Ethereum Price Forecast: ETH struggles below $2,500 amid State of Michigan pension fund investment in ETH ETF

Ethereum price today: $2,420

- Ethereum sees higher allocation than Bitcoin in State of Michigan Retirement System portfolio following the fund's $11 million ETH ETF holdings.

- Despite the investment, ETH ETFs continue to underperform BTC ETFs as the top altcoin's market dominance plunges further.

- Ethereum could find support around a key descending trendline and its major demand zone near $2,258.

Ethereum (ETH) is trading near $2,420, down about 1% on Monday, but could bounce off a key descending trendline close to the $2,258 historically high demand zone. Meanwhile, the State of Michigan pension fund revealed an investment of $11 million in ETH exchange-traded funds (ETFs) despite its underperformance compared to Bitcoin ETFs.

Ethereum ETFs sees institutional interest with State of Michigan investment amid underperformance

In a Monday 13F filing, the State of Michigan Retirement System disclosed that it held a combined $11 million in Grayscale Ethereum Trust (ETHE) and Ethereum Mini Trust (ETH). This makes it the first pension fund to hold a position in Ethereum ETFs since they went live on July 23.

Bloomberg analyst Eric Balchunas noted the importance of the holdings for Ethereum:

Not only did Michigan's pension buy Ether ETFs but they bought more then they did of bitcoin ETFs, $10m vs $7m, this despite btc being up a ton and ether in the gutter. Pretty big win for ether which could use one. https://t.co/0E6O6pKK8S

— Eric Balchunas (@EricBalchunas) November 4, 2024

However, even with the ETH ETF investment from Michigan, the products still lag Bitcoin ETFs significantly.

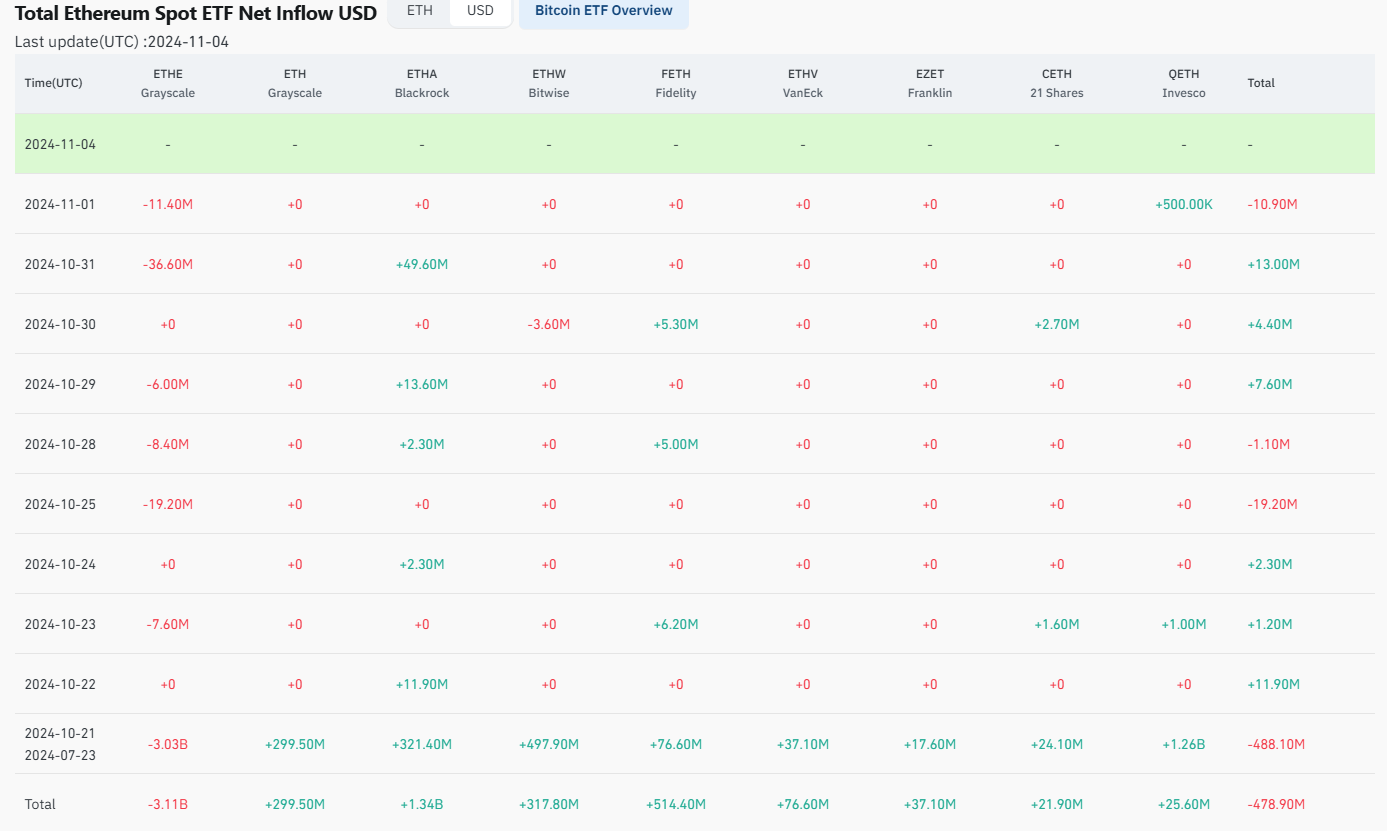

According to Coinglass data, Ethereum ETFs recorded $13 million in net inflows last week despite increased bullish sentiment across the market for most of the week. In contrast, Bitcoin ETFs posted $2.173 billion in net inflows during the same period.

ETH ETF Flows

Prior to its launch, several investors predicted ETH ETF inflows would boost the altcoin's price, but the products have met underwhelming reception, recording a total net outflow of $478.9 million since launch. With flows lagging, the Bitwise Chief Investment Officer’s (CIO) prediction of ETH reaching a new all-time high above $5,000 before year-end seems highly unlikely.

ETH's underperformance is also visible in the steady decline of its market dominance, which dropped to 13.09%, its lowest level since April 2021.

ETH Market Cap Dominance

Ethereum Price Forecast: ETH could bounce off its major demand zone

Ethereum has been struggling to recover from a major decline since seeing a rejection at the resistance level near $2,730. The top altcoin has declined by about 10% since then and moved below the $2,500 psychological level during the weekend.

The sideways price movement has seen ETH record $24.53 million in futures liquidations in the past 24 hours, with long and short liquidated positions accounting for $12.45 million and $12.09 million, respectively.

ETH could find support near a descending trendline extending from May 27. This trendline is also near the $2,258 support level, which is historically a major demand zone for ETH. Hence, the top altcoin could bounce off this level if prices decline toward it.

ETH/USDT daily chart

The Relative Strength Index (RSI) and Awesome Oscillator (AO) momentum indicators are below their mid-levels, indicating prevailing bearish pressure.

A daily candlestick close below $2,258 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.