Bitcoin Price Forecast: BTC on-chain metrics show weakness in institutional demand

Bitcoin price today:$62,500

- Bitcoin price stabilizes around $62,000; a firm close below would suggest a decline ahead.

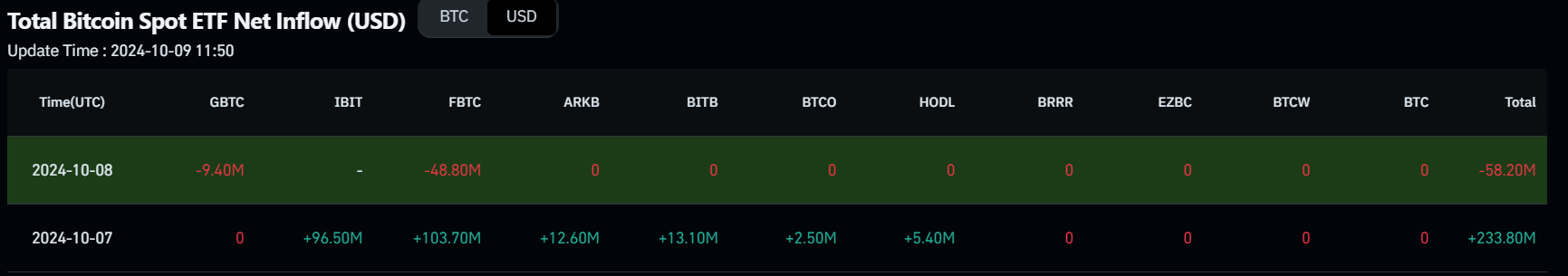

- US Spot Bitcoin ETF data recorded an outflow of $58.20 million on Tuesday, while the Coinbase Bitcoin Coinbase Premium Index is falling.

- Lookonchain data shows the US government gained full control over Silk Road’s seized funds of 69,370 BTC, worth $4.33 billion.

Bitcoin (BTC) stabilizes above $62,000 on Wednesday after a minor decline on Monday. A firm daily close below this level would suggest a decline ahead. Moreover, BTC shows weakness in institutional demand, highlighted by $58.20 million outflows in US Spot Bitcoin ETFs and a falling Coinbase Bitcoin Premium Index. In addition to these bearish signs, the US government has gained control over 69,370 BTC from the Silk Road funds, worth $4.33 billion, which might create Fear, Uncertainty, and Doubt (FUD) among traders, potentially adding further bearish pressure to Bitcoin price.

Bitcoin price could decline as institution demand is falling

US Bitcoin Spot Exchange Traded Funds (ETF) data recorded a slight outflow of $58.20 million on Tuesday. Studying the ETF flow data can be useful for observing institutional investors’ sentiment for Bitcoin. If the magnitude of outflow increases and continues, this trend would signal a fall in demand for Bitcoin, leading to its price decline.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Diving deep into the Bitcoin weak demand thesis, CryptoQuant’s Bitcoin Coinbase Premium Index provides a clearer picture. This indicator shows how large-wallet investors behave by showing the gap between the Coinbase Pro price (USD pair) and the Binance price (USDT pair), and is currently suggesting that institutional demand is falling.

The index fell from 0.007 to -0.061 from Friday to Tuesday, the lowest level since early August and has been constantly falling since mid-September. This fall in the Bitcoin Coinbase Premium Index indicates that BTC whales show signs of weakness, and investors’ interest and activity in Coinbase are also decreasing.

-638640609234758771.png)

Bitcoin: Coinbase Premium Index. Source: CryptoQuant

According to Lookonchain, the United States government appears now ready to sell 69,370 BTC – worth $4.33 billion – confiscated from a mysterious SilkRoad user, called “Individual X.”

The #USgovernment now appears free to sell 69,370 $BTC($4.33B) confiscated from #SilkRoad Individual X.

— Lookonchain (@lookonchain) October 8, 2024

On Oct. 7, the U.S. Supreme Court declined to hear Battle Born Investments' case over the ownership of 69,370 $BTC($4.33B) seized from #SilkRoad, giving the government full… pic.twitter.com/GipGCOpxq9

This came to light on Monday when the US Supreme Court declined to hear Battle Born Investments’ case over the ownership of 69,370 BTC seized from Silk Road and giving the government full control over the seized funds.

If the US government decided to sell the newly acquired Bitcoin, as it did two months ago when it transferred 10,000 BTC, worth $593.5 million, to Coinbase Prime, this event could generate bearish sentiment among traders, potentially contributing to a decline in Bitcoin price. Currently, the US government holds 203,239 BTC worth $12.63 billion, including the newly acquired 69,370 BTC.

Bitcoin Price Forecast: Holding $62,000 level key for direction

Bitcoin price found support at the 200-day Exponential Moving Average (EMA), around $60,000, on October 2. It rose 3.5% in the following four days and broke above the $62,125 resistance level. However, after Monday’s slight decline, BTC has found support at this same $62,125 level. At the time of writing, BTC trades just above $62,200.

If BTC breaks and closes below the $62,125 level, it could extend the decline to retest its 200-day EMA at $60,030.

The Relative Strength Index (RSI) is hovering around its neutral level of 50, indicating a lack of momentum and indecisiveness among traders. If the RSI fails below the neutral level, it will suggest weak momentum, leading to a fall in Bitcoin price.

BTC/USDT daily chart

However, if the $62,125 holds, BTC could rise to retest its psychological level of $66,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.