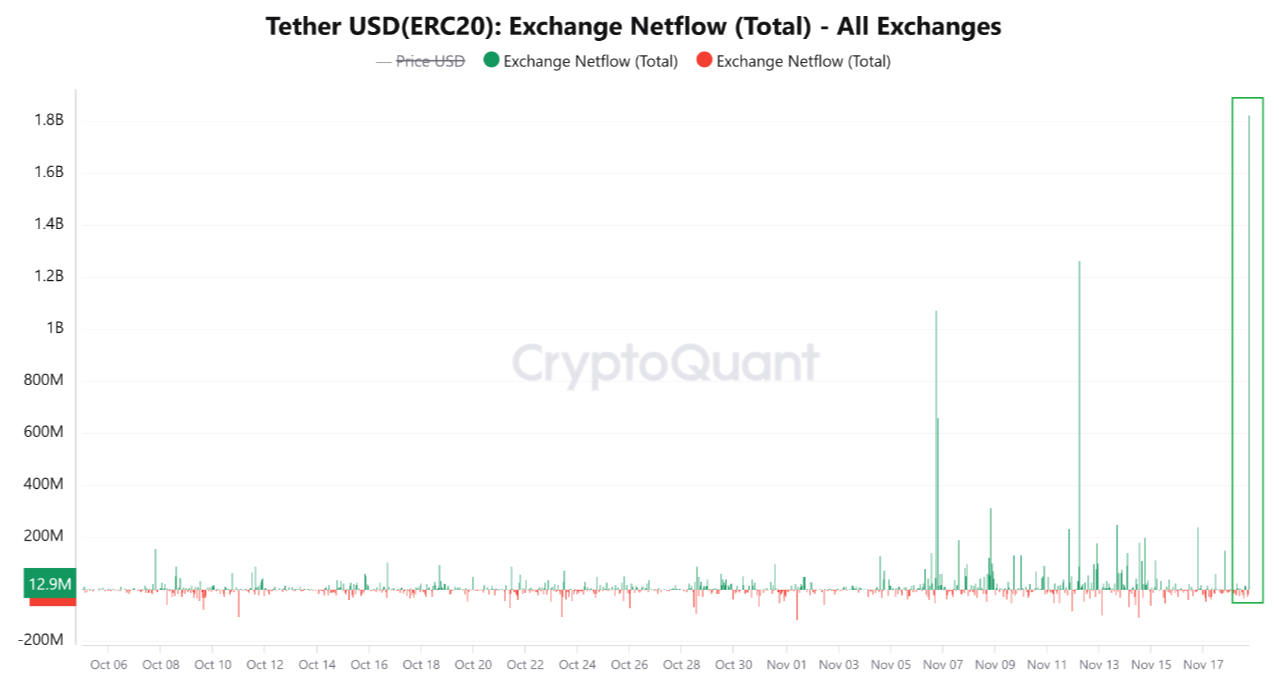

Moreover, CryptoQuant data shows that the inflow of stablecoins onto exchanges hit a new record of over 1.8 billion on Monday. The substantial inflow of stablecoins onto exchanges brings high purchasing power, which could drive demand for Bitcoin, reaching its $100K mark.

Tether exchange netflow chart. Source: CryptoQuant

Some signs of optimism for Bitcoin

On Tuesday, the Deutsche Borse Group report highlights MicroStrategy’s recent announcement that it had acquired nearly $4.6 billion worth of BTC (51,780 BTC) in just a few weeks since the US election, adding optimism for Bitcoin investors.

“An audio leak revealed Elon Musk stating he holds a significant amount of DOGE, while SpaceX owns a substantial amount of BTC. Meanwhile, rumors about Trump Media’s potential acquisition of the crypto platform Bakkt caused shares of both companies to surge, with Bakkt being a prominent player in the market.” says the report.

The OCC confirmed that IBIT options would begin trading on Tuesday, which could create new market dynamics, particularly around options expirations and weekends.

Lastly, as Trump pledged during the election campaign, the progress toward a Bitcoin strategic reserve or national Bitcoin stockpile could also catalyze Bitcoin’s $100,000 mark. The political momentum toward establishing a national Bitcoin reserve is gaining traction, though the process could take longer if it involves annual material Bitcoin purchases. Senator Cynthia Lummis introduced a draft of the BITCOIN Act in August, which proposes that the United States adopt a national Bitcoin reserve. The plan outlines acquiring up to 5% of Bitcoin’s total supply over five years, equivalent to nearly $100 billion at current market prices.

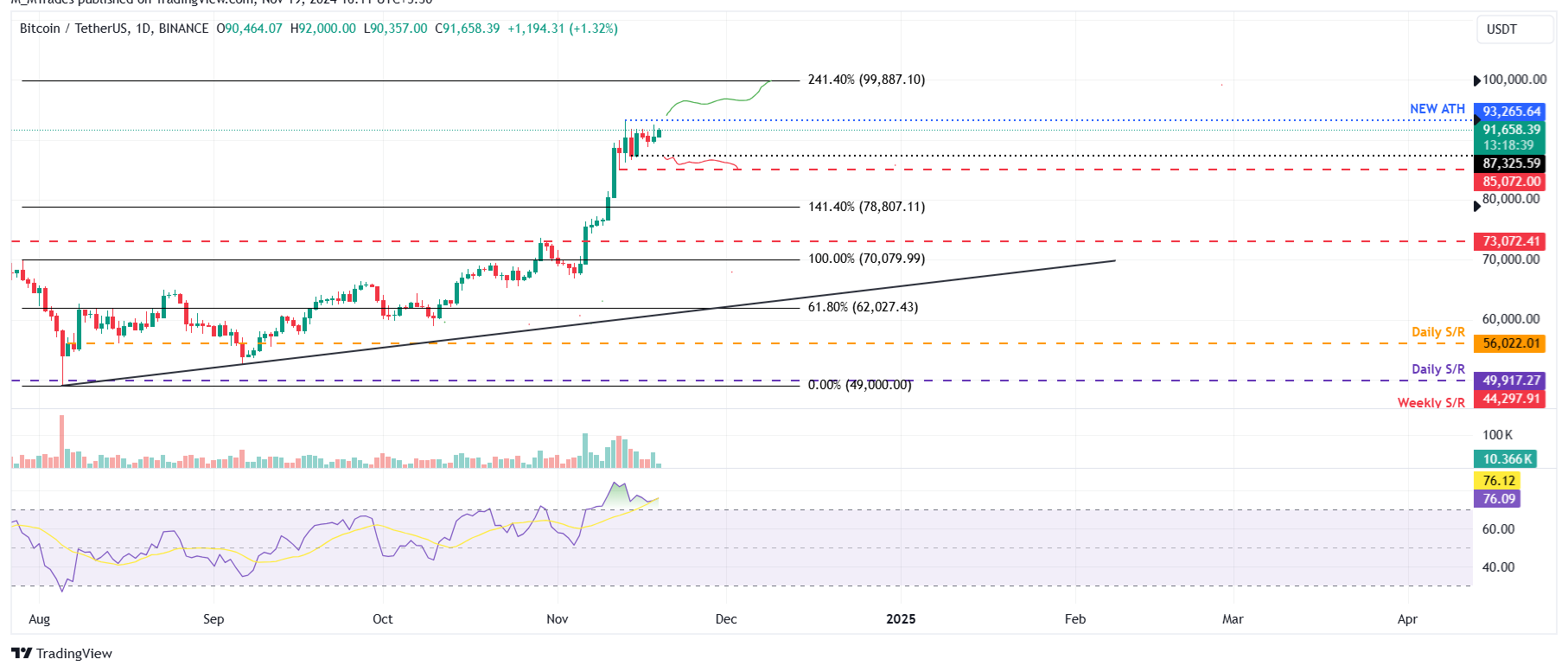

Bitcoin Price Forecast: Consolidates after a new ATH

Bitcoin price surged and reached a new all-time high of $93,265 on November 13. Since then, it has been consolidating, with initial support of around $87,000. On Tuesday, it trades slightly higher, around $91,600, approaching its upward consolidation zone near its ATH.

If BTC breaks and closes above $92,625, the rally could extend to the significant psychological level of $100,000.

However, the Relative Strength Index (RSI) momentum indicator stands at 76, hovering above the overbought level of 70, signaling an increasing risk of a correction. Traders should exercise caution when adding to their long positions, as the RSI's move out of the overbought territory could provide a clear sign of a pullback.

BTC/USDT daily chart

Conversely, if BTC drops below the $87,000 support level, it could extend the decline to nearly $85,000 (November 12 low). A successful close below this level might trigger a deeper sell-off to $78,800 (the 141.4% Fibonacci extension drawn from July’s high of $70,079 to August’s low of $49,000).

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.