Ethereum Price Forecast: ETH could see fresh demand after Fed's 25 bps rate cut and Trump's election victory

Ethereum price today: $2,960

- Ethereum could see renewed investor interest after the Fed cut rates by 25 basis points.

- The Ethereum Foundation treasury plunged by 39% in over two years.

- ETH needs to overcome key SMAs resistance across the daily and weekly charts to leap toward a new all-time high.

Ethereum (ETH) is trading above $2,900 on Thursday, up 2% on the day as it's looking to flip key resistance levels to set a new all-time high. The top altcoin could overcome these hurdles after the Federal Reserve (Fed) reduced interest rates by 25 basis points.

Ethereum staking yield could fuel ETH demand following Fed rate cut

Ethereum could begin to look attractive to investors again due to the combined effect of the Fed’s 25 bps rate cut and Donald Trump's victory in the presidential election.

The Fed reduced interest rates by 25 basis points on Thursday, following an earlier 50 bps cut in September. This has taken the agency's benchmark rates to 4.5%.

According to CoinDesk's Omkar Dobole, the US previous high interest rate environment is partly responsible for ETH's underperformance since the beginning of the year. While ETH only rose by a mere 30% in 2024, Bitcoin and Solana gained over 80% and 95% within the same time frame.

The Ethereum staking yield, which has stayed at 4% in the past two years — below the previous Fed benchmark rate of 5% — saw investors favoring investment in traditional bonds over the top altcoin.

However, with rates now trending downward and Donald Trump's presidential election victory potentially securing a clear regulatory path for decentralized finance (DeFi), demand for ETH could surge in the coming weeks.

Meanwhile, the Ethereum Foundation, a non-profit that helps develop the Ethereum blockchain, released a report, showing its treasury balance has plunged by 39% from $1.6 billion in March 2022 to $970 million on October 31.

Ethereum Price Forecast: ETH could leap to new all-time high as it attempts move above key SMAs

Ethereum has seen nearly $64.97 million in liquidations in the past 24 hours, with liquidated long and short positions accounting for $18.01 million and $46.96 million, respectively, per Coinglass data.

On the daily chart, ETH is testing the 100-day Simple Moving Average (SMA) near the $3,000 psychological level. If ETH crosses above this SMA, it could rally to test the resistance near $3,366. However, a rejection at this level could see ETH decline to the $2,817 support level.

ETH/USDT daily chart

The Relative Strength Index (RSI) on the daily chart is testing its oversold line. A cross into this region could lead to a temporary correction.

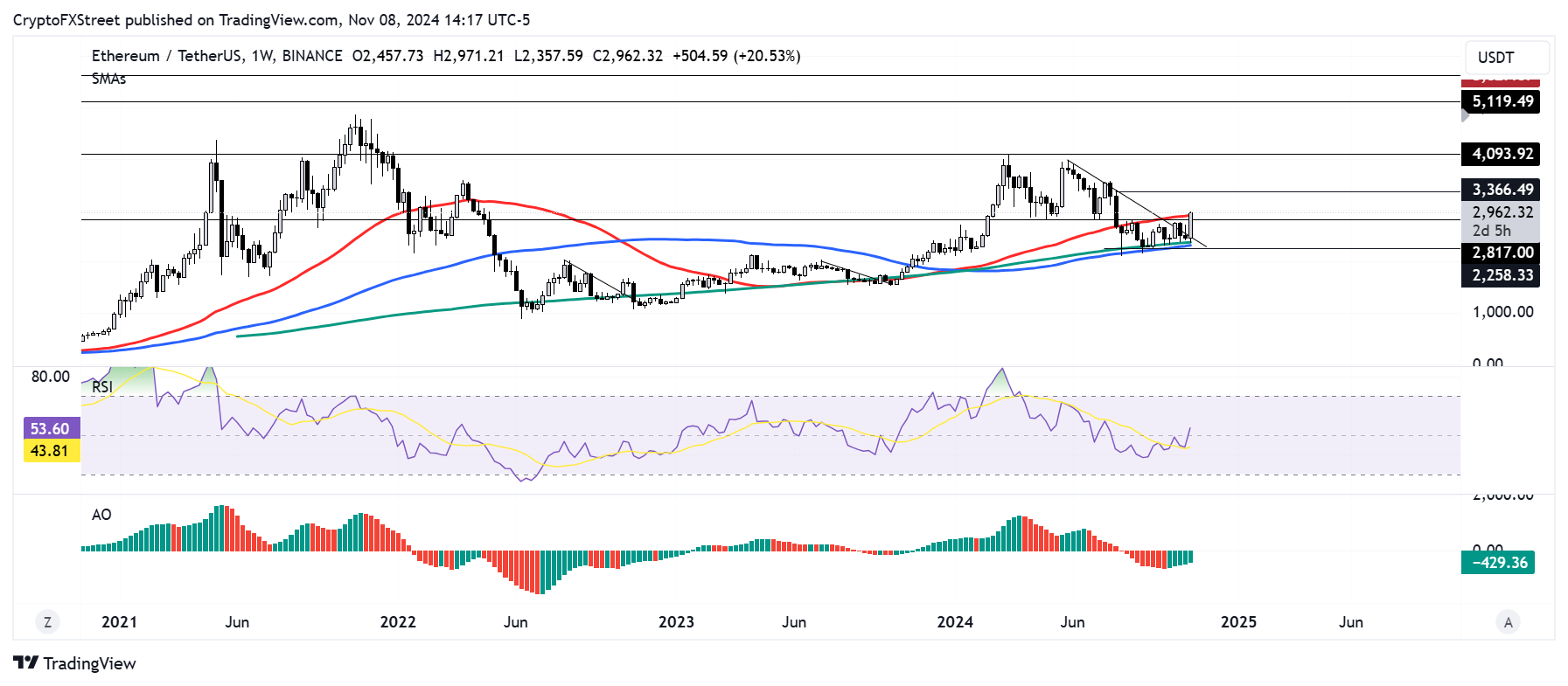

On the weekly chart, ETH is attempting to move above the 50-day SMA, which has restricted any upward price movement since August 5. If ETH rises above this SMA, then it could flip the $3,366 resistance into a support and rally to tackle its yearly high resistance of $4,093 before aiming for a new all-time high.

ETH/USDT weekly chart

The weekly RSI is above its neutral level and moving average yellow line for the first time since March 18, strengthening the bullish momentum. ETH rallied over 160% the last time its weekly RSI posted a similar move on October 16, 2023.

A daily candlestick close below $2,817 will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.