Bitcoin softens slightly as traders brace for Fed interest-rate cut

- Bitcoin hovers around $60,000 ahead of a key decision by the US Federal Reserve on interest rates.

- Fed Funds futures data projects a 63% chance of the US Federal Reserve cutting rates by 50 basis points.

- On-chain data supports a bullish outlook as BTC’s new whales accumulate while old whales hold still.

Bitcoin (BTC) retraces slightly, trading above $59,000 on Wednesday, as crypto markets brace for the upcoming interest-rate decision by the US Federal Reserve (Fed), which is expected to lower interest rates for the first time in more than four years. Even as traders widely anticipate the rate cut, the meeting is surrounded by the uncertainty of how big this cut will be, a key element that could influence BTC prices and crypto markets as a whole.

Bitcoin awaits the Fed’s decision

Bitcoin rose 3.6% to close above $60,000 on Tuesday, just a day before members of the US Federal Reserve decide on interest rates. While BTC gained 5%, stock markets exhibited mixed signals, hovering near previous highs, while Gold dipped more than 0.5% that day.

The main question mark surrounding the Fed decision is if the US central bank will opt for a standard 25-basis-point (bps) rate cut or will go for a large 50 bps reduction.

According to the CME’s Fed watch tool, which tracks the probabilities of changes to the Fed rate as implied by Fed Funds future prices, there is a 63% likelihood of a 50 basis points cut, while the remaining 37% points to a 25 bps trim. The outcome has the potential to move crypto markets.

Interest rates in the US are currently in a target range extending between 5.25% and 5.5%. Economists, investors, and analysts are constantly trying to predict how this level will change in the near future because this is key to determining the economy’s fortunes and, thus the valuation of currencies, stocks, commodities, or cryptocurrencies.

FXStreet Senior Analyst Yohay Elam outlines four scenarios that could happen today and their implications for markets depending on the decision and the message coming from Federal Reserve Chair Jerome Powell:

1) Big cut, confident message: Crypto bullish. In this scenario, Powell gives markets what they want without causing panic. High probability.

2) Small cut, confident message: A whipsaw move is likely, with crypto markets initially falling and later recovering slightly. A 25-bps cut would be disappointing and trigger a knee-jerk reaction. However, confidence in the economy and an open door to cut faster later could cause a reversal. Medium-high probability.

3) Big cut, concerned message: A whipsaw move is likely too, with crypto initially rising and retreating thereafter. A 50-bps cut is good news, but if it comes for the wrong reasons, the picture changes. Worries about an economic recession would sour the market mood. Medium probability.

4) Small cut, concerned message: Crypto down. In this scenario, the Fed begins small but is worried about the economy. Crypto markets would suffer, but they could recover afterwards on hopes of lower rates going forward. Low probability.

-638622584112253228.png)

Probability chart for rate cut

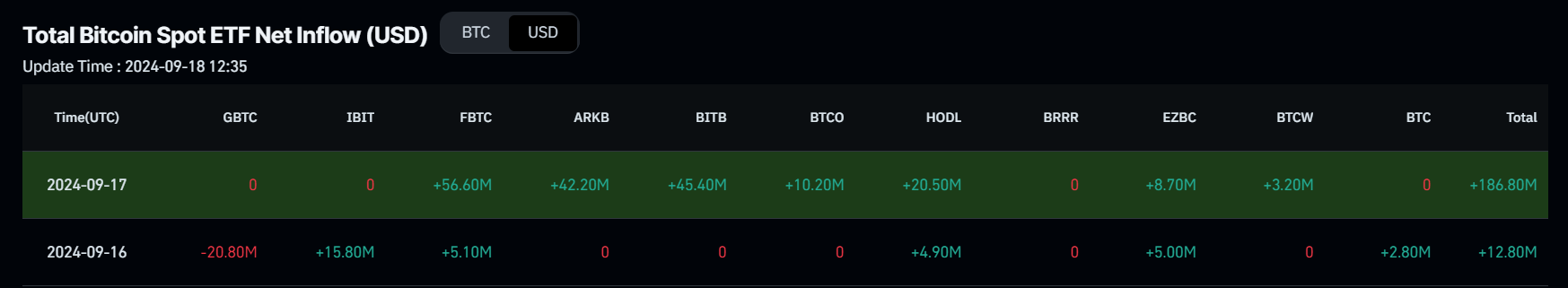

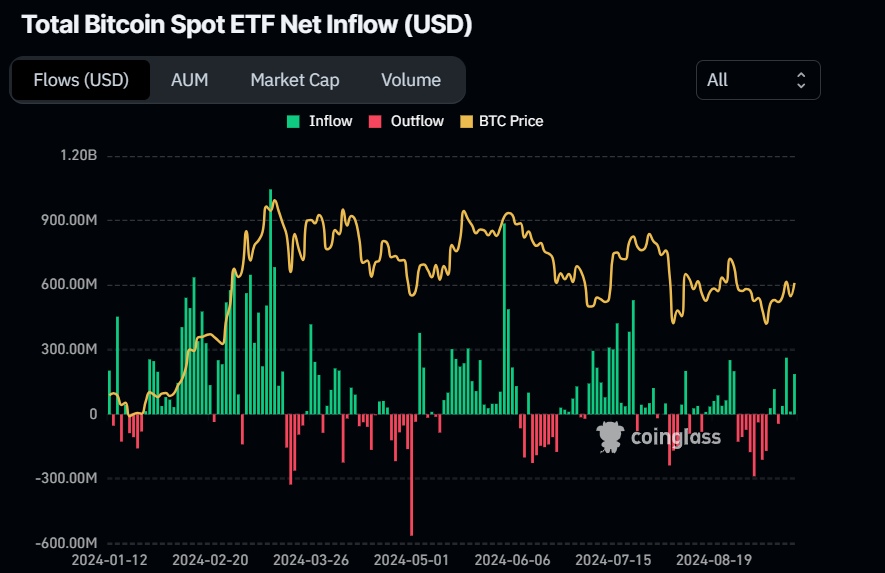

US Bitcoin Spot Exchange Traded Funds (ETF) data recorded a second consecutive day of inflows of $186.80 million on Tuesday. Studying the ETF flow data can be useful for observing institutional investors’ sentiment for Bitcoin. If inflow like this continues, demand for Bitcoin will increase, leading to a price rise. The total Bitcoin reserves held by the 11 US spot Bitcoin ETFs have risen to $49.95 billion in Assets Under Management (AUM) after a mild decline in early September.

Bitcoin Spot ETF Net Inflow chart

Bitcoin ETF AUM chart

Looking into CrytpoQuant’s data, the outlook for Bitcoin is bullish. The chart below shows the BTC balances of new and old whales.

New whales (orange line) refer to addresses with a current balance of more than 1,000 BTC and an average UTXO age of less than 155 days. Old whales (yellow) refer to addresses with a current balance of more than 1,000 BTC and an average UTXO age of 155 days or more.

From early September until today, the new Whale BTC balance has increased from 1.52 million to 1.70 million, while the old Whale balance shows no change in the same period. This indicates that new whales accumulate BTC while old wallets still hold it.

-638622585644409021.png)

Bitcoin new whales and old whales chart

Technical analysis: BTC breaks above the descending trendline

Bitcoin price rose 3.6% on Tuesday and broke above the descending trendline (drawn from multiple high levels from the end of July), which it had failed to close above this trendline last week. However, on Wednesday, it retraces and trades around $59,840 after facing resistance from the 100-day Exponential Moving Average (EMA) at $60,718.

If BTC breaks and closes its 100-day EMA at $60,718, it could first rise to retest its 61.8% Fibonacci retracement level around $62,000. A successful close above $62,000 could extend an additional rally of 5.5% to retest its daily resistance level at $65,379.

The Moving Average Convergence Divergence (MACD) indicator further supports Bitcoin’s rise, signaling a bullish crossover on the daily chart. The MACD line (blue line) moved above the signal line (yellow line), giving a buy signal. It shows rising green histogram bars above the neutral line zero, also suggesting that Bitcoin’s price could experience upward momentum.

Meanwhile, the Relative Strength Index (RSI) remains broadly unchanged and very close to its neutral level, indicating a lack of momentum.

BTC/USDT daily chart

However, If BTC closes below the $56,022 daily support level, the bullish thesis will be invalidated. It could decline 3.6% to retest its psychologically important level at $54,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.