Ethereum Price Forecast: Bulls are gaining strength

Ethereum price today: $2,600

- Ethereum price stabilizes above $2,600 on Thursday after finding support around the 50-day EMA.

- Ethereum’s fees collected are increasing, signaling rising network usage.

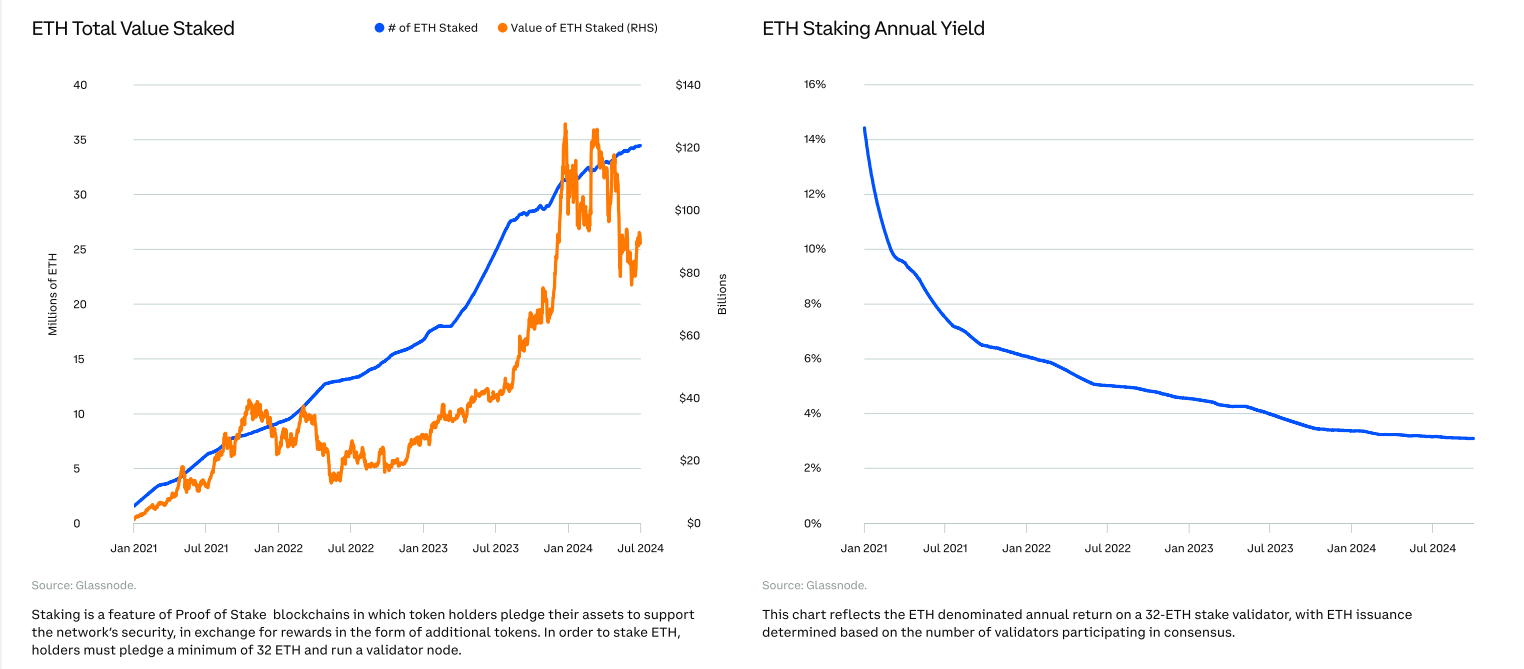

- ETH staking reached an all-time high in Q3 as more holders sought to earn yield.

Ethereum’s (ETH) price trades broadly stable above $2,600 on Thursday after finding support at a key level on Tuesday. Increasing fees indicate greater network usage, and a record high in ETH staking during the third quarter suggests that more holders are seeking yield, all pointing to the potential for a rally ahead.

Ethereum shows some signs of optimism

A joint report from Coinbase Institutional and Glassnode published on Wednesday highlights some signs of optimism for Ethereum.

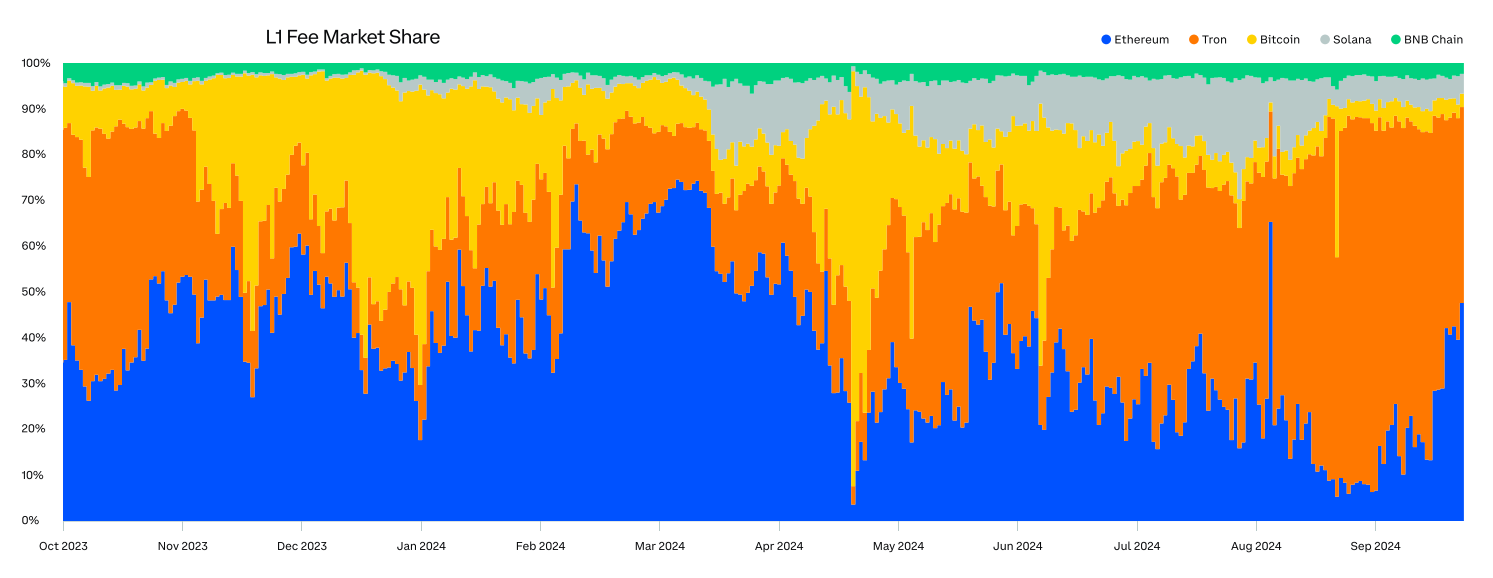

The reports show that Ethereum has regained a substantial market share of fees among fee-earning layer-1 (L1) blockchains, rebounding from a low of 9% in late August to a 40% high in late September. This rise indicates greater blockchain usage of Ethereum’s network.

L1 Fee Market Share chart. Source: Glassnode

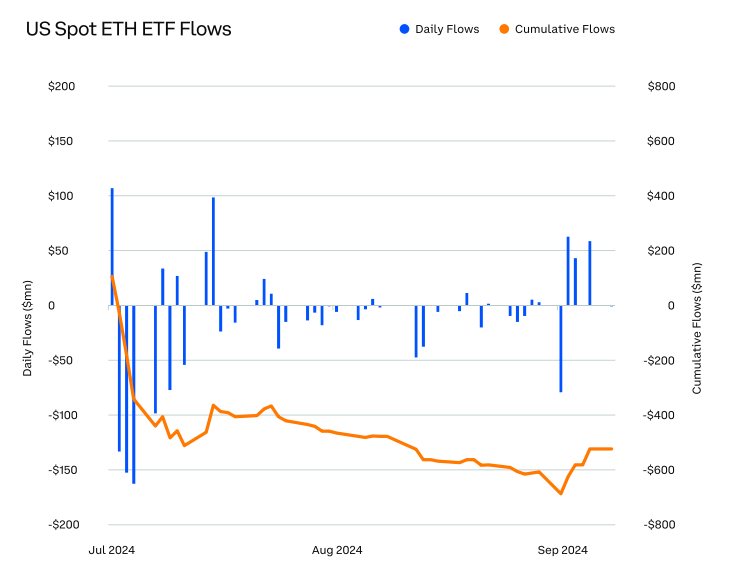

The US spot Ethereum Exchange Traded Fund (ETF) flows rebounded at the end of Q3 after several weeks of outflows, according to the analysts, indicating a mild recovery in institutional demand for ETH.

US Spot ETH ETF Flows Chart. Source: Glassnode

Another optimistic sign the report shows is that the number of Ethereum staked hit a new all-time high in the third quarter as more holders looked to generate yield from their positions.

ETH Total Value Stake and Annual Yield Chart. Source: Glassnode

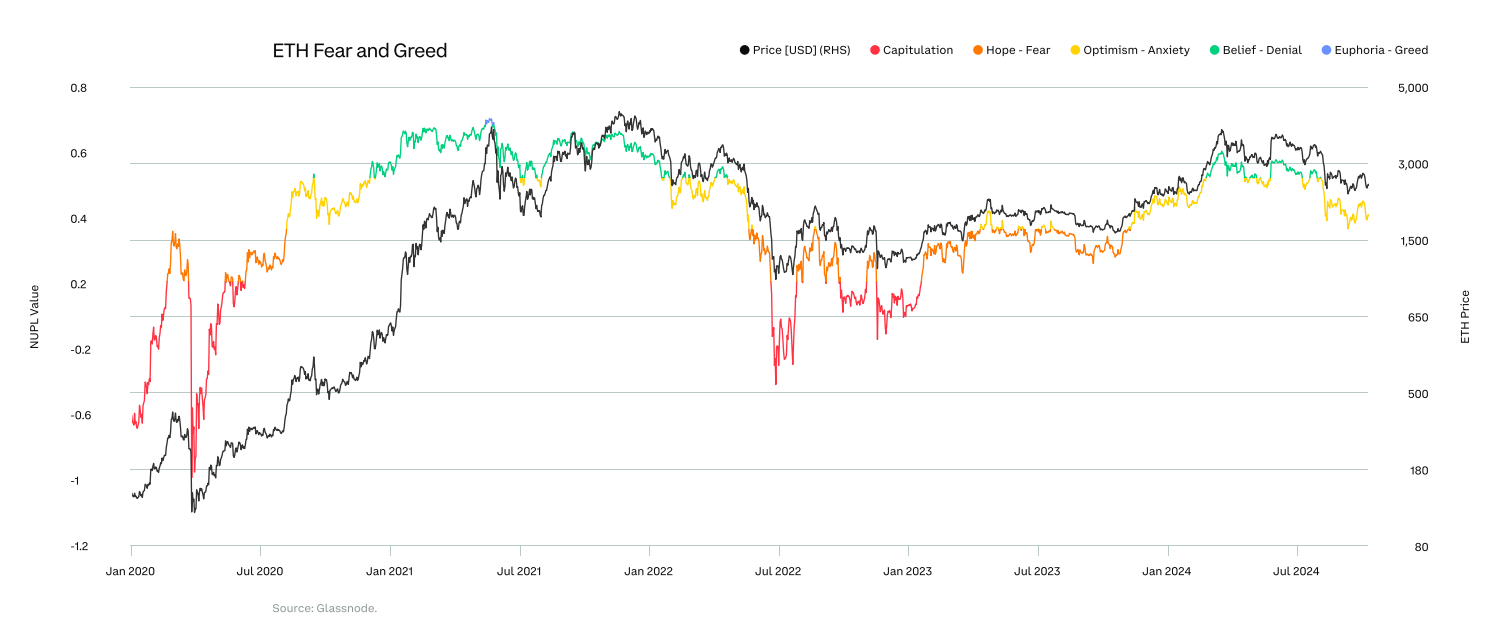

Finally, the analyst concludes that as the price of ether has retreated, sentiment has swung away from greed and toward fear, perhaps laying the groundwork for the next rally.

ETH Fear and Greed Chart. Source: Glassnode

Ethereum Price Forecast: Bulls set eyes at $2,800

Ethereum price broke above the daily resistance level of $2,461 and rallied 6.5% on Monday, successfully closing above its 50-day Exponential Moving Average (EMA). On Tuesday, ETH declined to test the 50-day EMA at $2,541 and bounced off. At the time of writing on Thursday, ETH’s price edges slightly higher and trades at around $2,600.

If the 50-day EMA at $2,541 continues to hold as support, ETH could extend the rally to retest its August 24 high of $2,820.

The Relative Strength Index (RSI) indicator on the daily chart trades at 59, above its neutral level of 50, suggesting bullish momentum is gaining traction.

ETH/USDT daily chart

However, if Ethereum’s price closes below the daily support level at $2,461, ETH could extend the decline by 13% to retest its September 6 low of $2,150.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.