Dogecoin Price Prediction: DOGE could hit a new yearly high after 50% rally in twenty days

Dogecoin price today: $0.1700

- Dogecoin has surged over 50% since mid-October.

- The meme coin has shown correlations with a Trump victory with the potential launch of a D.O.G.E. government agency.

- DOGE could set a new yearly high if it overcomes the $0.1758 resistance hurdle.

Dogecoin (DOGE) is up 8% on Tuesday following rising expectations of a Donald Trump victory in the ongoing U.S. presidential elections. If the bullish momentum continues, the meme coin leader could rise to a new yearly high.

Dogecoin investors are betting on a Trump victory

Dogecoin has been one of the best-performing cryptocurrencies since mid-October, soaring over 50% in the past 20 days. The top meme coin has been in focus since election day began and is showing increasing correlations with a potential Republican victory.

Most investors expect a Dogecoin rally if the Republican emerges as the winner of the U.S. presidential elections, particularly due to Trump and Elon Musk's plan to launch the Department of Government Efficiency, aka D.O.G.E.

However, a significant DOGE correction could ensue if Democrat candidate, Kamala Harris, gains victory over Trump.

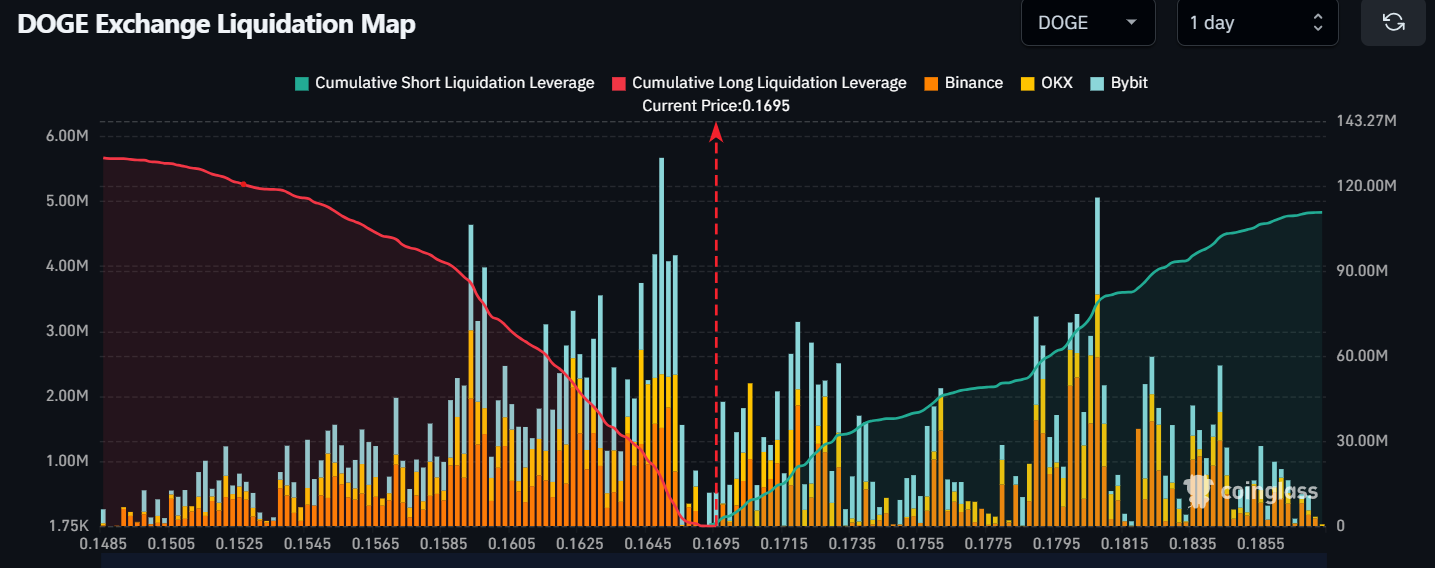

The high expectation of a DOGE rally is visible in the DOGE Exchange Liquidation Map, which shows traders opening long positions worth over $130 million for the meme coin in the past 24 hours.

DOGE Exchange Liquidation Map | Coinglass

Dogecoin Price Forecast: DOGE could be set for a new yearly high

Dogecoin is trading near the $0.1700 psychological level after seeing $20.50 million in liquidations in the past 24 hours, according to Coinglass data. Long and short liquidations accounted for $9.35 million and $11.15 million, respectively.

On the 4-hour chart, DOGE saw a rejection near the $0.1758 resistance, a level it has failed to sustain a move above since the meme coin mania in April. This marks the second time DOGE has seen a rejection near the $0.1758 resistance in the past week.

A successful move above this level could see the meme coin leader rallying nearly 20% to test the $0.2106 upper boundary of a key ascending channel. If the rally continues, DOGE could set a new yearly high above the $0.2288 resistance.

DOGE/USDT 4-hour chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their midlines, supporting the bullish outlook.

However, if DOGE crosses below its 50-day and 100-day Simple Moving Averages (SMAs), it could decline toward the support level at $0.1423.

A daily candlestick close below $0.1423 will invalidate the thesis and send prices lower toward $0.1111.